Veteran commodities trader Peter Brandt has posted a devastatingly bearish warning about Bitcoin, the leading cryptocurrency by market cap.

The cryptocurrency could face a double-whammy of a short-term technical capitulation to the $58,000–$62,000 range and a long-term existential risk posed by technological obsolescence, according to Brandt.

A return to $58,000?

Brandt’s downside target implies a severe market correction of nearly 40%. "58k to $62k is where I think it is going," Brandt stated.

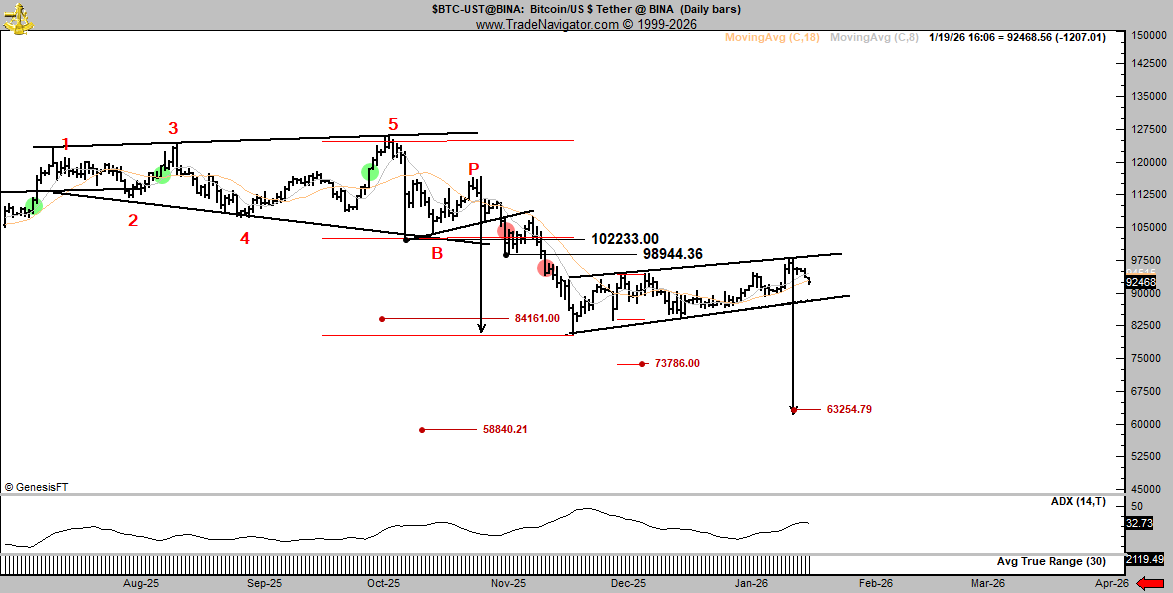

The chart shared by Brandt indicates that a correction from recent highs is far from over. It presents a potential bearish continuation that puts the $60,000 region firmly in focus.

There is a massive broadening top (the megaphone pattern), which is marked by points 1 through 5. This pattern is characterized by higher highs and lower lows.

The pattern resolved to the downside at point B, where the price decisively lost the lower trendline support.

Following the breakdown, Bitcoin staged a relief rally to point P (approx. $102,233). This move acted as a classic "bearish retest."

Since the rejection at point P, Bitcoin has been trading within a narrow, upward-sloping parallel channel.

Bitcoin is currently testing the lower boundary of this flag near $92,468. A breakdown from this channel would confirm the next leg lower.

A breakdown from the current flag targets $73,786. This could be followed by a deeper extension to $63,254.

The ultimate downside target shown on the chart stands at $58,840.

"If it does not go there I will NOT be ashamed... I am wrong 50% of the time. It does not bother me to be wrong," he wrote.

The "quantum" threat

Brandt took aim at the "Bitcoin up forever" narrative, arguing that it suffers from a "major flaw" because it assumes technological stagnation.

"It predisposes that nothing better will be developed/invented. As we approach quantum computing, that is a dangerous presupposition indeed," Brandt argued.

The "quantum threat" has long been a tail-risk lurking in the background of cryptographic discussions, and Brandt believes that one should not ignore it.

u.today

u.today