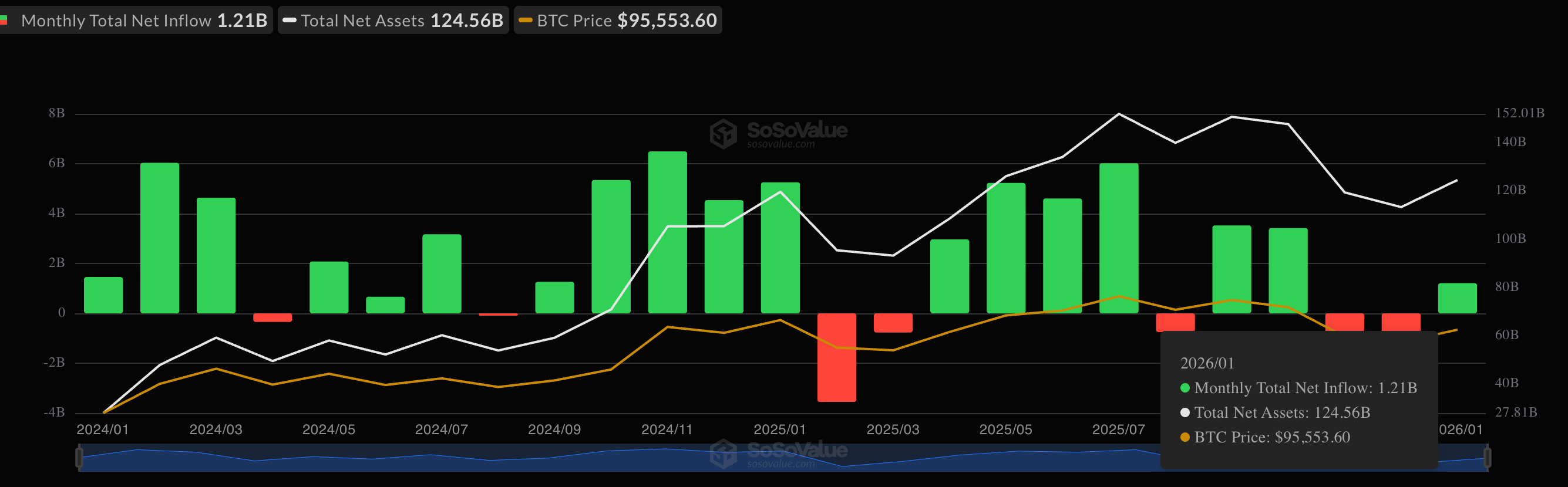

The eleven spot exchange-traded funds (ETFs) listed in the U.S. have registered a net inflow of $1.2 billion so far this month, reversing December redemptions, according to data from SoSoValue.

While the inflow number is positive, a deeper dive into the data reveals an even stronger bullish signal: large investors are ditching their usual arbitrage plays and betting more on a possible long-term price upswing.

Let's break it down.

For a while, big investors used a boring (but safe) strategy called "Cash-and-Carry" arbitrage to profit from bitcoin trading.

The trade worked for a while by exploiting the pricing mismatch between spot and futures markets. However, the latest inflows into U.S.-listed spot bitcoin exchange-traded funds (ETFs) suggest that traders are seeking increasingly directional bullish bets, moving away from the sophisticated arbitrage play.

Think of the trade this way: imagine buying a gallon of milk for $4 today because someone has signed a contract to buy it from you for $5 next month. You don't care if the price of milk crashes or skyrockets in between, because you’ve already locked in your $1 profit.

In the crypto world, investors were doing this by buying spot bitcoin ETFs and "shorting" (betting against) bitcoin futures. It wasn't about bitcoin's price going up; it was just about pocketing the tiny price difference between the two.

Read more: Bitcoin Futures ETFs May Boost Cash and Carry Yields

Now that the gap between "now and "later" has shrunk, and the costs of funding such trade have risen, the trade has lost its luster, at least that's what the data shows.

But large investors are still looking for exposure to bitcoin, which has led them to ditch the sophisticated trades and play it the old-school way: bet on the long-term price rally potential.

The vanishing profit

While spot ETFs in the U.S. have registered a net inflow of $1.2 billion, the total number of open or active standard and micro bitcoin futures contracts on the CME has increased by 33% to 55,947 contracts.

This combination of ETF inflows and an increase in CME open interest is usually associated with the "cash-and-carry" arbitrage.

However, the latest ETF inflows are unlikely to be part of carry trades, as the "basis" – the price gap between CME futures and spot ETFs – has narrowed to levels that barely cover transaction costs and funding expenses.

"This view is reinforced by the currently subdued front-month basis of approximately 5.5%. After accounting for funding and execution costs, the implied carry appears close to zero, offering limited incentive to re-engage in the trade," Mark Pilipczuk, research analyst at CF Benchmarks, told CoinDesk in a Telegram message.

One of the main reasons is likely how boring the price swings have been for bitcoin. Since the big drop from its all-time high in October of last year, the price of bitcoin has been "stuck" around 90,000.

Low volatility, smaller chances of price mismatch and less profitable to trade the "gap." And the data is showing exactly that.

Bitcoin's annualized 30-day implied volatility, as represented by Volmex's BVIV index, has dropped to 40%, the lowest since October. It shows that expectations for price turbulence have hit a three-month low, according to analysts at cryptocurrency exchange Bitfinex.

'Sticky' bullish bets

This shift marks a significant change in market microstructure, and it's bullish for bitcoin.

Make no mistake: investors are still piling into spot ETFs, as evidenced by $1.2 billion in inflows. But the bets are not for the carry trade; rather, they are in favor of direct price upside for longer-term investments.

Analysts at Bitfinex are calling these new investors "sticky" as they are not here for quick profits based on price gaps, but are in it for the long haul, given that the volatility has vanished. Essentially, the big institutions feel safer diversifying their money into alternative assets like bitcoin, which has been lagging other assets such as precious metals and equities.

"Institutions typically add [longer-term] exposure during low-volatility regimes and as liquidity gradually moves down the risk curve following rallies in gold and silver," analysts said, explaining the ETF inflows.

Simply, these investors aren't here for the "fast money," looking to gamble for five minutes; it's "sticky" money from serious investors who want to stay in the market for the long haul.

Rise of the 'speculators'

So who are these "sticky" investors betting on upside, not setting up arbitrage bets?

The answer lies in the data on how much investors are shorting bitcoin.

In CME-listed bitcoin futures, open interest has increased, driven by speculators betting on a bullish outcome rather than shorting as part of carry trades. There, non-commercial traders or large speculators are chasing profits rather than hedging risks via shorts, implying they have ramped up bullish exposure, which has led to the recent growth in open interest.

"Participation from non-commercial traders — a category that captures more speculative capital — has increased meaningfully. Open interest in CME Bitcoin futures held by this group has risen to over 22,000 contracts, broadly aligning with the recent improvement in price sentiment," Benchmarks' Pilipczuk said.

This suggests that the latest expansion in open interest has been driven primarily by institutional speculators, such as hedge funds, seeking exposure to long-term bitcoin price upside via the regulated futures market, rather than by a re-leveraging of basis trades, he added.

He further stated that leveraged funds, or hedge funds, which are typically short futures as part of carry trades, have steadily cut short exposure.

coindesk.com

coindesk.com