Cyber Capital founder and chief investment officer Justin Bons has predicted that Bitcoin ($BTC) could collapse within 7 to 11 years.

He pointed to declining security budgets, a rising risk of 51% attacks, and what he calls impossible choices for the network. Bons warns that these fundamental vulnerabilities may erode trust and even lead to chain splits.

Bitcoin’s Economic Security Model Under Scrutiny

Over the years, experts have raised alarms about several risks to Bitcoin, most notably quantum computing, which may undermine current cryptographic standards.

However, in a detailed post, Bons outlined a different category of concern. He argued that Bitcoin’s long-term threat lies in its economic security model.

“$BTC will collapse within 7 to 11 years from now! First, the mining industry will fall, as the security budget shrinks. That is when the attacks begin; censorship & double-spends,” he wrote.

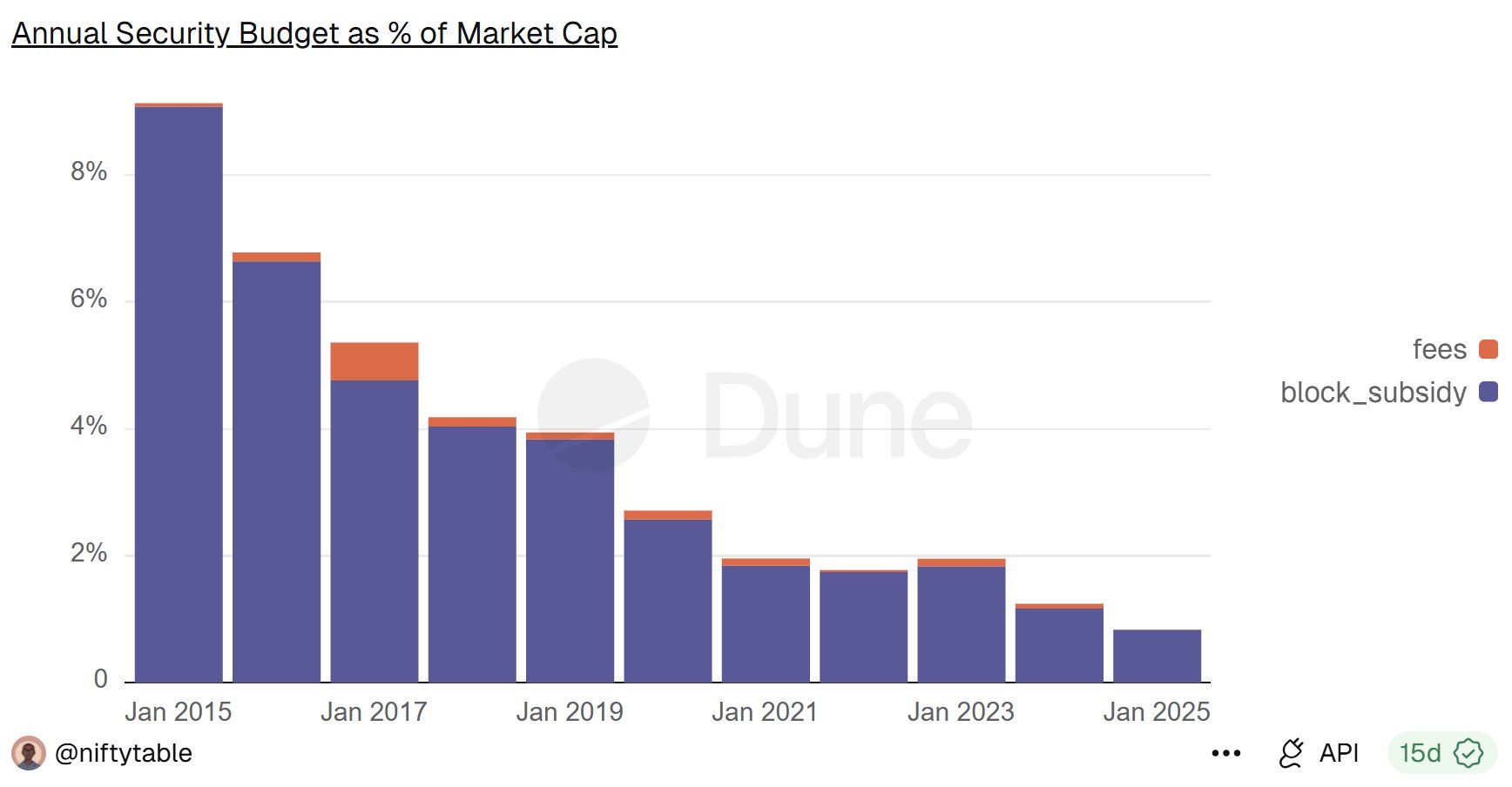

At the center of his argument is Bitcoin’s declining security budget. After each halving, miner rewards drop by half, reducing the incentive to secure the network.

The most recent halving was in April 2024, with more scheduled every four years. Bons contended that to maintain its current level of security, Bitcoin would require either sustained exponential price growth or permanently high transaction fees, both of which he considers unrealistic.

Declining Miner Revenue and Rising Attack Risk

According to Bons, miner revenue, rather than raw hashrate, is the most meaningful measure of network security. He highlighted that as hardware efficiency improves, hashrate can rise even while the cost of producing hashes falls, making it a misleading indicator of attack resistance.

In his view, declining miner revenue directly lowers the cost of attacking the network. Once the cost of mounting a 51% attack falls below the potential gains from double-spending or disruption, such attacks become economically rational.

“Crypto-economic game theory relies on punishment & reward, carrots & sticks. This is why miner revenue determines the cost of an attack. When it comes to the reward side of the calculation: Double-spending, with 51% attacks targeting exchanges, is a highly realistic attack vector due to the massive potential rewards,” the post read.

Currently, transaction fees account for only a small portion of miner income. As block subsidies approach zero over the coming decades, Bitcoin would need to rely almost entirely on fees to secure the network. However, Bitcoin’s limited block space caps transaction throughput and therefore total fee revenue.

Bons further claimed that sustained high fees are unlikely, as users tend to exit the network during fee spikes, preventing fees from reliably replacing block subsidies over the long term.

Congestion, Bank-Run Dynamics, and a Potential Death Spiral

Apart from concerns about the security budget, Bons warned of potential “bank-run” scenarios. According to him,

“Even according to the most conservative estimates, if every current $BTC user only did one transaction, the queue would be 1.82 months long!”

He explained that during panic events, the network may be unable to process withdrawals quickly enough, effectively trapping users through congestion and rising fees. This creates conditions similar to a bank run.

Bons also pointed to Bitcoin’s two-week difficulty adjustment mechanism as a compounding risk. In the event of a sharp price decline, unprofitable miners could shut down, slowing block production until the next adjustment.

“As the panic would cause the price to crash, which in turn causes more miners to shut down, which in turn slows the chain down even more, causing even more panic & the price to crash again & even more miners shutting down, etc, etc; ad infinitum…That is known as a vicious cycle in game theory, also referred to as a negative feedback loop or a death spiral,” he remarked.

He further added that such congestion risks make mass self-custody unsafe during periods of stress, warning that users may be unable to exit the network when demand spikes.

An Unavoidable Dilemma for Bitcoin

Bons concluded that Bitcoin faces a fundamental dilemma. One option would be to increase the total supply beyond the 21 million coin limit to preserve miner incentives and network security. However, he noted this would undermine Bitcoin’s core value proposition and likely lead to a chain split.

The alternative, he said, is to tolerate a steadily weakening security model, increasing exposure to attacks and censorship.

“The most likely outcome is that in 7–11 years from now, both of the options I described & more occur simultaneously,” Bons wrote.

He also tied the issue to the legacy of the block size wars, arguing that governance constraints within Bitcoin Core make meaningful protocol changes politically unlikely until a crisis forces action. By that point, he warns, it may already be too late.

The post Bitcoin Faces Possible Collapse in 7 to 11 Years, Warns Cyber Capital Founder appeared first on BeInCrypto.

beincrypto.com

beincrypto.com