Bitcoin has rallied roughly 10% so far in 2026, holding just below $97,000, and the move appears to be driven primarily by spot buying rather than leveraged positioning through futures.

Spot markets involve the direct purchase of bitcoin for immediate delivery, meaning buyers take ownership of the asset. Futures markets, by contrast, are derivative contracts that allow traders to gain exposure using leverage without owning the underlying bitcoin.

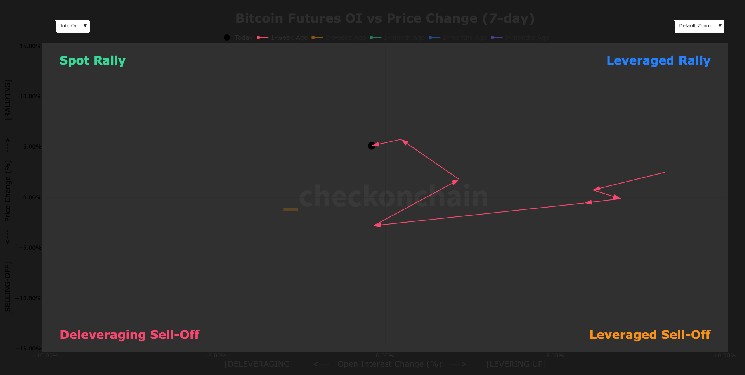

A spot driven rally is generally healthier than a leveraged rally because it reflects genuine demand rather than speculative positioning. Checkonchain data shows that the recent move from $90,000 to $97,000 has transitioned from a leverage led rally into one supported by spot buying over the past week.

Coinglass data reinforces this view, showing futures open interest denominated in bitcoin at 678,000 $BTC, compared with 679,000 $BTC on Jan. 8, indicating that overall leverage in the system has remained largely unchanged.

Adding another dimension, perpetual futures funding rates are currently negative, according to Glassnoe data. Funding rates represent the periodic payments exchanged between long and short positions, with positive rates meaning longs pay shorts and negative rates meaning shorts pay longs. If the spot rally continues while funding remains negative, this setup increases the risk of a short squeeze, which occurs when rising prices force short sellers to close positions, accelerating upside momentum as liquidations cascade.

Meanwhile, the Nasdaq 100 is relatively flat year to date while bitcoin is up 10%. This divergence could support an ongoing rotation narrative, where bitcoin is increasingly viewed as a higher beta, leveraged tech proxy, potentially attracting further inflows and adding fuel to the rally.

coindesk.com

coindesk.com