Bitcoin surged above $97,000 on Tuesday as large traders returned to the spot market after weeks of ETF-driven selling. The move puts the $100,000 level back in play and signals a shift in who is driving the market.

Recent on-chain and derivatives data show that this rally is not powered by retail leverage. Instead, whales are accumulating Bitcoin on spot, while smaller traders chase the move through futures. That matters because rallies led by spot buyers tend to last longer.

Whales are Buying While Retail is Using Leverage

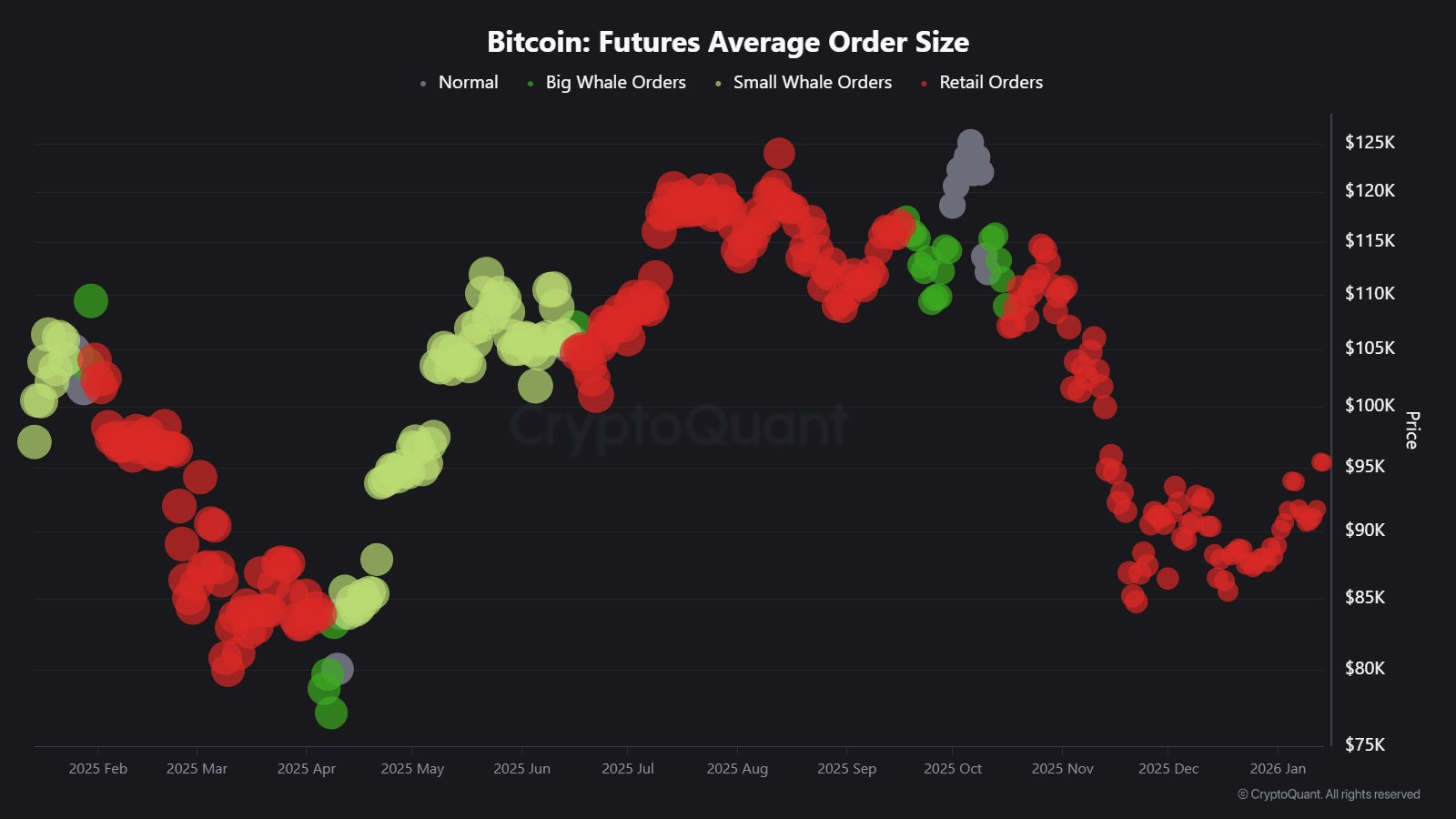

CryptoQuant’s Futures Average Order Size chart shows a clear pattern. Large orders, typically linked to whales and funds, have increased as Bitcoin moved from the mid-$80,000s to above $95,000.

At the same time, small trades surged in futures markets. That means retail traders entered mostly through leverage, not spot buying.

This split is important. In previous market tops, retail usually leads and whales sell. This time, whales are buying first. Retail is following.

That structure fits an early-trend phase rather than a late-cycle blow-off.

Spot Buyers Drove the Rebound from $84,000

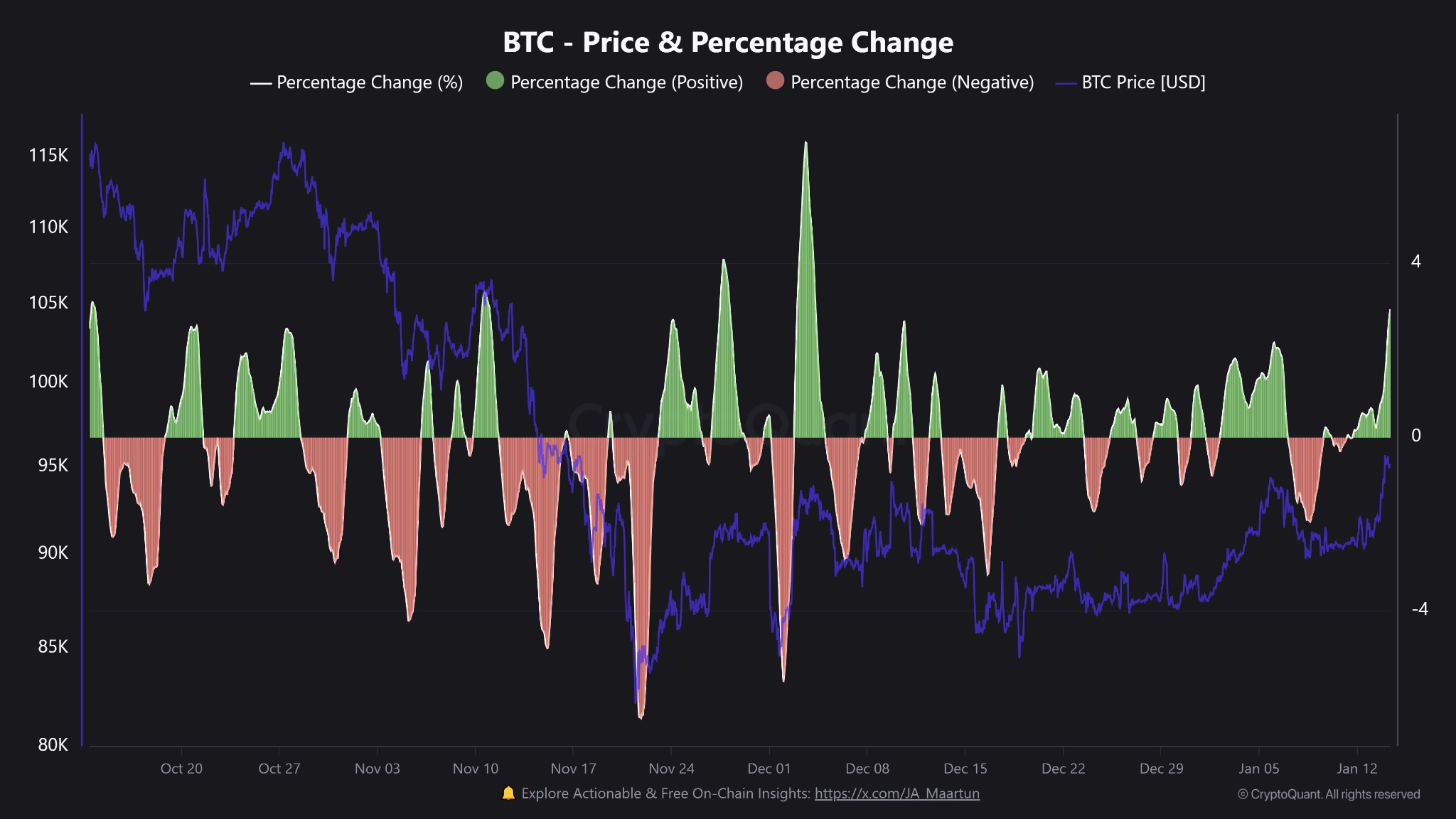

Another CryptoQuant chart shows Bitcoin’s daily percentage changes shifting from heavy red spikes in November to steady green clusters in January.

That change reflects real buying pressure, not short squeezes. When price rises in steps with shallow pullbacks, it usually means spot demand absorbs supply.

Bitcoin rallied from about $84,400 to more than $96,000 on that pattern. The selling pressure that dominated in November has faded.

The ETF Reset Cleared the Way

Earlier this month, US spot Bitcoin ETFs lost more than $6 billion. That selling came from late buyers who entered after the October peak and exited at a loss.

Bitcoin held near the ETF cost basis around $86,000. That level acted as support. Once redemptions slowed, price stabilized.

This cleared out weak hands and reset positioning. Whales then began to rebuild exposure at lower levels.

Bitcoin Never Left Its Macro Bull Market

The move down from $110,000 to $85,000 was not the end of the bull market. It was the end of the first speculative leg.

That phase flushed leverage and forced ETF investors to exit. What followed was a reaccumulation phase, where strong hands bought while price moved sideways.

Now, Bitcoin is entering the expansion phase again. Price is breaking out as fresh capital returns.

Bitcoin ETFs had Big Day with $760m in flows. They needed it, started year real strong, dipped and now made it up, YTD above water. Check out the YTD flows every one is seeing action (this was like when 10 kids on my 8th grade bball team scored in game the other night, you love… pic.twitter.com/xeHw6EfBrS

— Eric Balchunas (@EricBalchunas) January 14, 2026

Bitcoin is now holding above $95,000, a level that capped every rally since early December. That break suggests control has shifted back to buyers.

If whales continue to lead on spot and ETF selling remains muted, the path toward $100,000 is open. A push to new highs becomes possible if demand keeps building.

For now, the data shows this rally is built on real capital, not fragile leverage. That gives Bitcoin its strongest foundation in months.

The post Bitcoin Whales Return to Spot Markets as Price Nears $100,000 Again appeared first on BeInCrypto.

beincrypto.com

beincrypto.com