Exchange-traded funds based on Spot Bitcoin are witnessing massive inflows of liquidity. January 2026 has all the chances to end a bearish streak despite the consensus about "Crypto Winter" starting for the entire segment.

Bitcoin spot ETFs: Biggest inflows since October 10

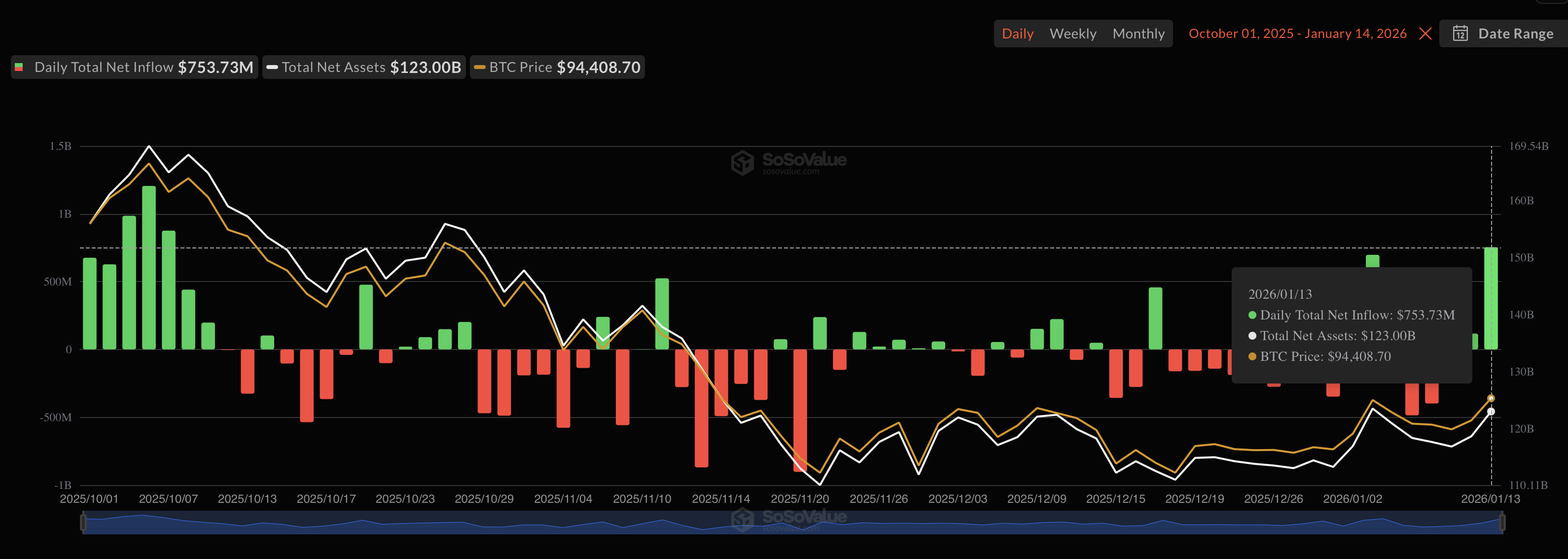

Bitcoin Spot ETFs — U.S.-registered exchange-traded investing fund products based on spot Bitcoin ($BTC) holdings — are seeing the most notable inflows since the market collapse on Oct. 10. Yesterday, in just 24 hours, investors injected $753 million into this class of assets.

That said, the Jan. 13 session was the most productive for Bitcoin ($BTC) spot ETFs since Oct. 7, 2025. On the weekly time frame, this week is the biggest since mid-October.

In total, since the start of this year, the class of spot Bitcoin ETFs is up by $660 million in terms of AUM.

Bitwise's NYSE, BlackRock's IBIT and, in particular, Fidelity's FBTC are top gainers in last 24 hours. In total, three funds allocated almost 7,000 $BTC yesterday.

The optimism of investors in Bitcoin ($BTC) should be attributed to regulatory and macroeconomic positive announcements in the U.S.

Bitcoin ($BTC) price almost at two-month high

As a result, the Bitcoin ($BTC) price jumped today to $95,700, its highest since mid-November. The largest cryptocurrency is up by 3.1% today, while the rest of the market added 3.2%.

In the last 24 hours, Bitcoin ($BTC) sees $300 million in liquidations, with 99% being short. For Ethereum ($ETH), this metric is at $220 million as Ether price jumps by 5% to $3,283.

The largest liquidation, according to CoinGlass's data, is a $12 million ETHUSDT long on Binance.

u.today

u.today