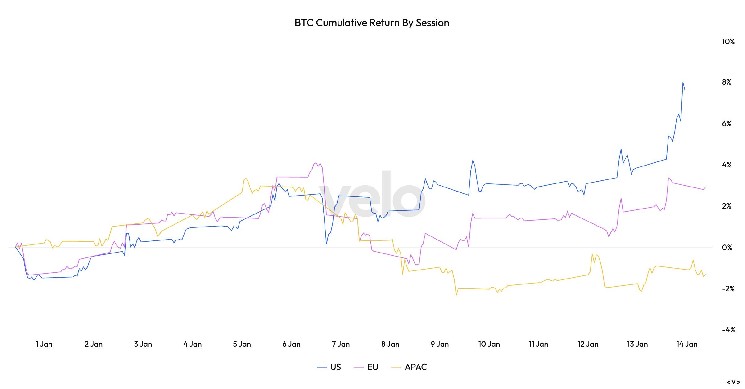

Bitcoin BTC$95,040.16 is up nearly 10% so far in 2026 after briefly touching $96,000 on Tuesday, a move largely driven by strong performance during the North American hours.

The cumulative return for bitcoin during that time of the day is roughly 8%, according to Velo data. Prices gained a modest 3% in European hours, while Asian hours dragged performance down

This trend marks a sharp reversal from late 2025, when bitcoin was down as much as 20% on a cumulative basis during the North American hours at the end of November when bitcoin bottomed near $80,000. During the fourth quarter, U.S. market opens frequently saw bitcoin selling pressure, while spot bitcoin ETFs faced near-daily outflows.

Breaking the data down further by hour reinforces the positive shift in sentiment during the North American hours. Velo data shows that the strongest returns now occur shortly after the U.S. market opens, between 2 PM and 4 PM UTC. While zooming out over the past six months, this same window had previously been the weakest period for bitcoin performance.

U.S. trading hours do not necessarily equate to activity driven by U.S. based investors, as the price performance during these hours reflect gains made across both U.S.-based and offshore exchanges such as Binance. As a result, strong returns during U.S. market hours can coexist with a negative Coinbase premium, suggesting that demand may be coming from global participants rather than domestic U.S. buyers.

Bitcoin-linked stocks rally

Supporting the improved U.S. session sentiment, bitcoin linked U.S. equities have also rebounded. Strategy (MSTR) the largest publicly traded company holding bitcoin appears to have bottomed on Dec. 31 at $151 per share and is now up more than 12% in 2026, trading around $178 per share.

The stock found support just above its 200 week moving average, which stood near $145. The 200 week moving average represents the average closing price over the past 200 weeks and is widely viewed as a long term trend indicator and potential support level during market downturns.

coindesk.com

coindesk.com