Corporate digital asset treasuries (DATs) added a net 260,000 Bitcoin to their balance sheets over the past six months, far outpacing the estimated 82,000 coins mined over the same period.

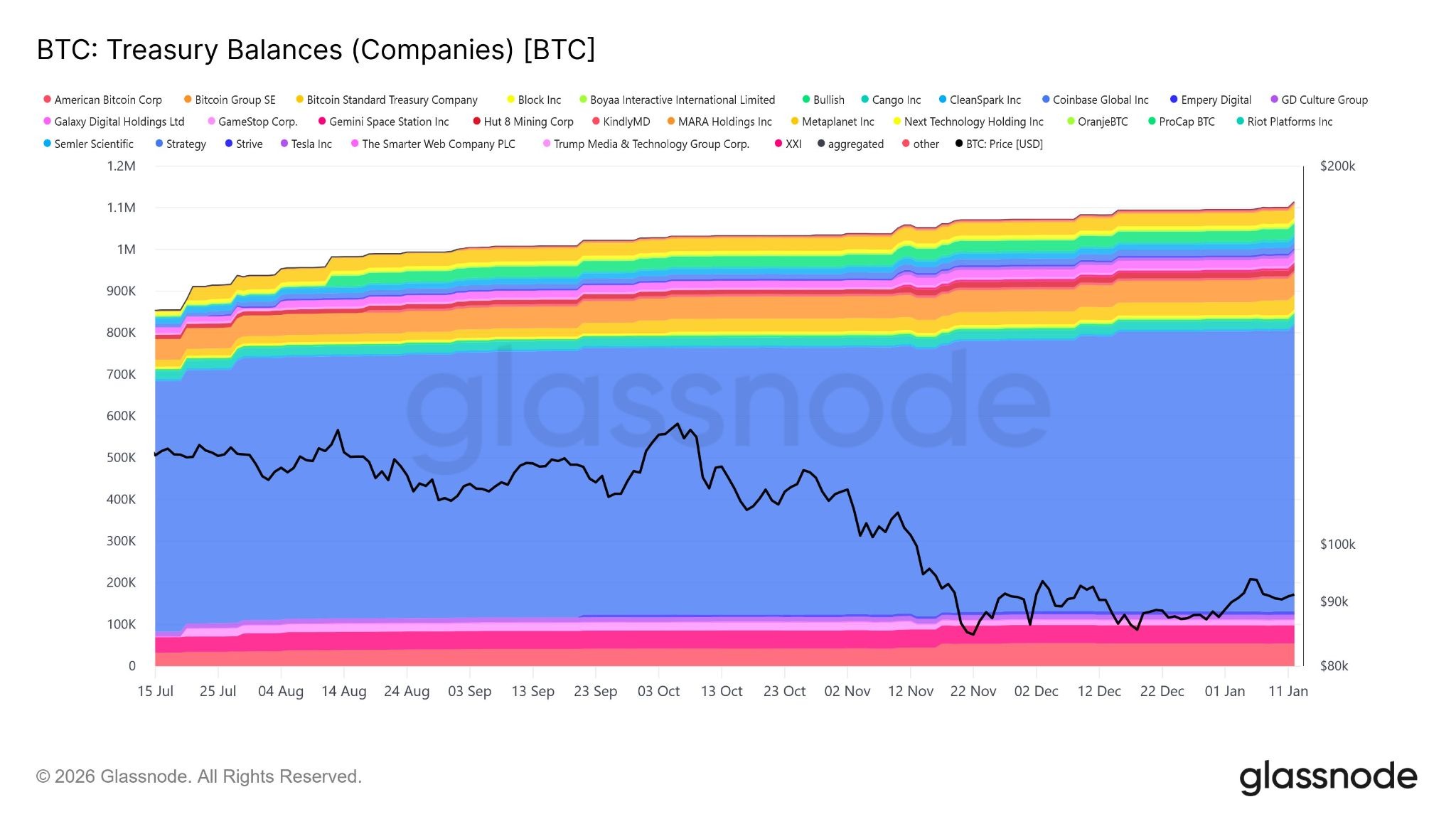

Over the past six months, Bitcoin ($BTC) treasuries held by public and private companies have increased from approximately 854,000 $BTC to 1.11 million $BTC, on-chain analytics provider Glassnode reported on Tuesday.

This equates to an expansion of around 260,000 $BTC, worth roughly $25 billion at current market prices, or 43,000 $BTC per month.

The growth in treasuries highlights “the steady expansion of corporate balance-sheet exposure to Bitcoin,” stated Glassnode.

Bitcoin miners, which produce on average 450 $BTC per day, mined around 82,000 coins over the same period, which could indicate a favorable supply-demand dynamic at play.

Strategy has 60% of the total $BTC balance

The lion’s share of the 1.2 million $BTC held in public and private company treasury balances is held by Michael Saylor’s Strategy.

Strategy currently holds 687,410 $BTC, or 60% of the total, worth around $65.5 billion at current market prices.

The firm resumed its purchases this month after a brief hiatus, revealing that it acquired an additional 13,627 $BTC between January 5 and 11 in its largest purchase since July.

The second-largest corporate Bitcoin DAT is MARA Holdings with 53,250 $BTC worth around $5 billion, according to Bitcoin Treasuries.

Bitcoin ETFs could add to demand

Spot Bitcoin exchange-traded funds could add to this supply-and-demand dynamic if the inflow trend continues this year. “Bitcoin’s price will go parabolic if ETF demand persists long-term,” said Bitwise chief investment officer Matt Hougan on Tuesday.

“Since ETFs debuted in Jan 2024, they’ve been buying more than 100% of the new supply of bitcoin. But the price hasn't gone parabolic, because existing holders have been willing to sell. If ETF demand persists — and I think it will — eventually, these sellers will run out of ammo.”

Spot $BTC ETFs in the US saw net inflows of almost $22 billion in 2025, with BlackRock’s iShares Bitcoin Trust (IBIT) taking the lion’s share.

However, they have had a mixed start to 2026 with current data showing $1.9 billion inflows and $1.38 billion outflows, resulting in a net aggregate inflow of just over $500 million.

cointelegraph.com

cointelegraph.com