Bitcoin has been locked in a tight consolidation range since late November, frustrating traders and fueling growing speculation about a major move ahead. Volatility has compressed, price has stabilized near key psychological levels, and market participants are increasingly divided on what comes next. Some analysts argue that this prolonged consolidation is laying the groundwork for a renewed upside recovery, while a broader consensus warns that Bitcoin could still face another leg lower before a sustainable trend emerges.

Adding to this uncertainty, top analyst Darkfost points to an important and potentially concerning on-chain development: the first signs of long-term holder (LTH) capitulation are beginning to surface. The last time Bitcoin traded at similar price levels was in April 2025, roughly nine months ago. Since then, a large portion of market participants accumulated BTC at higher prices and have continued to hold through the recent correction.

Today, many of those investors are sitting on unrealized losses. As a reminder, Bitcoin held for more than six months is classified as long-term holder supply, typically associated with higher conviction and lower sensitivity to short-term price moves. When this cohort begins to show signs of stress, it often marks a critical phase in the market cycle.

Whether this emerging LTH pressure becomes a brief shakeout or evolves into broader capitulation could play a decisive role in shaping Bitcoin’s next major move.

Early Signs of Long-Term Holder Capitulation Emerge

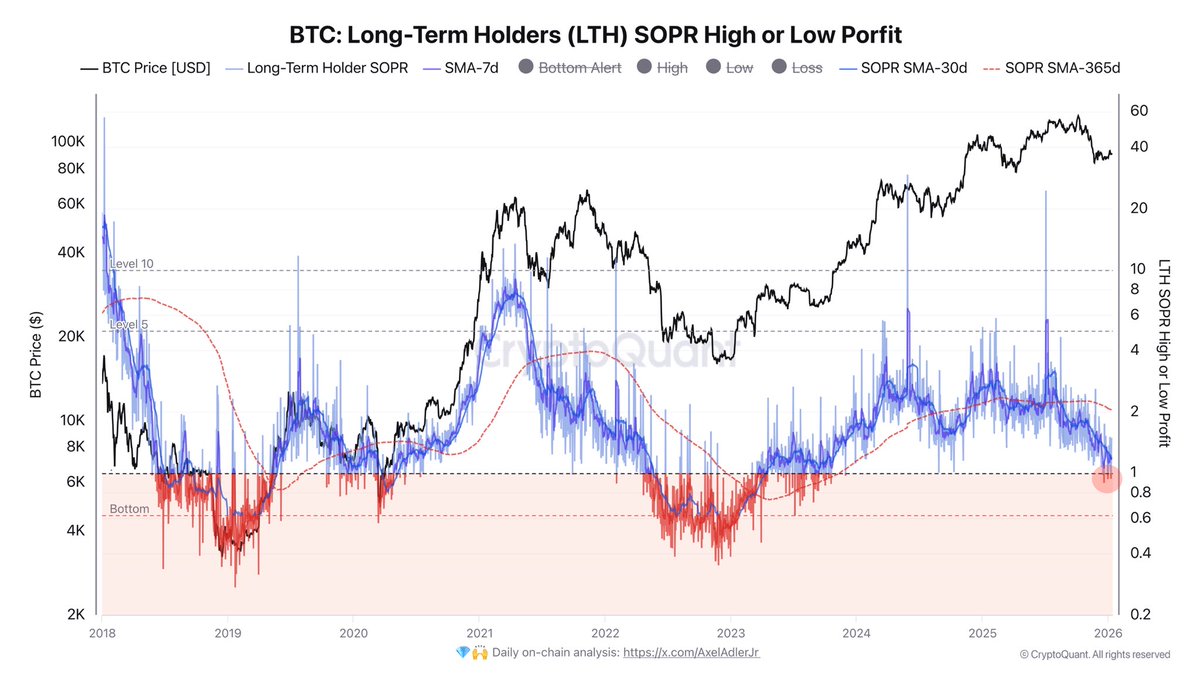

What we are currently observing on the Long-Term Holder SOPR (Spent Output Profit Ratio) is a behavior that typically appears during bear market phases. LTH SOPR measures whether coins held for more than six months are being sold at a profit or a loss, offering insight into conviction among the most resilient cohort of Bitcoin investors.

In recent days, LTH SOPR briefly dipped below the critical 1.0 level. This signals that some long-term holders—most likely the younger segment of this group—have begun to capitulate by selling at a loss. Historically, such moves reflect rising stress among holders who bought closer to cycle highs and are now facing prolonged drawdowns.

For now, however, this behavior remains limited. The 30-day moving average of LTH SOPR still stands at a healthy 1.18, meaning long-term holders have realized an average profit of 18% over the past month. While this confirms that broad-based capitulation has not yet materialized, it is worth noting that this level is well below the annual average near 2.0, indicating a clear slowdown in realized profits.

A deeper deterioration would be bearish in the short term, signaling expanding sell pressure. Conversely, declining realized profits may also suggest that traders are gradually exhausting selling pressure. For a bullish continuation to develop, LTH SOPR would need to stabilize and begin trending higher again, confirming renewed confidence among long-term holders.

Bitcoin Price Consolidates Below Key Resistance

Bitcoin continues to trade within a well-defined consolidation range after the sharp correction from the October highs. On the weekly chart, price is holding just below the $92,000–$94,000 resistance zone, an area that previously acted as support before the breakdown. This level now represents a key inflection point for market structure.

Despite the recent volatility, Bitcoin remains above its rising 200-day moving average, which continues to slope upward near the mid-$80,000 region. This suggests that the broader trend remains constructive, even as short-term momentum has weakened. The 100-day moving average has flattened, reflecting a loss of upside momentum, while the 50-day average is still attempting to stabilize after rolling over during the sell-off.

Price action over the past several weeks shows a series of higher lows, indicating that buyers are gradually stepping in and absorbing selling pressure. However, volume has declined during this consolidation, signaling a lack of strong conviction from either side of the market. This behavior is typical of compression phases that often precede larger directional moves.

A sustained break and weekly close above $94,000 would signal renewed strength and open the door for a move toward the $100,000–$105,000 range. Conversely, failure to hold above the $86,000–$88,000 support zone would increase downside risk and shift focus toward deeper retracements. For now, Bitcoin remains in balance, building tension for its next decisive move.

Featured image from ChatGPT, chart from TradingView.com

newsbtc.com

newsbtc.com