Bitcoin’s breakout story is on course, but the needed bounce is not clean. The Bitcoin price has reclaimed key trend support, history favors continuation, and short-term selling has dried up.

Yet every push higher is meeting supply. The reason is not obvious from the price alone. One holder group is still selling into strength, and that could delay the next leg higher.

Breakout Structure Is Still Intact

Bitcoin is trading inside a cup-and-handle structure on the daily chart. Price briefly pushed toward the handle breakout near $92,400 before pulling back, but the structure remains valid as long as a key support holds.

The most important support signal is the 20-day EMA. An EMA, or exponential moving average, gives more weight to recent prices and helps define short-term trend direction. Bitcoin reclaimed the 20-day EMA on January 10 and followed it with two green daily candles. That sequence matters.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

In December, Bitcoin reclaimed the 20-day EMA twice, on December 3 and December 9. Both times, the reclaim failed because the next candle turned red. On January 1, the reclaim was followed by another green candle. That move led to a nearly 7% rally.

A similar setup is now forming again. As long as Bitcoin holds above the 20-day EMA, the breakout theory remains on track. But the long upper wicks near $92,400 show supply is still active. That raises one question: who is selling?

Short and Long-Term Holders Are Quiet, Ultra-Long Holders Are Not

On-chain data helps answer that question.

Short-term selling pressure has collapsed. Spent Coins Age Band data, which highlights cohort-specific coin activity, for the 7-day to 30-day group shows activity falling sharply, from around 24,800 $BTC to just 1,328 $BTC, a 95% decline since January 8. This means recent buyers are not rushing to sell into the bounce.

Standard holder net position change also turned positive on December 26. These holders, often seen as long-term investors, (holding for 155 days or more) have been net buyers since then and continued buying even when Bitcoin peaked on January 5.

The selling is coming from a different group.

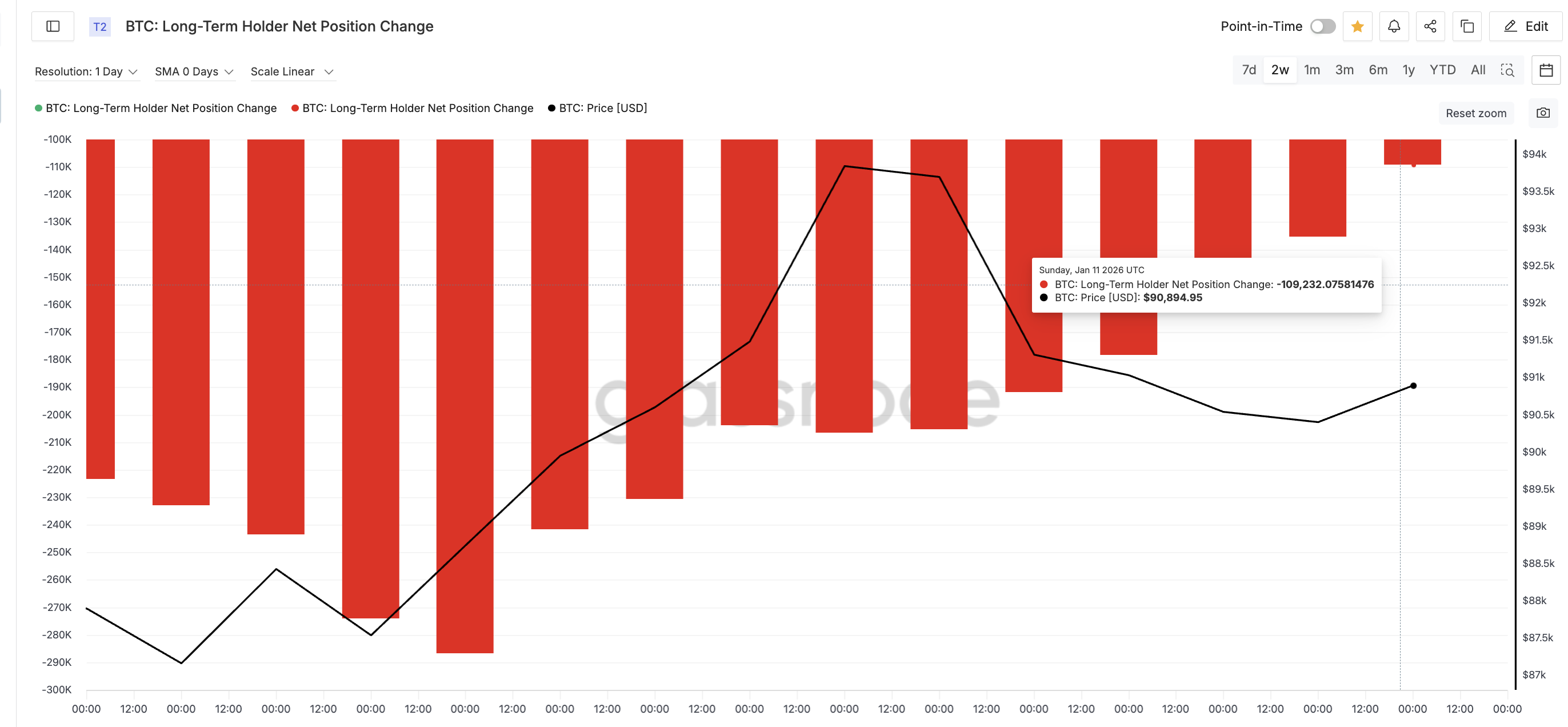

Long-term holder net position change, which tracks ultra-long holders with coins possibly held well over one year, remains negative. On January 1, this group distributed roughly 286,700 $BTC. By January 11, that selling slowed to about 109,200 $BTC, a drop of over 60%. Selling pressure is easing, but it has not flipped to buying yet.

This explains the hesitation near resistance. Short-term sellers are gone, long-term investors are buying, but ultra-long holders are still distributing enough supply to cap price for now.

Bitcoin Price Levels That Hold The Key

Bitcoin now needs a clean daily close above $92,400 to open the path toward $94,870. Clearing that zone would complete the breakout story and activate the measured 12% upside target. That move projects toward the $106,630 area.

For this to happen, Bitcoin must stay above the 20-day EMA and prevent ultra-long holder selling from pushing the price back down.

On the downside, $89,230 is key support. A daily close below it would weaken the breakout structure. A deeper drop toward $84,330 would invalidate the bullish setup entirely.

For now, Bitcoin’s breakout story is still on course. The only missing piece is conviction from the oldest holders. Once that group stops selling, the delayed breakout could move fast.

The post Bitcoin’s 12% Breakout Story Lives — But One Group Is Trying To Spoil The Ending? appeared first on BeInCrypto.

beincrypto.com

beincrypto.com