After a lengthy disappearing act—last spotted in November 2024—the elusive 2010-era mega whale has resurfaced yet again, finally rousing 2,000 long-slumbering bitcoins mined in bitcoin’s earliest chapter. The hoard, now valued at $181 million, traveled in a single, clean sweep and was processed in full at block height 931668.

Early Bitcoin Miner Breaks Silence, Transfers 2,000 $BTC Held Since 2010

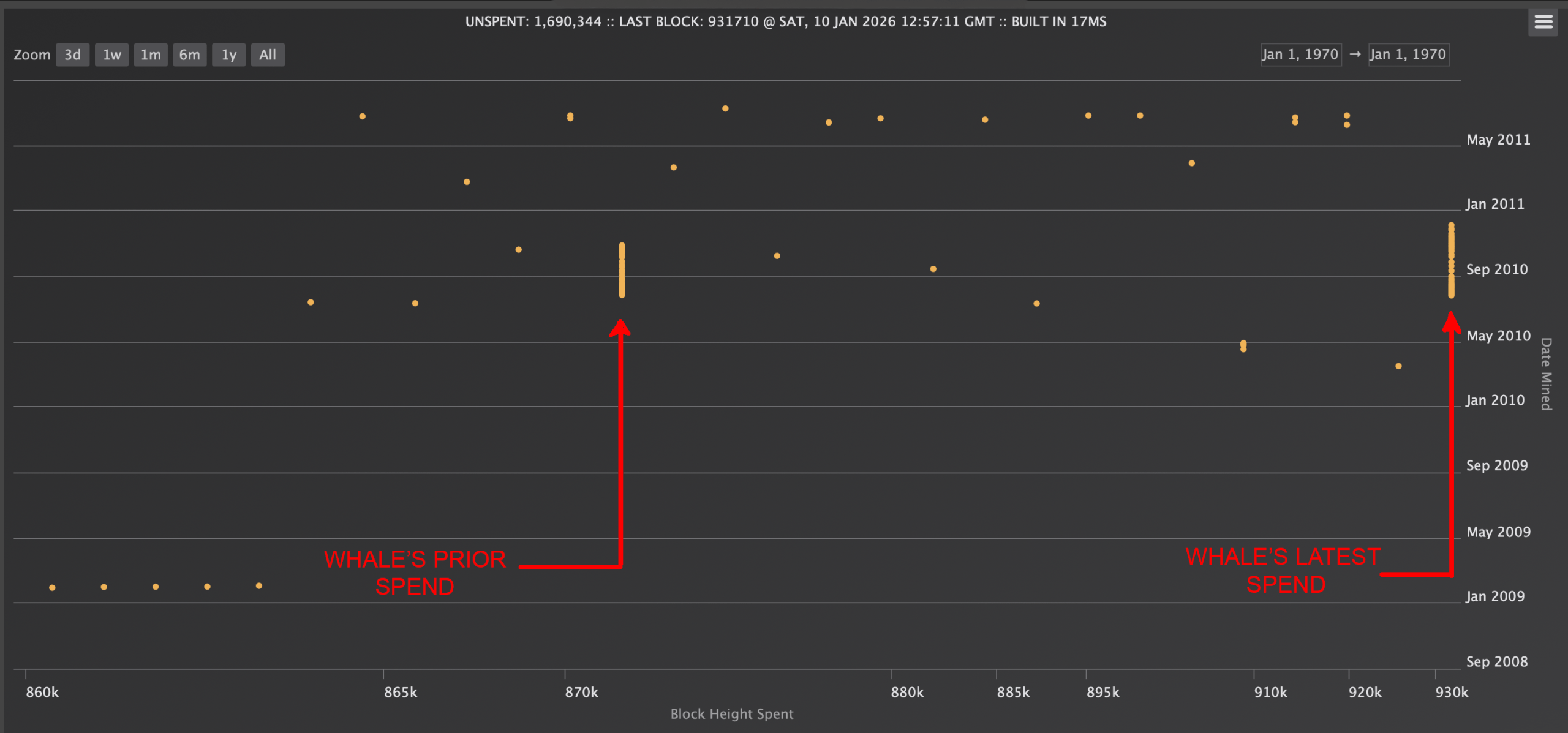

Bitcoin.com News has chronicled this specific whale repeatedly since 2020, operating on the view that the massive holder is likely a single entity or individual rather than a loose cluster of wallets. Further examination of the bitcoin blockchain suggests this entity had been quietly unloading strings of 2010 coinbase rewards well before we identified the spender six years ago.

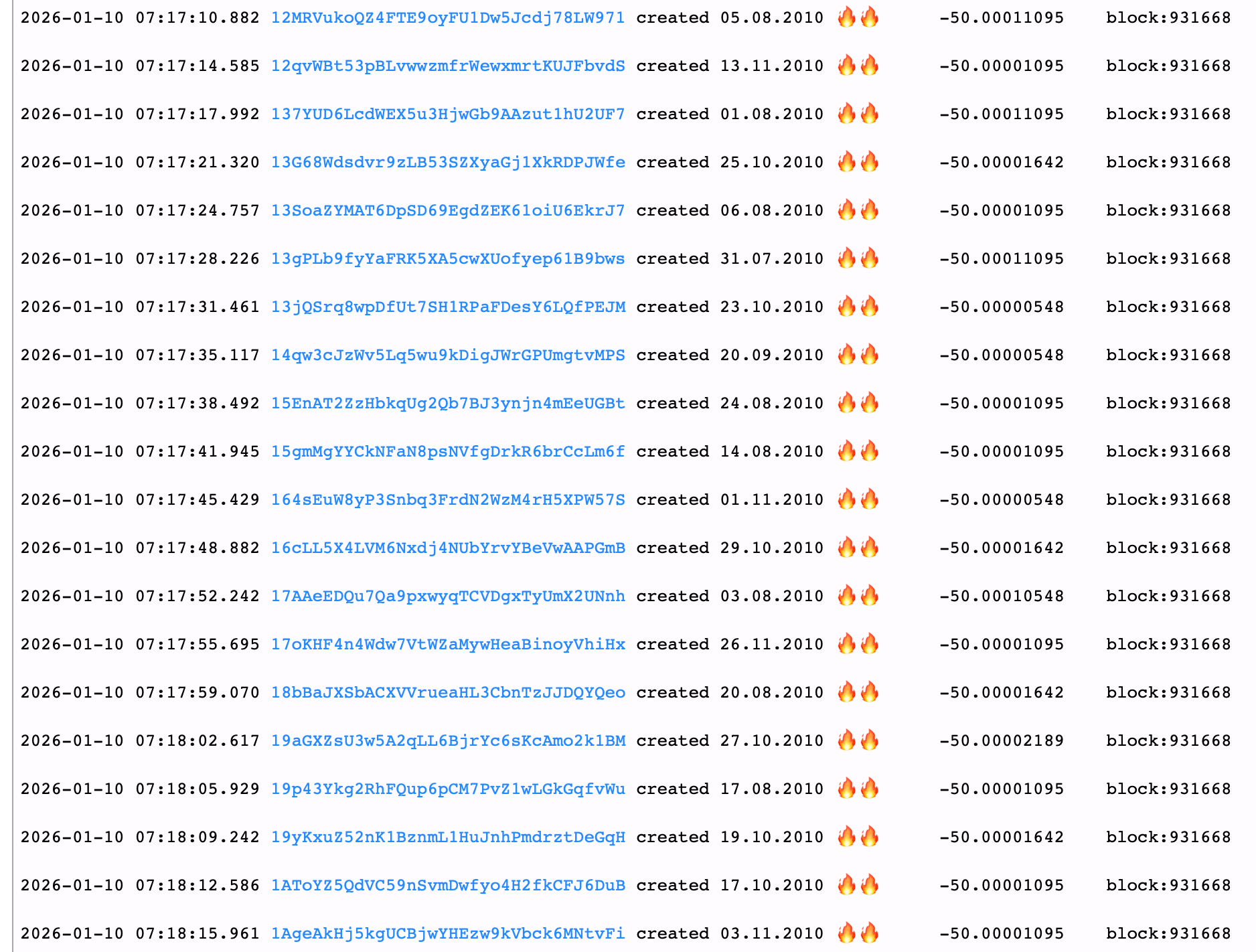

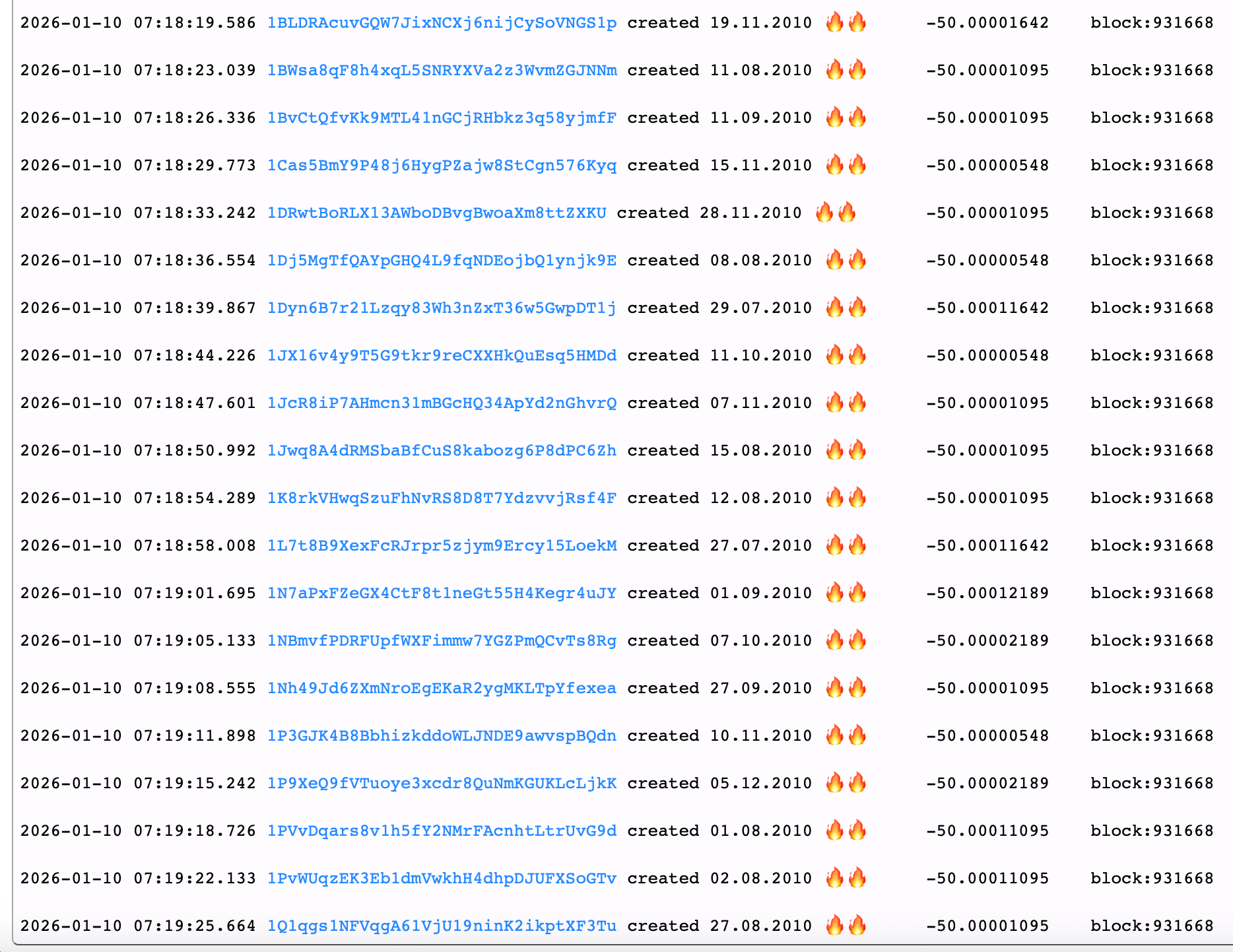

Notably, the whale’s previous sighting came on Nov. 14, 2024, after which it sat out the entirety of 2025. That day’s pattern mirrored Jan. 10, 2026, with the entity spending 40 coinbase rewards mined in 2010 and clearing the full settlement in block 870,329. The most recent 40-block subsidy transfer cleared at block 931,668, and it was flagged by btcparser.com, with other onchain sleuths quickly catching the same trail.

“A miner just sold 2,000 $BTC from block rewards dormant since 2010, transferring the funds to Coinbase Exchange,” wrote Sani, founder of timechainindex.com, on X. “The funds were held in 40 P2PK addresses,” the analyst added.

The P2PK wallets funneled the 2,000 $BTC into a consolidated P2SH (Pay-to-Script-Hash) address, which ultimately made its way to the crypto exchange Coinbase. This wasn’t a one-off either, as the whale’s earlier spending strings discovered by Bitcoin.com News have repeatedly shown ties to Coinbase-linked wallets.

Adding another wrinkle, the matching bitcoin cash ( BCH) tied to these same block rewards was shuffled roughly five years ago. This whale—previously caught offloading tens of thousands of coins—has appeared largely indifferent to bitcoin’s price swings.

For example, it could have unloaded this batch when $BTC topped the six-figure level; on Oct. 6, the take would have been roughly $126,000 per coin. Instead, the coins moved today with $BTC sitting just north of the $90,000 mark. That price indifference has become a defining trait of this whale’s onchain behavior, reinforcing the view that timing market tops has never been the primary objective.

Also read: Stablecoin Volumes Hit Record $33 Trillion Amid Policy Tailwinds

Whether prices sit at record highs or cool-off levels, the entity’s actions suggest a methodical, long-term unwind rather than a reactive trade chasing optimal exits. Moreover, with a bitcoin stash this deep, marginal price differences hardly seem consequential. When bitcoin once changed hands between $0.01 and $0.40, even a $90,000 price tag still represents an eye-watering payoff.

For now, the whale slips back into the shadows, leaving analysts to wait for the next movement from one of bitcoin’s earliest miners. If history is any guide, the silence may last months—or years—before another neatly packaged string of 2010-era rewards quietly makes its way onto the chain.

FAQ 🐋

- Who moved the 2,000 $BTC? A long-dormant bitcoin whale tied to 2010-era mining rewards transferred the funds after more than a year of inactivity.

- Where did the bitcoin go? The 2,000 $BTC was consolidated and ultimately sent to Coinbase-linked wallets, according to onchain data.

- When were the bitcoins originally mined? The coins came from block rewards mined in 2010 during bitcoin’s earliest years.

- Why does this whale’s activity matter? Large moves from early bitcoin miners often draw attention due to their size, age, and potential market impact.

news.bitcoin.com

news.bitcoin.com