Bitcoin briefly surged toward $92,000 on Jan. 9 after the U.S. Supreme Court delayed a ruling on the Trump administration’s reciprocal tariffs. The price quickly retraced, however, triggering $20 million in liquidations and returning the asset to its $90,000 to $92,000 consolidation zone.

Bitcoin Surges on Court Deferral

Bitcoin surged toward the $92,000 threshold on Jan. 9, fueled by intense market anticipation as the U.S. Supreme Court deferred a high-stakes ruling on the legality of the Trump administration’s reciprocal tariffs. This upward momentum offered a brief reprieve for the digital asset, which had earlier slipped below the $90,000 mark following reports that major centralized exchanges had offloaded an estimated $3 billion in $BTC.

The relief rally proved short-lived. By 12:20 p.m. EST, the cryptocurrency had entered a sharp retracement, surrendering the bulk of its court deference-induced gains. This aggressive reversal triggered a liquidation cascade, wiping out approximately $20 million in short positions within a four-hour window. The price action ultimately forced $BTC back into its established consolidation zone, oscillating between $90,000 and $92,000—a range that has served as the asset’s primary “anchor” over the last three days.

In the lead-up to what proved to be a “damp squib” session, crypto analysts were tracking a high-conviction theory: a ruling against the administration could trigger massive tariff refunds estimated to be between $133 billion and $140 billion. Proponents of this liquidity injection thesis argue that such a windfall would flood the markets with capital, potentially serving as the rocket fuel needed to propel bitcoin past the psychological $100,000 barrier.

Macro Risks and De-risking Fears

Conversely, skeptics insist that a ruling declaring the tariffs illegal could spark immediate contagion across U.S. stocks and bonds. In this scenario, the resulting de-risking event—driven by a sudden projected increase in the U.S. budget deficit—could drag the crypto market down in a broader flight to safety.

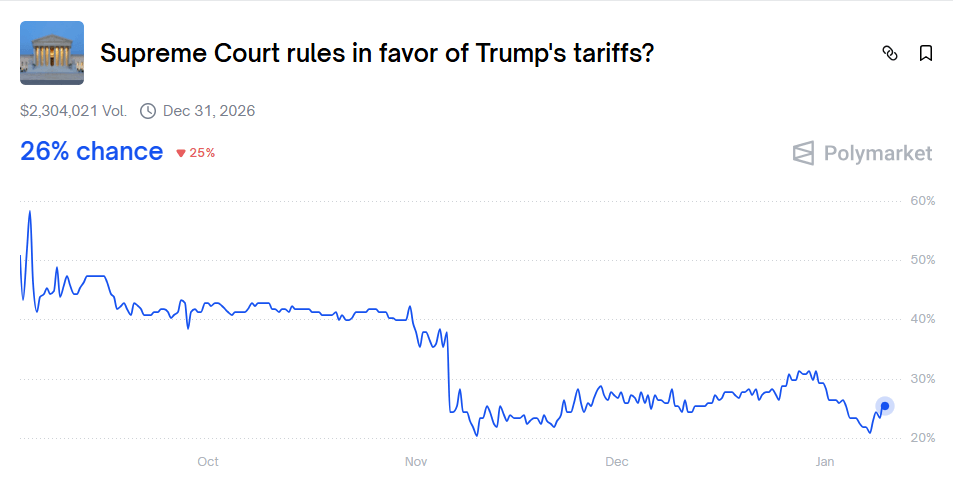

While the Supreme Court is now expected to deliver its verdict on Jan. 14, prediction markets suggest a shifting sentiment. Some punters interpreted the delay as a sign that the conservative-dominated bench is wavering on whether to torpedo the administration’s signature trade policy. This theory is reflected in Polymarket odds, where the probability of the tariffs being upheld ticked up from a low of 21% on Jan. 7 to roughly 26% following the deferral.

Despite the uncertainty, the prevailing analyst consensus remains that the court will ultimately strike down the levies, dealing a significant blow to the administration’s economic framework. However, officials have signaled that President Trump is prepared to pivot to alternative executive powers—such as Section 301 or Section 232—to maintain the duties if necessary.

For now, technical analysts view the $90,000–$92,000 range as a high- volume “magnet zone.” The community expects $BTC to station within this corridor for the next five days, with any interim breakouts likely dismissed as fake-outs until the Jan. 14 ruling provides a definitive catalyst.

FAQ ❓

- Why did bitcoin spike near $92K on Jan. 9? It rallied after the U.S. Supreme Court delayed ruling on Trump’s reciprocal tariffs.

- What triggered the sharp retracement later that day? Liquidations wiped $20M in shorts as $BTC fell back into the $90K–$92K zone.

- How could the tariff case impact crypto markets globally? Refunds up to $140B may fuel liquidity, but contagion risks could hit U.S. stocks and crypto.

- When is the Supreme Court verdict expected? The ruling is set for Jan. 14, seen as the next key catalyst for Bitcoin’s range breakout.

news.bitcoin.com

news.bitcoin.com