As revealed by Onchain Lens, one of Hyperliquid's most aggressive and closely watched traders is back, and this time, he is going long on $XRP, with $30 million of conviction. This whale became famous for unloading 255 $BTC on-chain in December before going on the offensive, with short positions across $BTC and $ETH.

Now, they have done a total 180 reversal, going long on $XRP with 20x leverage for a whopping $30,043,987.

Back in December, this same wallet unloaded 514 $BTC it had held for over a year, then sold 255 $BTC for $21.8 million and used it to fund $80.2 million in Bitcoin shorts and $2.1 million in $ETH shorts. That move gave him a big boost in PnL, bringing his total to $8,283,137.32.

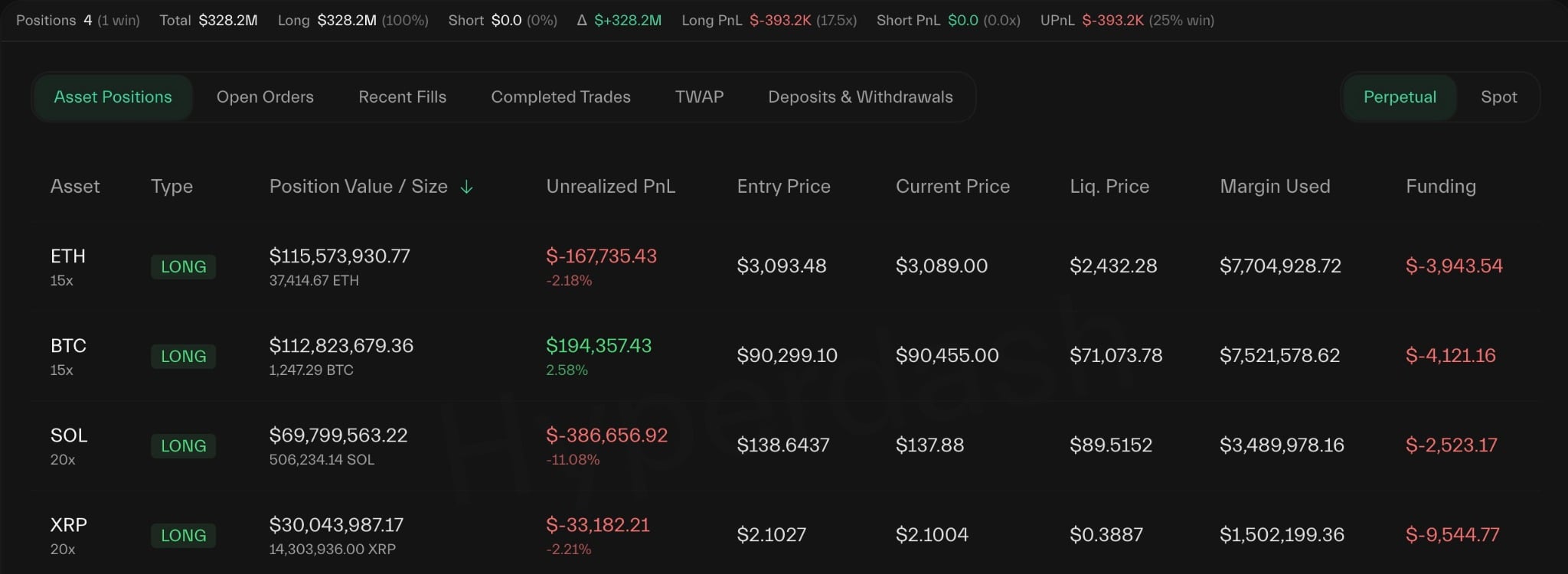

The new move is part of a bigger $328 million long position, split across four major assets: 1,247 $BTC worth $112.8 million; 37,414 $ETH worth $115.6 million; 503,778 $SOL worth $69.8 million and 14.26 million $XRP.

How risky is the move?

Despite high leverage — averaging over 10.8x across positions — the whale has yet to deploy additional margin, with a $0 withdrawable balance signaling full capital commitment.

His $BTC long is currently at 2.58% profit, but he is underwater on $ETH, $SOL and $XRP. $SOL is the worst, with a loss of $386,000. The $XRP entry at $2.1027 is just above the current market price of $2.1004, which makes it seem like the whale timed the entry during a local spike.

Liquidation for the $XRP position is still at just $0.3887, more than 80% below the current price, so it is clear the investor is comfortable with risk.

The move into altcoins, especially $XRP, suggests a bet on a breakout leg rather than a passive rotation. It is not clear if it is a volatility play or an early move ahead of new catalysts, but this whale is once again fully exposed — this time to the upside.

u.today

u.today