The new proposal could put Florida in rare company with three other states that have successfully passed crypto reserve legislation.

Bitcoin Flat After Florida Proposal for State Crypto Reserve

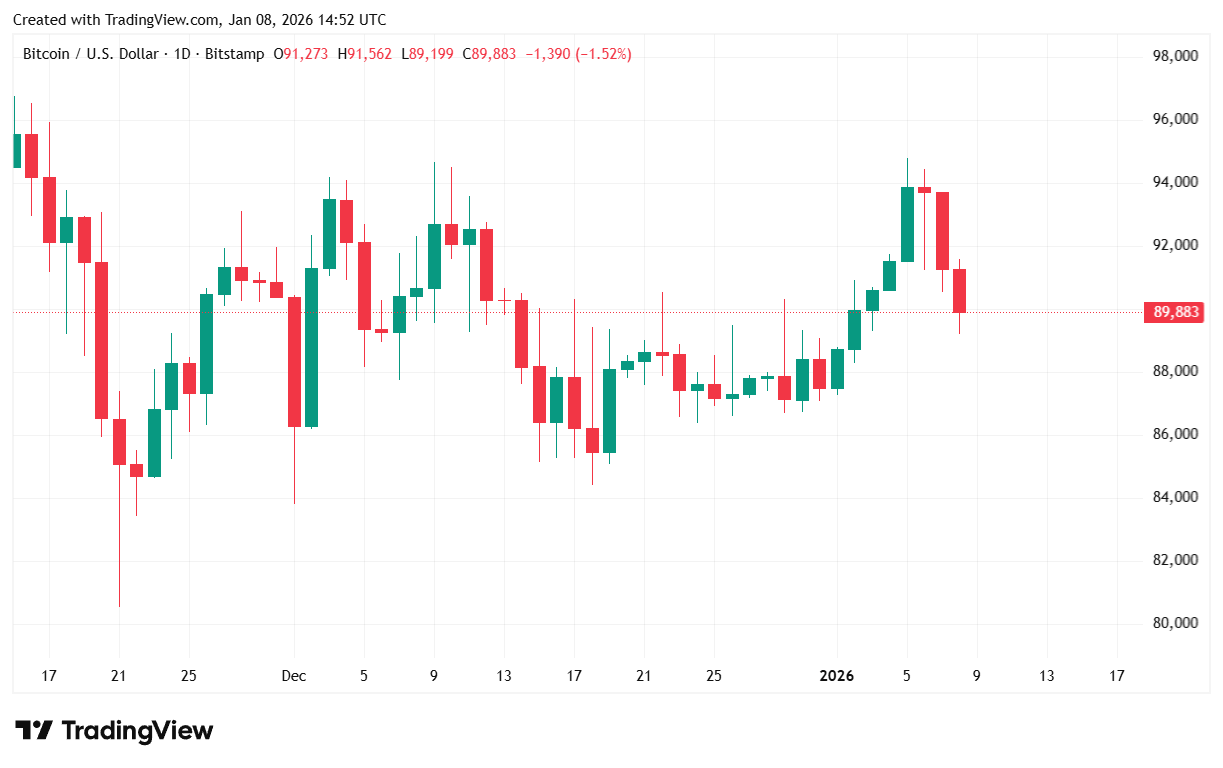

Florida Republican John Snyder has been bullish on crypto for years. So on Wednesday, when the 38-year-old legislator filed House Bill 1039 to establish the Florida Strategic Cryptocurrency Reserve, it didn’t come as a surprise. What left traders scratching their heads was the market’s reaction to the news. The average analyst would have predicted at least a slight bump in bitcoin’s price. Instead, the cryptocurrency didn’t move much, and when it finally did, it went down and not up.

Read more: Stocks Continue to Outperform Bitcoin Despite Trump’s Shenanigans

Florida has gradually positioned itself as a bitcoin and crypto stronghold. Last year, Japanese bitcoin treasury firm Metaplanet chose the state as home to its new U.S. subsidiary. That’s because Florida has been passing crypto-friendly legislation for years. In 2022, lawmakers passed a bill that made it easier for Floridians to buy and sell crypto. Snyder, who was a sophomore legislator at the time, hailed the proposed measure as “a great bill.”

And now, more than three years later, Snyder is not just cheering on; he’s in the driver’s seat. If his Strategic Cryptocurrency Reserve proposal is indeed approved by Governor Ron DeSantis, Florida will join Texas, Arizona, and New Hampshire as one of only a handful of jurisdictions that have passed legislation to establish some form of crypto reserve. Previously, such an announcement would have buoyed BTC’s price, but after the so-called “Great Liquidation” event of October 2025, the cryptocurrency’s price movements have stumped even the most insightful pundits.

There are several possible explanations for bitcoin’s muted reaction, but the increasingly uncertain geopolitical environment seems to be the strongest candidate. The Trump administration’s capture of Venezuelan strongman Nicolas Maduro, threats to annex Greenland, and calls to bump up U.S. military spending to $1.5 trillion, may be causing investor angst. Risk-on assets such as bitcoin just don’t do very well during times of unrest.

Overview of Market Metrics

Bitcoin was trading at $89,452.04 at the time of reporting, down 2.6% over 24 hours, according to Coinmarketcap data. The cryptocurrency’s price fluctuated between $89,578.31 and $92,064.60. Weekly performance remained positive, with BTC up 2.23% over seven days.

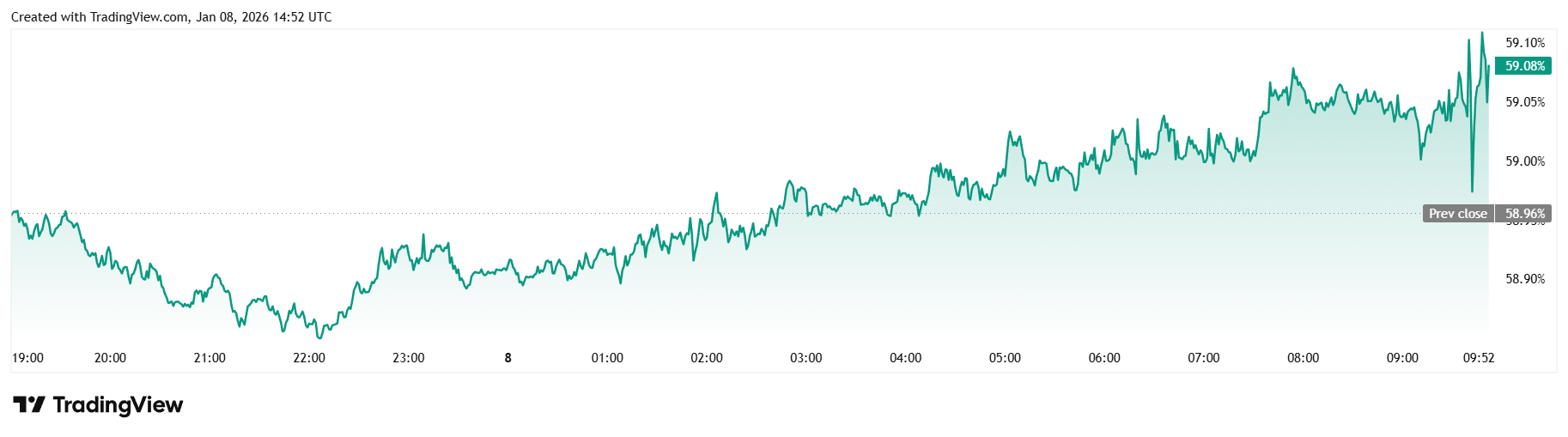

Daily trading volume fell 23.15% to $42.95 billion and market capitalization dropped to $1.79 trillion. Bitcoin dominance rose 0.19% to 59.09%, reinforcing BTC’s resilience relative to alts.

Total bitcoin futures open interest rose 2.03% to $62.87 billion, Coinglass data shows. Total liquidations doubled over 24 hours and stood at $148.42 million at the time of writing. The jump in losses may indicate traders were surprised by bitcoin’s retreat despite positive news coming out of Florida. Long investors saw $140.23 million wiped out but short sellers were largely unscathed, recording only $8.19 million in liquidated margin.

FAQ ⚡

-

What did Florida propose?

Florida lawmakers introduced House Bill 1039 to create a state-backed strategic cryptocurrency reserve. -

Why didn’t bitcoin rise on the news?

Despite the proposal, bitcoin stayed flat and later dipped, suggesting the move was already priced in or overshadowed by broader market risks. -

Which states already have crypto reserve laws?

If approved, Florida would join a small group including Texas, Arizona, and New Hampshire. -

What’s weighing on bitcoin instead?

Rising geopolitical tensions and risk-off sentiment appear to be dampening bitcoin’s reaction to otherwise positive policy news.

news.bitcoin.com

news.bitcoin.com