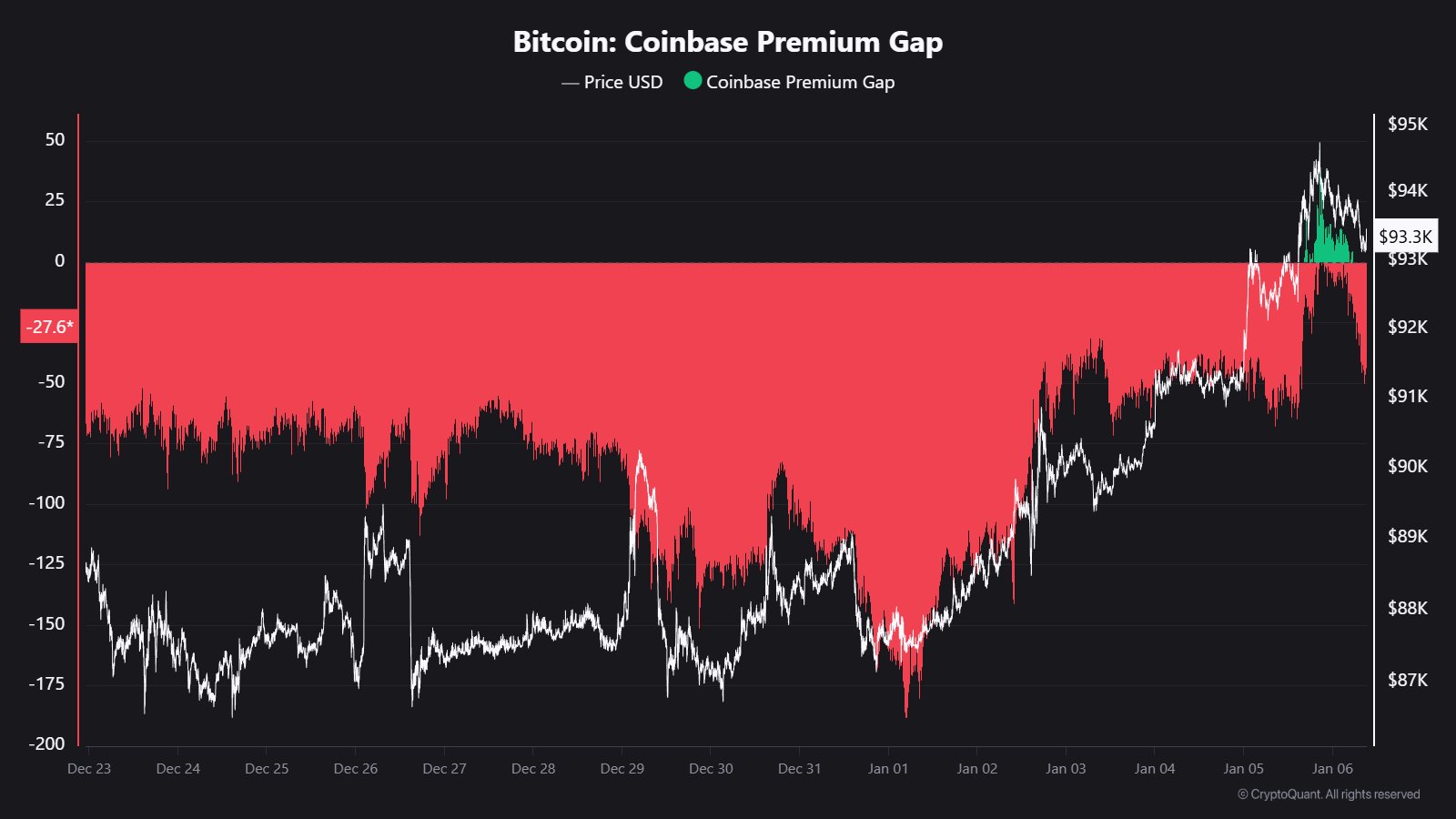

On Friday, something changed for Bitcoin, and it was not just the price of the cryptocurrency but who was behind the rally. After nearly two weeks of discounted pricing on Coinbase, the U.S. spot market suddenly became aggressive, buying into strength rather than weakness.

For those unfamiliar with it, the Coinbase Premium Gap is a metric that tracks the price difference between the major U.S. exchange and offshore platforms. It went positive for the first time since Christmas. This indicates that U.S.-based buyers were willing to pay more than the global average for exposure. And they were not alone.

The shift occurred as Bitcoin finally made it past $93,000 and quickly approached $94,000. The premium flip occurred shortly after the U.S. market opened.

However, shortly after, the local peak for Bitcoin followed. The U.S. bid was real but came at the end of a weeklong rally fueled by non-U.S. flows and derivatives-driven exposure. Friday’s candle was different; it had U.S. fingerprints all over it.

Bitcoin's catch-up play

Maartunn from CryptoQuant was the first to point this out: when the premium flips after a rally, it is rarely a trigger, but rather a result. This kind of flow marks tops, not breakouts. This doe not mean Bitcoin will reverse immediately.

It means the late bid needs help to keep the price elevated. If help does not come, it starts to unwind fast.

What happens next depends on the buyers' ability to maintain the price at or above $94,000, which would open the path to $95,800 per BTC. If it slips below $91,000, then $89,400 becomes a magnet. Overall, the next move will depend on whether the new money bought strength or bought the top.

u.today

u.today