The cryptocurrency market entered 2026 with strong momentum that has lifted the total market value above $3.2 trillion.

Bitcoin led the advance, climbing past $94,000 and setting the tone for gains across the broader digital asset space.

Global Crypto Market Gains Momentum

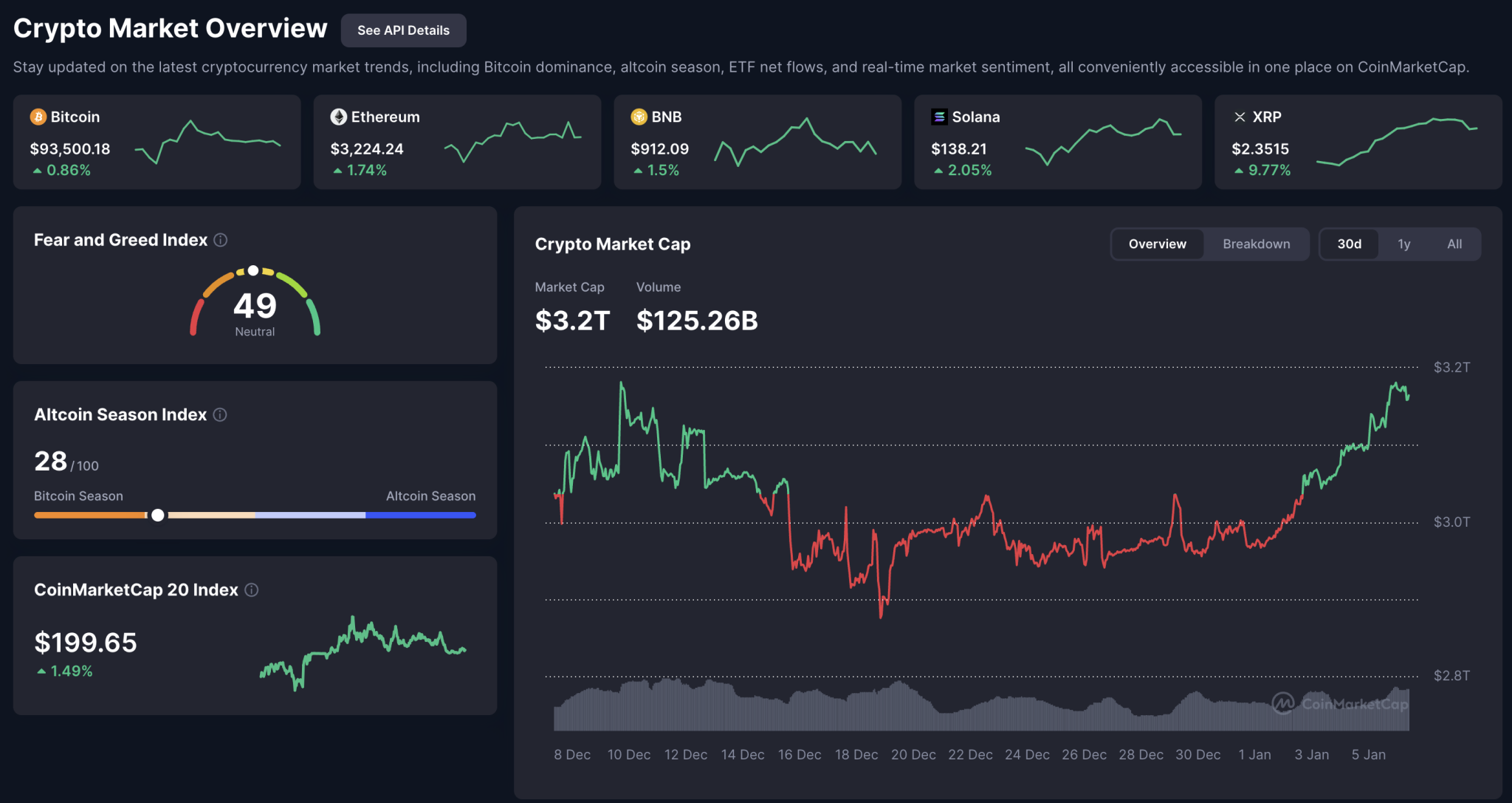

At the beginning of the year, the total cryptocurrency market was at roughly $2.96 trillion. Since then, it has expanded by about 7.7%, thus adding nearly $250 billion in capitalization.

Over the past 24 hours, the market has grown by approximately 1.5%. This pushed total crypto capitalization to $3.20 trillion, according to CoinMarketCap data, reinforcing renewed interest in large-cap assets.

Bitcoin Breaks Higher as Sentiment Improves

Bitcoin spearheaded the move higher during Tuesday’s trading session, breaking above the $94,500 level and drawing strong buying interest.

At the time of writing, Bitcoin was trading near $93,332. The asset posted a daily gain of roughly 0.79% and has risen more than 6% over the past week.

This advance followed a broad reset in leveraged positions, while escalating global tensions appeared to boost demand for perceived alternative assets.

Major Altcoins Follow Bitcoin’s Lead

Bitcoin’s strength spilled over into the broader market, lifting major altcoins. Ethereum gained around 1.5% to trade near $3,214 and is up approximately 8% over the past week.

Similarly, Solana also advanced about 1.4% on the day, thereby bringing its weekly gains to more than 10% as risk appetite widened.

Notably, XRP stood out among large-cap tokens, surging roughly 9% in a single session. Over the past seven days, the token has gained nearly 26%, trading around $2.33.

Liquidation Wave Clears Derivatives Markets

Behind the price action, derivatives markets experienced a sharp shakeout. A wave of liquidations eliminated heavily crowded positions, particularly among bearish traders.

Data from CoinGlass shows that $418.62 million in futures positions were liquidated over the past 24 hours. Of this total, short positions accounted for $330.16 million, while long liquidations reached $88.46 million.

This imbalance indicates that many traders were positioned against higher prices. Consequently, as markets rose, forced buybacks amplified the rally.

Venezuela Developments Add to Market Volatility

Geopolitical developments added another layer of uncertainty to the market backdrop. Recent U.S. operations targeting Venezuela’s leadership coincided with heightened volatility across global financial markets.

Specifically, U.S. forces captured Venezuelan President Nicolás Maduro over the weekend. Both Maduro and First Lady Cilia Flores were detained at their residence and later transported to the United States.

Subsequently, both have been charged in New York with weapons- and drug-related offenses. Meanwhile, U.S. President Donald Trump stated that the United States would oversee Venezuela during a transitional period.

Speculation Grows Over Venezuela’s Crypto Holdings

Following news of Maduro’s detention, market attention shifted to Venezuela’s potential cryptocurrency holdings. Bitcoin, in particular, became central to renewed speculation.

An investigative report published by The Whale Hunt claimed Venezuela may hold a large, undisclosed Bitcoin reserve valued between $60 billion and $67 billion.

However, publicly available data tells a very different story. BitcoinTreasuries lists Venezuela’s known holdings at just 240 BTC, worth approximately $23 million. Therefore, the stark discrepancy between the figures fueled further debate across the crypto community.

Seizure Risk Seen as a Narrative Shift for Bitcoin

Discussion then turned to the possibility of U.S. authorities seizing Venezuelan digital assets. During a CNBC appearance, journalist MacKenzie Sigalos addressed the issue, suggesting that such an outcome could reshape Bitcoin’s narrative.

She noted that even the prospect of state-held Bitcoin being seized could strengthen the asset’s appeal, reinforcing its role as a hedge during periods of political instability.

thecryptobasic.com

thecryptobasic.com