Bitcoin (BTC) had a turbulent 2025, so it kicked 2026 off with a dose of both optimism and caution as the price found itself in a tug-of-war between institutional outflows and whale accumulation.

However, while the pressure is clearly visible, artificial intelligence (AI) models suggest that the cryptocurrency may somewhat stabilize this month and maybe see some gains.

Some early signs of this stabilization may already be evident, with Bitcoin trading at around $89,500 at the time of writing, up nearly 2% on the day due to a supportive technical picture.

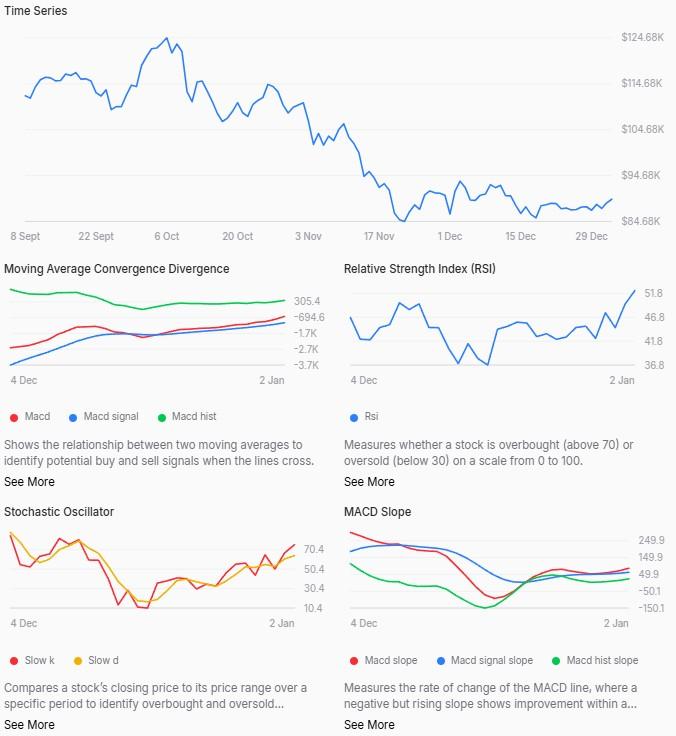

Bitcoin price reclaims key technical levels

A few of the core momentum measures have also strengthened, led by the Relative Strength Index (RSI) at 70.4, signaling firm upside momentum. The MACD value of 319.5 likewise remains positive.

Trend strength readings further reinforced the picture. For instance, the Average Directional Index (ADX) rose to 65.2, a level typically associated with bullish directional moves. Similarly, a positive Rate of Change (ROC) at 1.308 indicates that bulls are firmly in control of order flow.

However, it must be noted that the white/red Stochastic Oscillator, which measures price momentum over the past nine periods smoothed across six periods, is at 99.2, suggesting a consolidation period or a pullback toward short-term moving averages is possible.

AI Bitcoin price prediction for January 2026

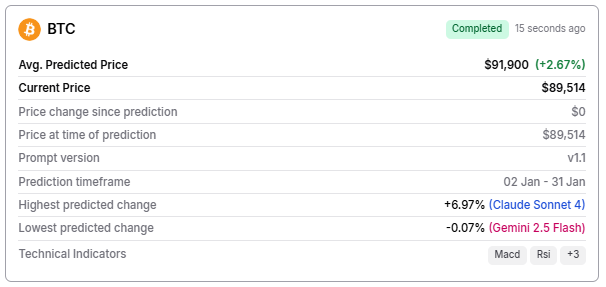

With the technical picture hinting at potential short-term upticks, Finbold used its AI-driven price prediction tool to see where BTC could sit by the end of the month. To generate its forecast, the model aggregates results from ChatGPT, Gemini 2.5 Flash, and Claude Sonnet 4, pointing to a range of potential outcomes.

The average Bitcoin price target for the end of January came out at $91,900, implying a 2.67% upside from current levels. Claude Sonnet 4 gave the most bullish figure, projecting a potential 6.97% rally, while Gemini 2.5 Flash actually suggested the price could go down 0.07% downside. ChatGPT was bullish but conservative, arguing for a 1.1% gain.

Overall, Bitcoin’s potential this month primarily reflects its technical resilience, although it can be added that $12 million in altcoin-driven liquidity inflows could also have played a role. In other words, short-term momentum currently favors buyers, who are closely watching whether Bitcoin can defend support around $88,319, the 61.8% Fibonacci level.

Featured image via Shutterstock

finbold.com

finbold.com