Bitcoin faces challenges as short traders take a hit, but its ability to hold key support will determine if BTC can gain momentum.

Bitcoin (BTC) faced significant challenges in December, on track to end the year without the widely expected year-end rally. Despite reaching $89,201.50 within the 24-hour range, the price has struggled to reclaim key resistance levels, including the $90K zone, which continues to cap upward movement.

The price action has remained largely contained between $87,121.05 and $89,201.50. Immediate support lies near the lower end of the daily range. If BTC fails to hold this level, it could face further downside, potentially testing $87K or lower.

Over the near term, Bitcoin posted a modest 1.4% increase in the last 24 hours but still faces a challenging short-term outlook with a 7-day gain of just 1.4%. Over the past 14 days, Bitcoin has shown a slightly more encouraging 1.9% increase, but this is still a far cry from the explosive price action seen in past bull runs.

With momentum slow, Bitcoin’s performance lags behind other asset classes, especially precious metals like gold and silver, which saw strong performance during the same period. Will Bitcoin catch up?

Can Bitcoin Catch Up with Precious Metals?

On a TradingView chart, Bitcoin is currently navigating a narrowing range, with the price now just above the middle band (20-day SMA) at $87,884. The price is now moving towards the upper Bollinger Band, suggesting that BTC is in a positive trajectory.

On the upside, the immediate resistance sits at $90,139.53 (upper Bollinger Band), a critical point where the price has previously faced rejections. If Bitcoin can break above this level, it may target higher resistance zones, potentially moving toward the $92,000 range.

On the downside, the key support lies at $85,628, which aligns with the lower Bollinger Band and has acted as a floor for the price in recent sessions. If Bitcoin fails to hold this level, further downside could bring the price to the $84,000 range, where another significant support level exists.

The Chande Momentum Oscillator (CMO) is currently flat at -3.16, indicating weak bullish momentum, further suggesting that Bitcoin is struggling to maintain upward movement. For BTC to reclaim a bullish outlook and catch up with recent performers, it needs to break the resistance above $90K and hold above the $87,884 support to build stronger momentum.

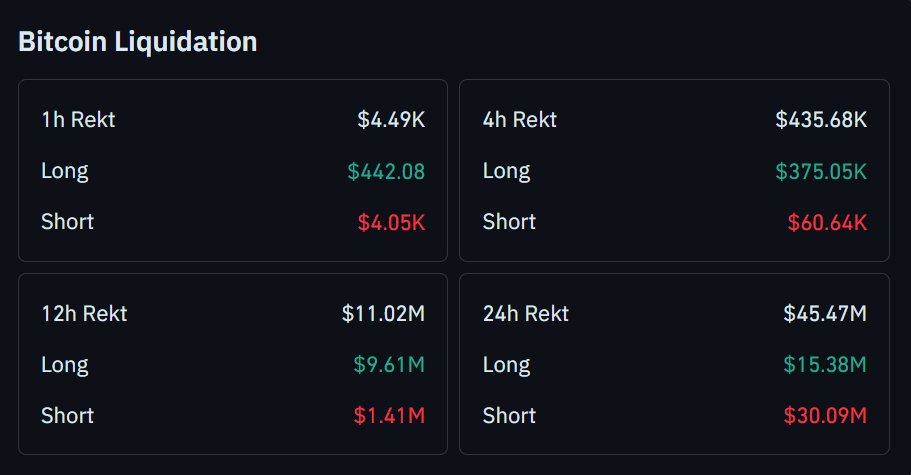

Bitcoin Liquidation Data

Meanwhile, as Bitcoin’s volatility continues to shake the market, liquidation data reveals intriguing trends in market sentiment. Over the past 12 hours, Bitcoin liquidations have totaled $11.02 million, with long positions accounting for the bulk at $9.61 million, while short positions faced smaller liquidations of $1.41 million.

This shift indicates that although buyers are active, some volatility remains, causing positions to shake out.

Looking at the 24-hour data, the total liquidation figure skyrocketed to $45.47 million, with shorts suffering major losses at $30.09 million, compared to $15.38 million in long liquidations. This dramatic imbalance shows that despite recent price fluctuations, short positions are taking the hardest hit, indicating stronger bullish momentum or a potential market rebound.

thecryptobasic.com

thecryptobasic.com