Bitcoin’s price stands at a lofty $89,995 to $90,094 over the past hour, capping a range-bound 24-hour session with a market cap of around $1.79 trillion. Trading volume clocked in at a robust $32.98 billion, as prices oscillated between $87,655 and $90,353. The digital heavyweight may not have burst through new all-time highs, but it’s clearly flexing muscle within its current battleground.

Bitcoin Chart Outlook

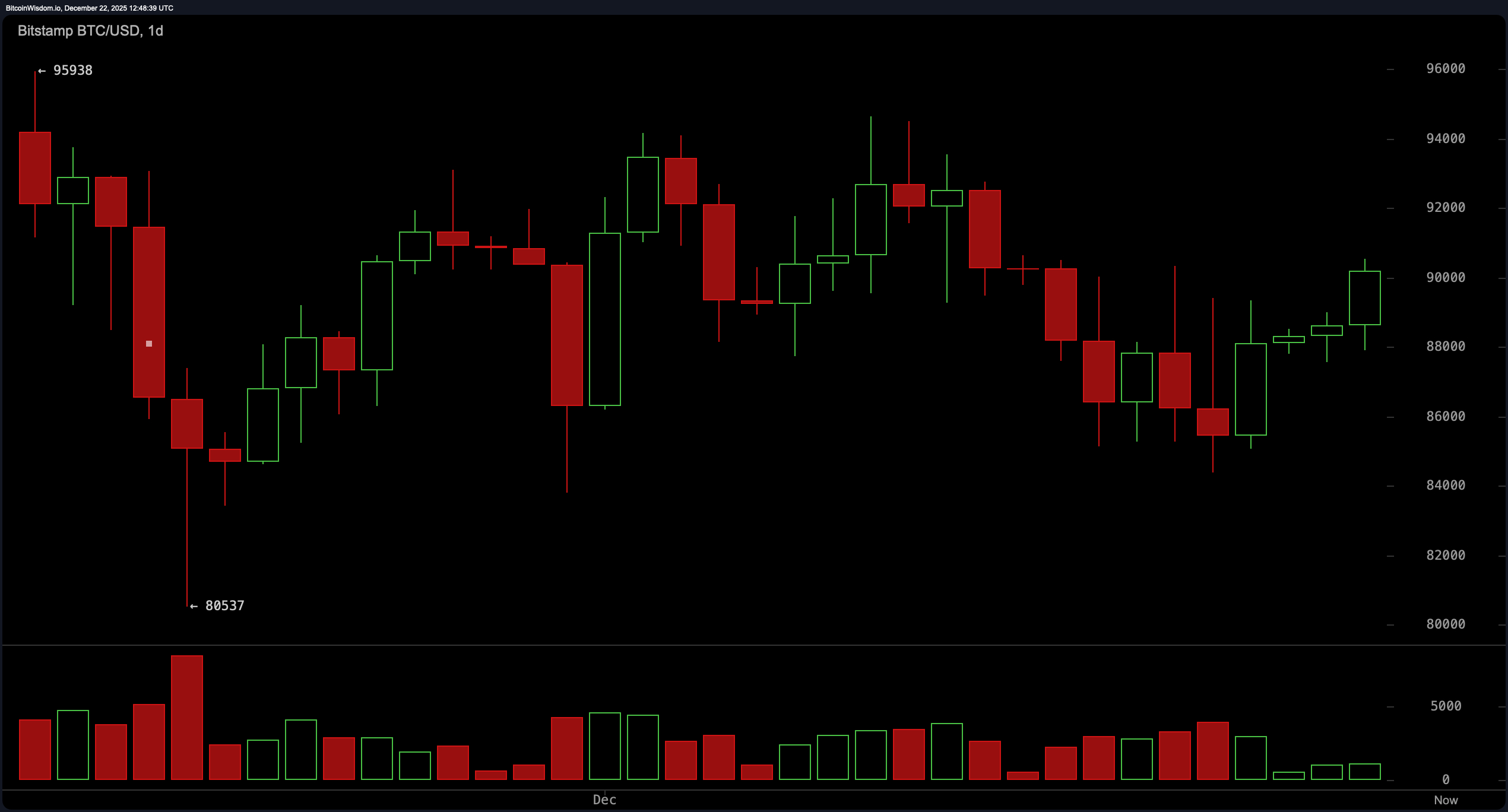

The daily chart paints a picture of calculated optimism. After shaking off a nosedive to the $80,537 low, bitcoin is now consolidating in a comeback arc. A succession of green candlesticks with upper wicks reflects buyers showing up—but with just enough hesitation to keep the $91,000 resistance intact.

Momentum is building, albeit at a cautious pace, and an uptick in volume suggests that institutional players are quietly refueling their rockets. Should bitcoin secure a solid daily close above $91,000, the door creaks open toward the $95,000–$96,000 corridor.

Zooming into the 4-hour chart, the medium-term trajectory tilts bullish with classic higher highs and higher lows defining structure. The price pivoted dramatically from around $84,398, climbing toward $90,536 on surging volume—a telltale sign that whales aren’t just watching, they’re swimming. The current consolidation band between $86,500 and $89,000 is acting as a launchpad. An intrachart revisit to the $89,000–$89,500 zone could offer reentry prospects, so long as price maintains altitude above $87,000.

At the 1-hour level, it’s all green lights and full throttle. The breakout has been decisive, with $90,536 showing up as the recent peak. Increased volume on the way up solidifies this short-term bullish streak. The $88,500–$89,000 region, once resistance, has turned into a comfy support hammock. If there’s a minor pullback toward $89,500–$90,000 with weak selling pressure, that may just be a pit stop before the next leg higher.

Now let’s talk indicators. Oscillators are playing it cool across the board, with the relative strength index ( RSI) holding steady at 50, the Stochastic oscillator lounging at 45, and the commodity channel index (CCI) barely budging at -8—all signaling neutrality. The average directional index (ADX) reads 24, indicating a trend that’s still stretching its legs. But if you’re looking for some bullish cheerleaders, look no further than momentum at -216 and the moving average convergence divergence ( MACD) at -1,325—both suggesting some forward thrust behind the scenes.

Moving averages (MAs), however, are serving up a mixed cocktail. Short-term lines like the exponential moving average (EMA) 10 at $88,605 and simple moving average (SMA) 10 at $87,947 are nudging upward. The mid-range 30-period EMA, perched at $90,574, throws in a mild contrarian vibe. Yet, the heavyweight long-term averages like the EMA 200 and SMA 200—far above the current price at $102,001 and $107,885, respectively—suggest bitcoin still has mountains to climb before calling itself fully recovered. Translation: we’re in a tug-of-war between near-term strength and long-term hesitation.

Bull Verdict:

With rising momentum, institutional-sized volume spikes, and a fierce hold above critical support zones, bitcoin appears locked and loaded for a breakout. A confirmed move above the $91,000 resistance could unleash a rally toward $95,000–$96,000, reigniting the bull flame that’s been flickering since the $80K dip. For now, the bulls are in the driver’s seat—seatbelts optional.

Bear Verdict:

Despite a strong recovery, bitcoin is still boxed below the $91,000 resistance and facing headwinds from long-term moving averages. Neutral oscillators and a narrowing price range hint at waning conviction. Without a decisive breakout, this could all be smoke before the next slide—especially if volume fizzles or $89,000 support caves in.

FAQ ❓

- What is bitcoin’s price today? Bitcoin is trading at $90,094 as of Dec. 22, 2025.

- Where is bitcoin’s key resistance level now?The $91,000 zone is the critical resistance across all timeframes.

- What support levels should traders watch?Key support lies between $88,500 and $89,000 short-term, and $85,000 longer-term.

- Is bitcoin showing bullish or bearish signals?Technical indicators and price structure lean bullish, but resistance remains unbroken.

news.bitcoin.com

news.bitcoin.com