With bitcoin off 5.5% for the month of December on a returns basis, plenty of eyes are squinting at the chart and asking what comes next. To size things up, we leaned into the wisdom of the crowd and peeked at what today’s most active prediction markets are betting on.

Myriad Bettors Still Favor $100K, but the Margin Keeps Shrinking

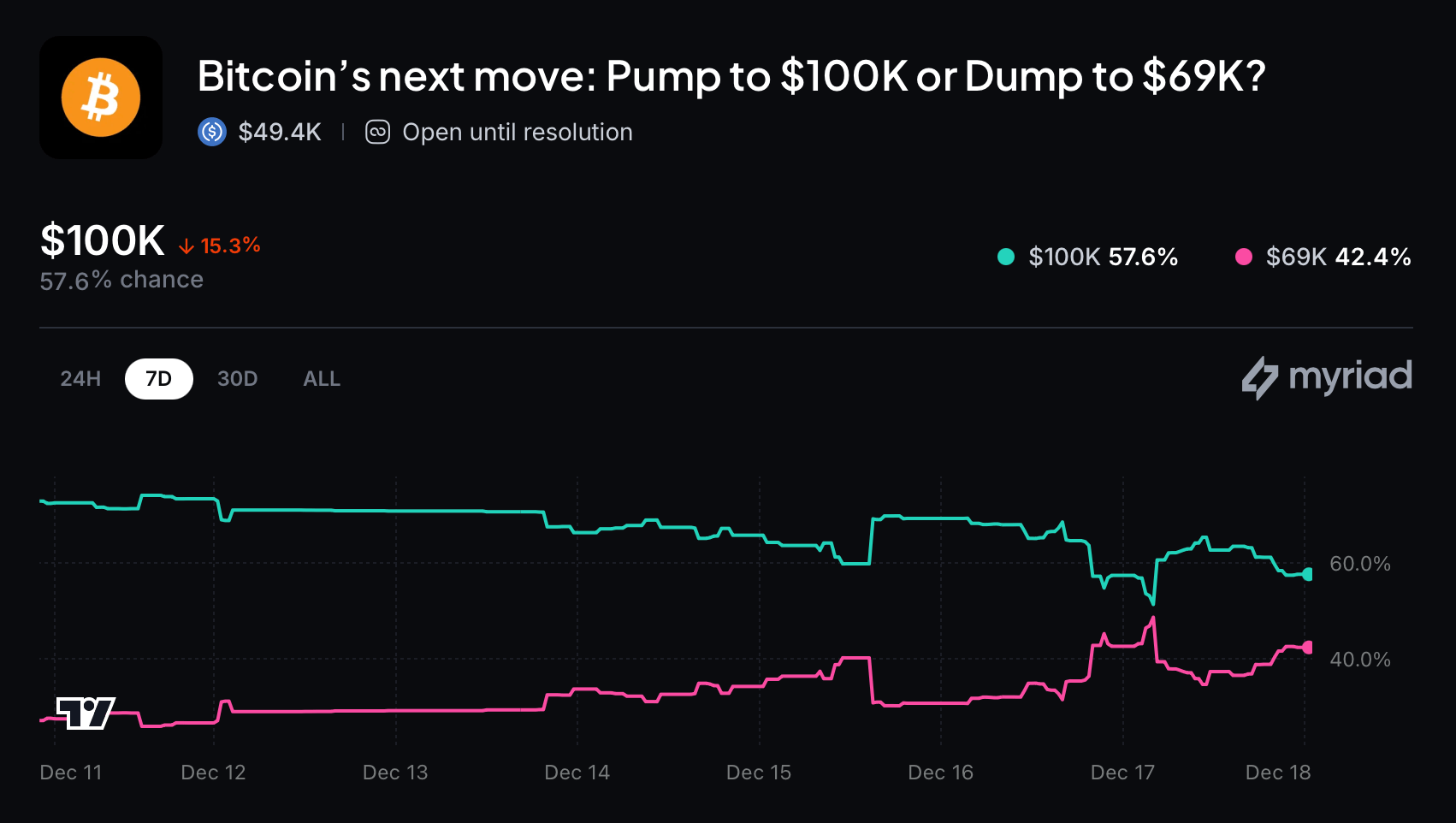

On Dec. 18, 2025, bitcoin (BTC) is trading just north of $85,000 after a brisk pop and then a drawdown earlier in the session. To get a read on where expectations are headed, we tapped the Myriad marketplace wager titled “Bitcoin’s next move: Pump to $100K or Dump to $69K?” which has chalked up 49.4K in USDC volume as of today.

In plain terms, the crowd is giving $100,000 a 57.6% chance, while $69,000 trails at 42.4%. That’s an edge, yes—but hardly the stuff of champagne corks. Over the past week, belief in the $100K outcome has slid by 15.3 percentage points, a telltale sign that some bettors are quietly dialing back their confidence.

The rules are brutally straightforward: the market stays open until bitcoin either taps $100,000 or drops to $69,000—no extensions, no gray areas. Put differently, bettors are strapped in, glued to the chart, waiting for bitcoin to choose a side and expose someone’s conviction.

For now, six figures still have the upper hand, but the spread is tightening and the tension is getting harder to ignore.

Big Targets Stay Intact on Kalshi, but the Timeline Keeps Stretching

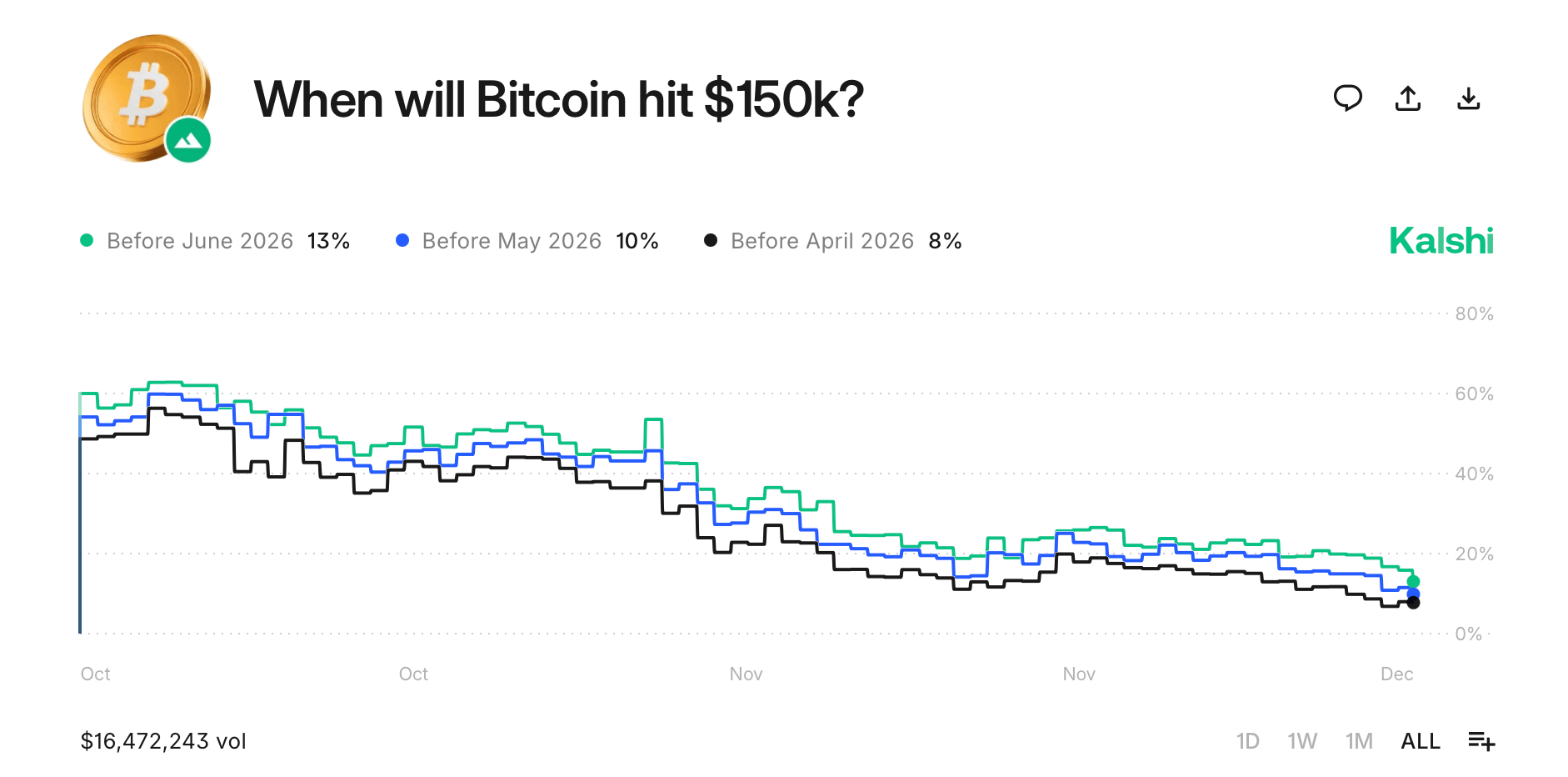

The Kalshi market asking “When will Bitcoin hit $150K?” has logged roughly $16.47 million in volume, and the odds are doing a slow fade rather than a victory dance.

As of now, mid-December 2025, the most optimistic camp—before June 2026—gets just 14%, down two points. Tightening the window trims confidence even further: 12% before May 2026 and 8% before April 2026. Anything sooner than that? Barely registers.

Scroll the timeline and the message gets louder: probabilities have steadily drifted lower from October into December, suggesting traders have cooled on the idea of bitcoin sprinting to $150K anytime soon. The pricing tells the same story—“Yes” contracts remain cheap, while “No” dominates the board like it owns the place.

Bottom line: Kalshi’s bettors aren’t denying $150K outright, but they’re clearly penciling it in for later rather than sooner. Patience, not champagne, seems to be the trade of choice.

$80K Dominates Polymarket’s Board as the Near-Term Outcome

Polymarket’s crowd isn’t hedging here—they’ve already made up their mind and circled it in permanent marker.

In the wager “Will Bitcoin hit $80K or $150K first?” nearly $693,000 in volume has piled in, and the verdict is quite lopsided. $80,000 holds an 87% probability, a confidence boost of 37 percentage points, leaving $150,000 looking like the scenic route rather than the next exit. The chart shows a steady march higher in conviction from October into December, with bettors repeatedly buying the dip in doubt and reloading on the same outcome.

The takeaway is blunt: Polymarket traders see $80K as a pit stop, not a finish line, and they’re betting bitcoin gets there long before any six-figure fireworks beyond $100K. In this matchup, $80K isn’t just favored—it’s the overwhelming house pick.

Bitcoin’s Next Chapter Is Priced With Caution, Not Cheers

Step back from the individual wagers, and a clear tone emerges: confidence hasn’t vanished, but it has definitely been trimmed. Prediction market bettors are still mapping out higher paths, yet those routes now come with longer timelines and fewer bold declarations. December hasn’t inspired panic—it’s inspired restraint, the kind that shows up when conviction meets reality and decides to slow its roll.

Also read: MicroBT Enters the Petahash Club, Taking Bitcoin Mining Rigs to a New Extreme

What ties these markets together is a preference for caution over spectacle. Short-term bets lean defensive, big-number targets are being pushed further down the calendar, and certainty is in short supply. Right now, prediction markets aren’t chasing bragging rights—they’re pricing in patience, second thoughts, and a bitcoin market content to keep everyone guessing a little longer.

FAQ ❓

- What are prediction markets signaling for bitcoin right now? Traders lean cautiously bullish but are trimming confidence on fast moves to higher price targets.

- What is the Myriad market betting on? It’s wagering on whether bitcoin hits $100,000 or drops to $69,000 first, with six figures still narrowly favored.

- What do Kalshi traders think about $150,000 bitcoin? Most see it as a later event, not something likely in early 2026.

- How does Polymarket compare? Polymarket bettors overwhelmingly expect bitcoin to revisit $80,000 before making any serious run toward $150,000.

news.bitcoin.com

news.bitcoin.com