Taiwan has disclosed that it holds more than 210 Bitcoin tokens seized through criminal investigations.

The confirmation came from the Ministry of Justice and was made public by legislator Ko Ju-Chun. Based on Bitcoin’s market price at the time of reporting, the holdings are worth approximately $18 million.

Taiwan’s Standing Among Global Government Bitcoin Holders

When compared internationally, Taiwan’s Bitcoin position is notable. Data from BitcoinTreasuries.NET would rank Taiwan as the 10th largest government holder of Bitcoin worldwide.

By contrast, the United States leads by a wide margin, holding more than 328,000 $BTC, largely acquired through seizures linked to cybercrime and fraud investigations. China and the United Kingdom follow, rounding out the top three.

Collectively, governments worldwide control more than 640,000 bitcoins, roughly 3% of Bitcoin’s total circulating supply.

Taiwan No.8!! The Ministry of Justice revealed Taiwan holds 210.45 $BTC in seized assets as of Oct 31, 2025. @coingecko data suggests this could rank Taiwan 8th globally in gov Bitcoin holdings!🏆!

經我質詢要求: 法務部回函10/31前,我國司法扣押 $BTC 達 210 顆,持有量位居全球第8! pic.twitter.com/HsGJ6ND7rP

— 科技立委葛如鈞 Ko Ju-Chun (@dAAAb) December 18, 2025

Seized Digital Assets Extend Beyond Bitcoin

While Bitcoin has drawn the most attention, the Ministry of Justice emphasized that it represents only a portion of Taiwan’s confiscated digital assets.

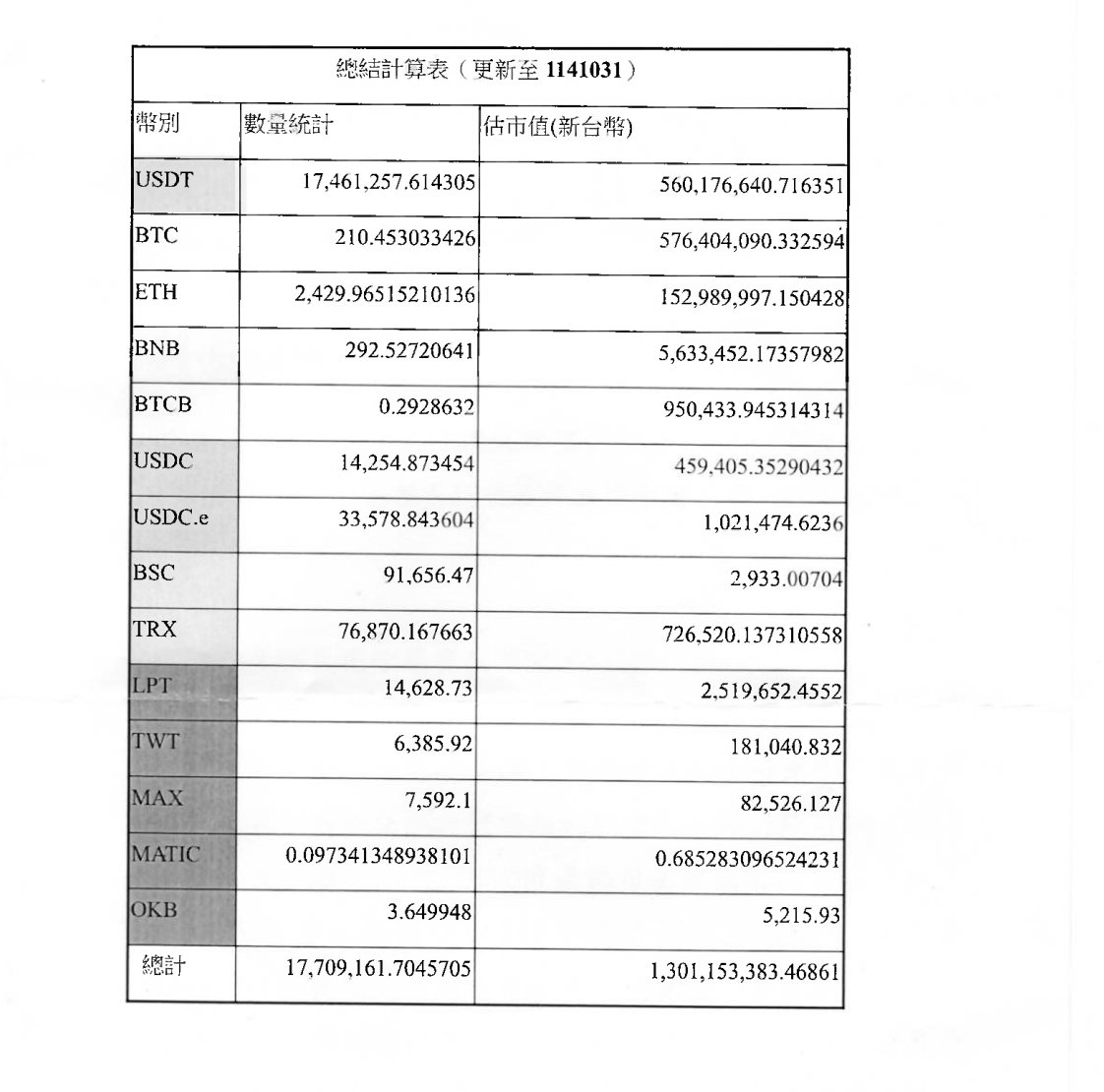

According to official inventory data, the total value of seized cryptocurrencies stands at nearly $40 million, based on market prices at the time of disclosure. Notably, stablecoins account for the largest share by quantity.

Authorities reported holding more than $17.77 million in USDT. Additional assets include $USDC and $USDC.e, as well as Ethereum and several other cryptocurrencies.

Judicial wallets also hold smaller amounts of BNB, TRX, LPT, and other minor token balances, such as TWT, MAX, and BSC.

Standardizing the Handling of Digital Assets

The Ministry of Justice said these assets were accumulated as part of broader efforts to formalize crypto-related enforcement practices.

Officials noted that work is underway to standardize the seizure, storage, and ultimate disposition of virtual assets through the judicial system. The goal is to ensure consistency in how courts manage digital assets tied to criminal cases.

Political Debate Over Bitcoin’s Strategic Role

The disclosure has intensified political debate over Bitcoin’s place within Taiwan’s financial framework.

Last month, a Taiwanese lawmaker urged policymakers to examine whether Bitcoin should be treated as a strategic or reserve asset. During a legislative session, Ko Ju-Chun argued that virtual assets increasingly intersect with national security and financial sovereignty.

Despite the growing discussion, Taiwan has not committed to any reserve strategy involving Bitcoin. Any long-term policy shift would require legislative approval and coordination with financial regulators.

Stablecoin Regulation Gains Momentum

Alongside the Bitcoin debate, momentum is also building around stablecoins oversight. In November, Taiwan’s central bank called for stricter licensing requirements for stablecoin issuers and recommended that a portion of issuer reserves be held directly at the central bank.

Additionally, the bank has sought a formal supervisory role under the Financial Supervisory Commission’s draft Virtual Asset Services Act.

FSC Chair Peng Jin-long informed lawmakers that the bill has cleared initial cabinet reviews. He added that the legislation could pass its final reading in the next session.

Consequently, stablecoin-specific regulations are expected to follow within six months, making late 2026 the earliest possible launch window for a locally issued stablecoin.

thecryptobasic.com

thecryptobasic.com