The leading cryptocurrency, Bitcoin (BTC), yesterday evening, after rising above $90,000, suddenly dropped to around $85,000.

While volatility in BTC continues, the whole world is waiting for US inflation figures.

As is known, the US Department of Labor was unable to release monthly inflation data for October due to the 43-day government shutdown.

Now, while figures for November are awaited, only annual rates will be released this month. At this point, the released CPI figures are expected to provide further clues regarding the Fed’s meeting next week.

At this point, according to FEDWatch Toll data, the probability of the Fed keeping interest rates unchanged at 3.5%-3.75% in January is priced at 73.4%, while the probability of a 25 basis point cut is priced at 26.6%.

Here are the data released for November:

Consumer Price Index Annual: Announced 2.7% – Expectation 3.1% – Previous 3.0%

Core Consumer Price Index Annual: Announced 2.6% – Expectation 3.0% – Previous 3.0%

The consumer price index is a key variable used to measure consumer purchasing trends and changes in US inflation.

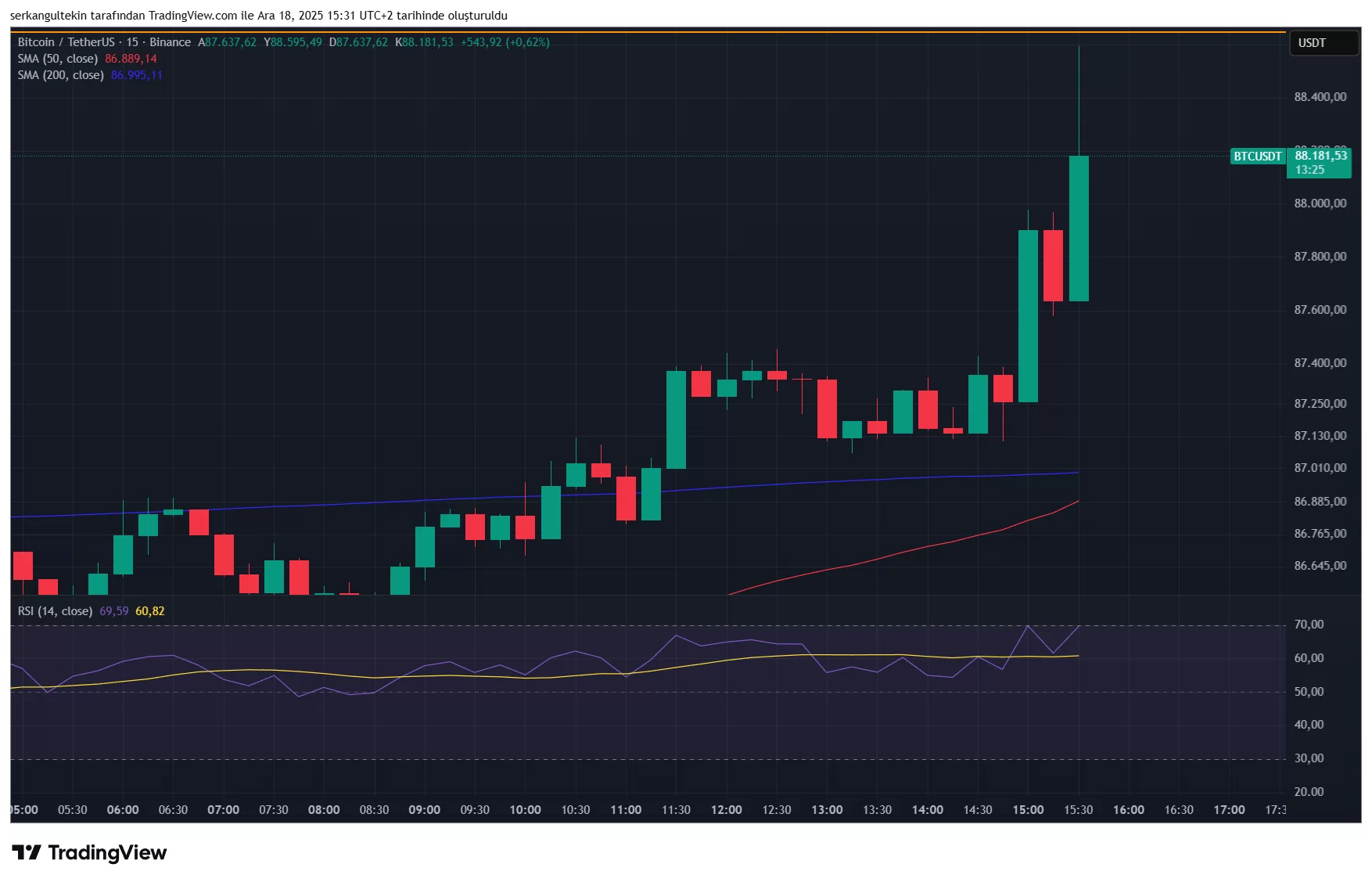

Bitcoin’s Initial Reaction After the CPI Data!

*This is not investment advice.