Veteran trader and chart analyst Peter Brandt has warned that bitcoin's $BTC$89,583.57 signature growth parabola has fractured, opening the door to a brutal slide potentially down to $25,000.

Brandt's call hinges on exponential decay in bitcoin's bull cycles. The cryptocurrency has historically rallied hard in 12-18 months after halving and subsequently slipped into a bear market, characterized by 70% to 80% pullback from record highs.

However, each bull cycle has seen diminishing returns. For instance, following the first halving on Nov. 28, 2012, $BTC chalked out a 100-fold rise to $1,240 by December 2013. The 2016 halving produced a 74-fold rise and the 2020 halving brought an eight-fold rise.

The latest post-halving cycle, which kicked off following the quadrennial event in April 2024, saw prices double to a record high of $126,000 by October this year. Since then, prices have pulled back to just under $90,000, slicing through the parabola curve that has marked massive price uptrends during each prior cycle.

"The current parabolic advance has been violated. 20% of ATH = $25,240," Brandt said on X.

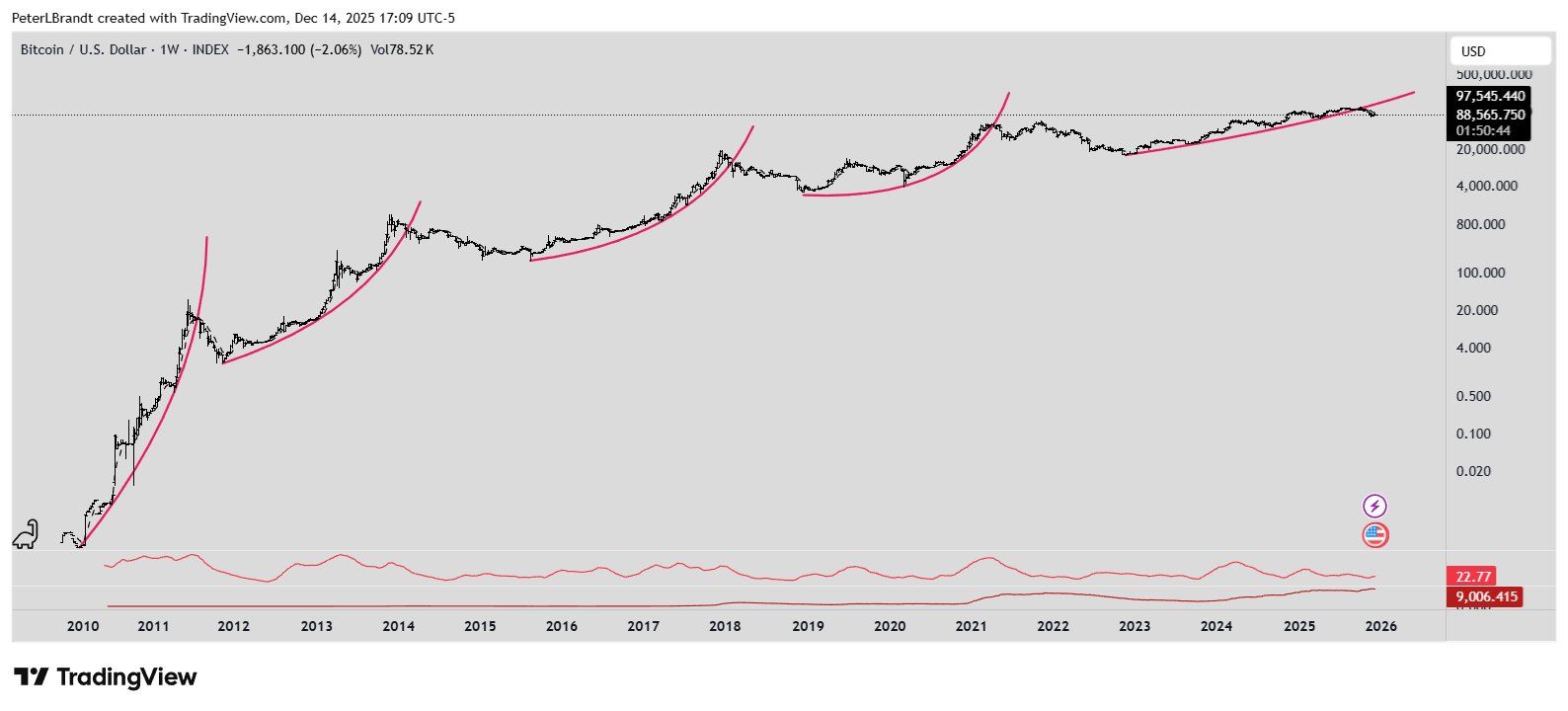

Brandt lays it out on a log-scale chart stretching back to 2010: four steepening pink arcs, each tracing a cycle's manic vertical climb. Parabolas don't bend gently, they accelerate skyward, just like $BTC's history of rapid gains.

Meanwhile, crosses below that support line have marked end of bull runs. The slide from October highs has done that, knifing under the fourth arc.

coindesk.com

coindesk.com