EGRAG Crypto suggests Bitcoin is entering phase 2 of a radical uptrend, citing the similarities between the current market conditions and 2019.

The market technician attempted to correct widespread sentiment that the current Bitcoin price action resembles the 2021 bull-cycle top. Notably, several prominent commentators have shared this view, predicting a severe price correction by next year when the pattern fully forms.

Wrong Fractal

However, EGRAG insisted that those who believe the market may have peaked, as it did in 2021, are looking at the wrong fractal. He went ahead to call it the biggest misconception floating around today’s market.

Backing his claims is the liquidity behavioral difference between 2021 and 2025. For context, the closing stages of the previous cycle followed the end of the quantitative easing (QE) effort in the US. In late 2021, the US Fed wound down its efforts to stimulate the economy after the COVID-19 outbreak and started quantitative tightening (QT) in early 2022.

EGRAG noted that this marked the top of the 2021 bull cycle, as the Bitcoin market distribution phase started afterwards.

Meanwhile, the US Fed recently did the opposite this year by ending QT on December 1. The central bank has already injected $13.5 billion into the banking sector.

“Two cycles…opposite liquidity conditions,” he concluded, speaking about the 2021 and 2025 market cycles.

Interestingly, he noted that the real comparison to current market conditions was seen in 2019, when the US Fed ended QT in December of that year. The analyst also addressed skepticism of the COVID market crash, noting that it was a black swan event and doesn’t count as normality.

What the Bitcoin Chart is Saying

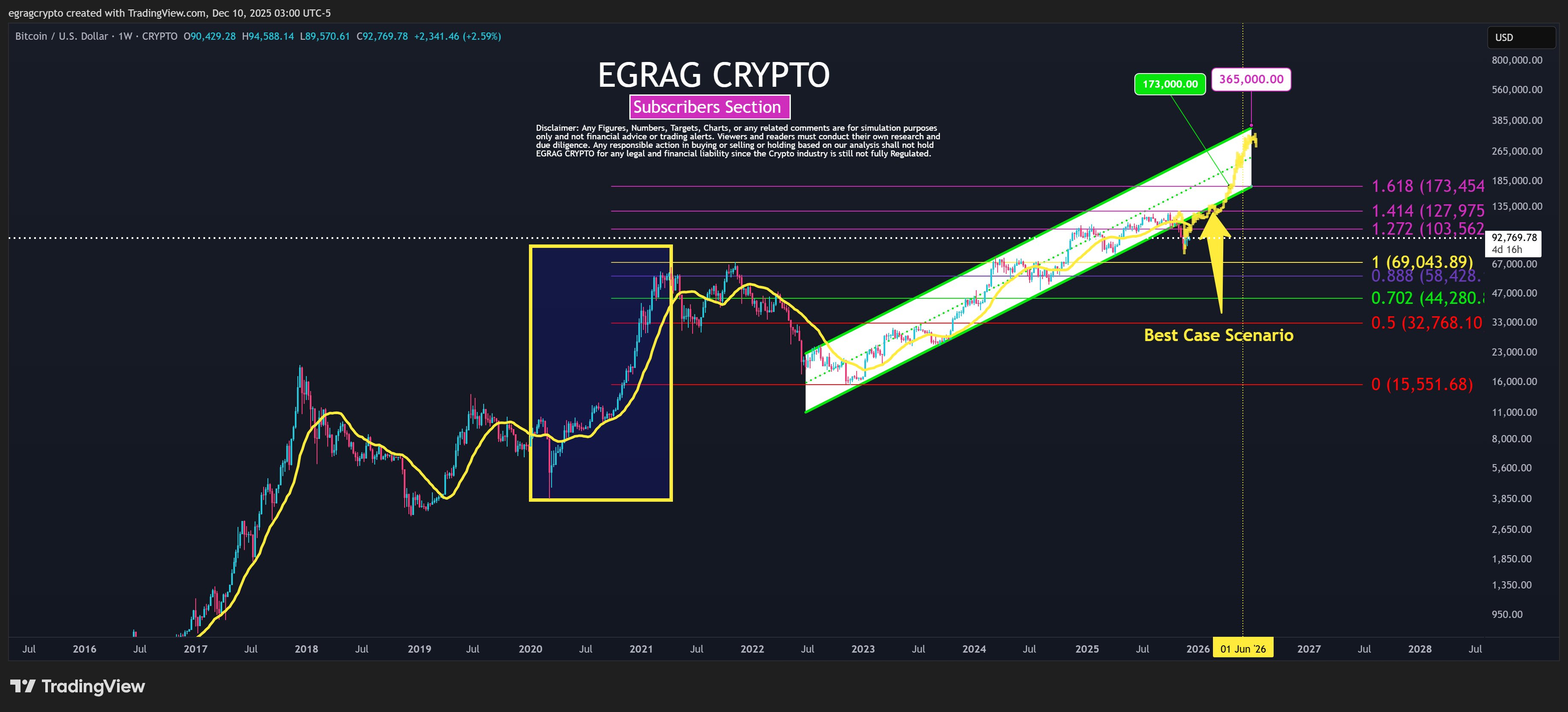

EGRAG further backed the bullish macroeconomic outlook with technical analysis. Specifically, he noted that BTC currently trends outside a multi-year ascending channel after recently losing the $100,000 psychological level.

According to him, this represents a higher-low formation, which shows continuation, not exhaustion. The analysis suggests that as liquidity strengthens, the premier crypto asset’s price would follow suit, starting the second phase of an explosive move.

In an accompanying chart, EGRAG highlighted an “expansion fractal” that Bitcoin would likely follow next year, asserting there is a 72% chance this happens. Notably, this fractal started around March 2020 with BTC rising from a low of $3,880 to the April 2021 high of $64,900.

Meanwhile, his target for this next Bitcoin rally is a recovery to $103,000, then $128,000, before a conservative push to a new all-time high of $173,000. His chart also highlighted the best-case scenario for Bitcoin, which is a rally to $365,000 per coin.

thecryptobasic.com

thecryptobasic.com