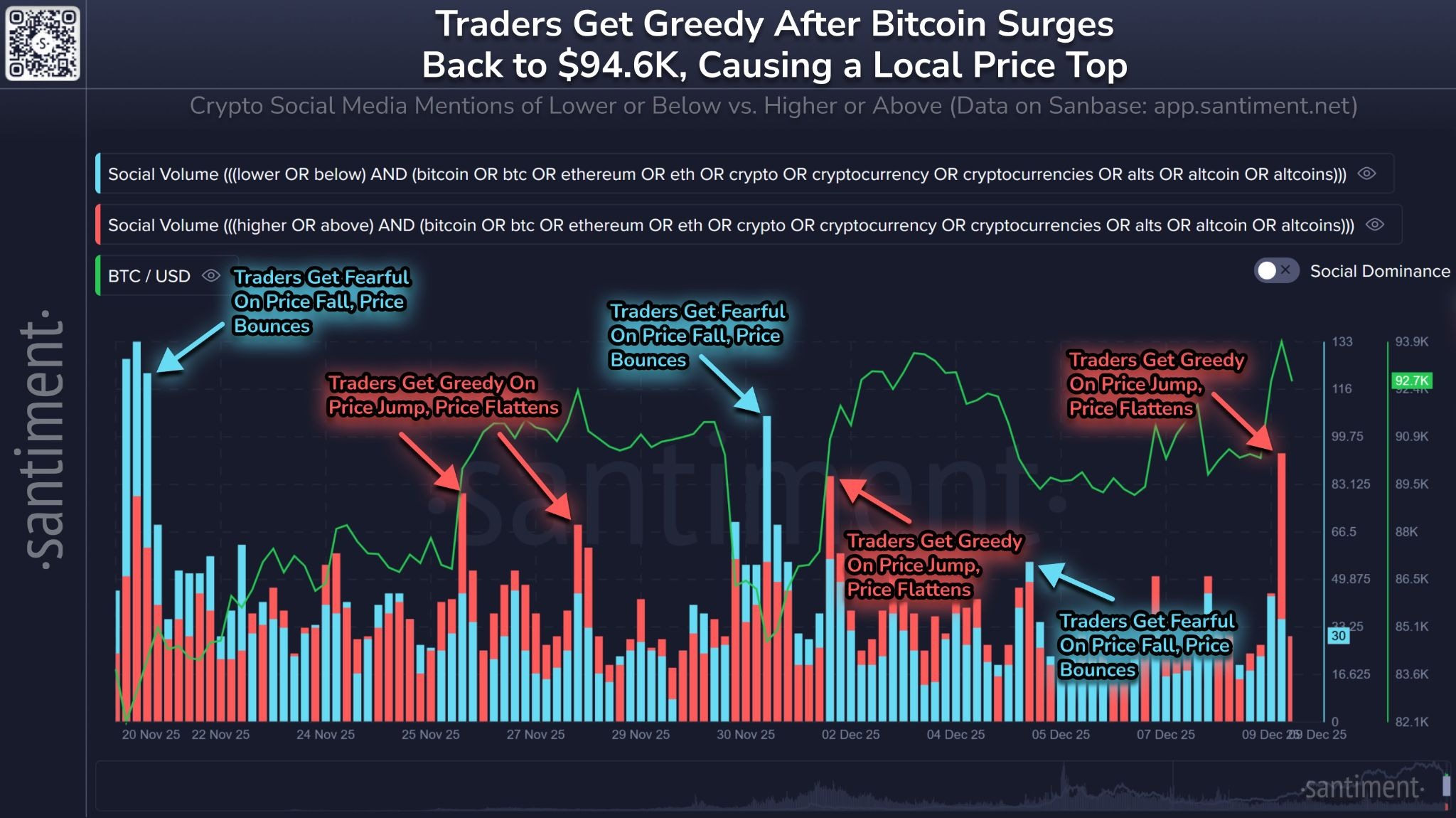

Bitcoin prices surged to a three-week high on Tuesday in a “much-needed rebound” that has caused traders to “FOMO back in and expect higher prices,” according to blockchain analytics firm Santiment.

Bitcoin (BTC) prices jumped to $94,625 on Coinbase in late trading on Tuesday, according to TradingView, its highest level since Nov. 25.

Santiment said this has led to an explosion of social media calls for “higher” and “above” across various platforms.

However, it has already started to retreat from that level, falling back to $92,400 at the time of writing, leaving analysts wondering where it will go next.

“Markets move opposite to the small traders’ behavior,” said Santiment, as this appears to be happening in the hours that followed the monthly high.

Bitcoin volatility ahead of the Fed decision

The recent surge could be challenged once the Fed meeting takes place on Wednesday, some analysts warn.

The Federal Reserve will announce its interest rate decision on Wednesday, and there is an 88.6% probability of a 0.25% rate cut, according to CME Group futures markets.

“Bitcoin is likely rallying on rate cut expectations, but right now it’s difficult to say what will happen after tomorrow’s Fed meeting,” Jeff Mei, chief operations officer at the BTSE exchange, told Cointelegraph.

He cautioned that any hesitation on future rate cuts could be bearish for Bitcoin and crypto markets. The CME futures prediction market has a 21.6% probability of another quarter-point rate cut in January.

“The risk is that the Fed outlook could include hesitation to cut rates or stimulate the economy further for the risk of inciting inflationary pressures. This happened the last time the Fed cut rates and prices tanked afterward.”

“Any price action leading into FOMC is hard to read because tomorrow [Wednesday] will be very volatile,” agreed analyst “Sykodelic.”

A Bitcoin investor suggests the recent price move was fishy

Long-term Bitcoin investor “NoLimit” told their 53,000 X followers that the move was “pure manipulation.” That sudden Bitcoin spike to $94,000 “doesn’t look organic at all,” he continued.

“People are celebrating, but if you zoom out for even 10 seconds, the move has all the fingerprints of a classic engineered pump.”

The analyst pointed out that thin order books make it cheap to push prices up, massive market buys were clustered within a few minutes, and this was followed by zero continuation, “just immediate stalling.”

“This is exactly how big players create FOMO so they can offload at better prices.”

cointelegraph.com

cointelegraph.com