Key Highlights

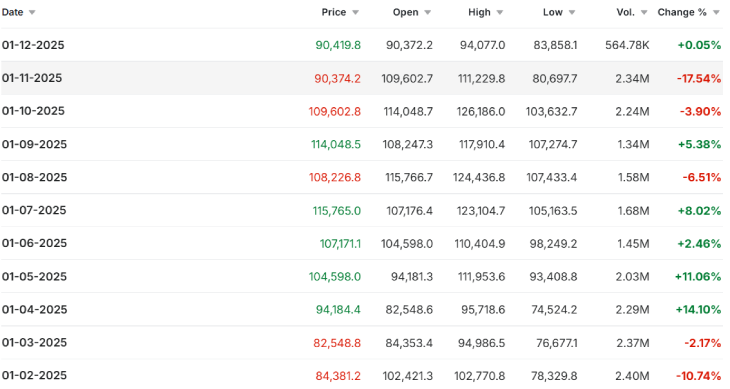

- In November, Bitcoin dropped by 17.54% due to massive liquidation events(Like October 10) and intense sell-off pressure

- After the major downward trend in November, institutional investment also depleted from Bitcoin ETFs, witnessing $3.57 billion

- Despite this downfall, Tom Lee shared a bullish outlook for the cryptocurrency market, saying the supercycle is still active

Despite the dip in Bitcoin’s price, experts like Justin Lee are still bullish about its future as they are forecasting that Bitcoin could follow an upward trajectory in the upcoming months.

“Not-So-Good November”: Bitcoin Fell Below $81,000 with Massive Liquidation

The cryptocurrency market witnessed the biggest liquidation of its history on October 10 after U.S. President Donald Trump declared a 100% tariff on China. Following this announcement, over $19 billion worth of cryptocurrency investment was wiped out from the market overnight, according to Coinglass.

After poor performance in October, the cryptocurrency market got a rough start in November, where the biggest cryptocurrency was barely seen trading above $110,000. Like this wasn’t enough, some unfortunate events have triggered the biggest downfall of the year.

According to CoinMarketCap, Bitcoin has witnessed a sharp decline throughout November, including its fall below $80,000 on November 21. This was a seventh-month low and wiped out over 35% of the cryptocurrency’s value from its peak at $126,000 in October.

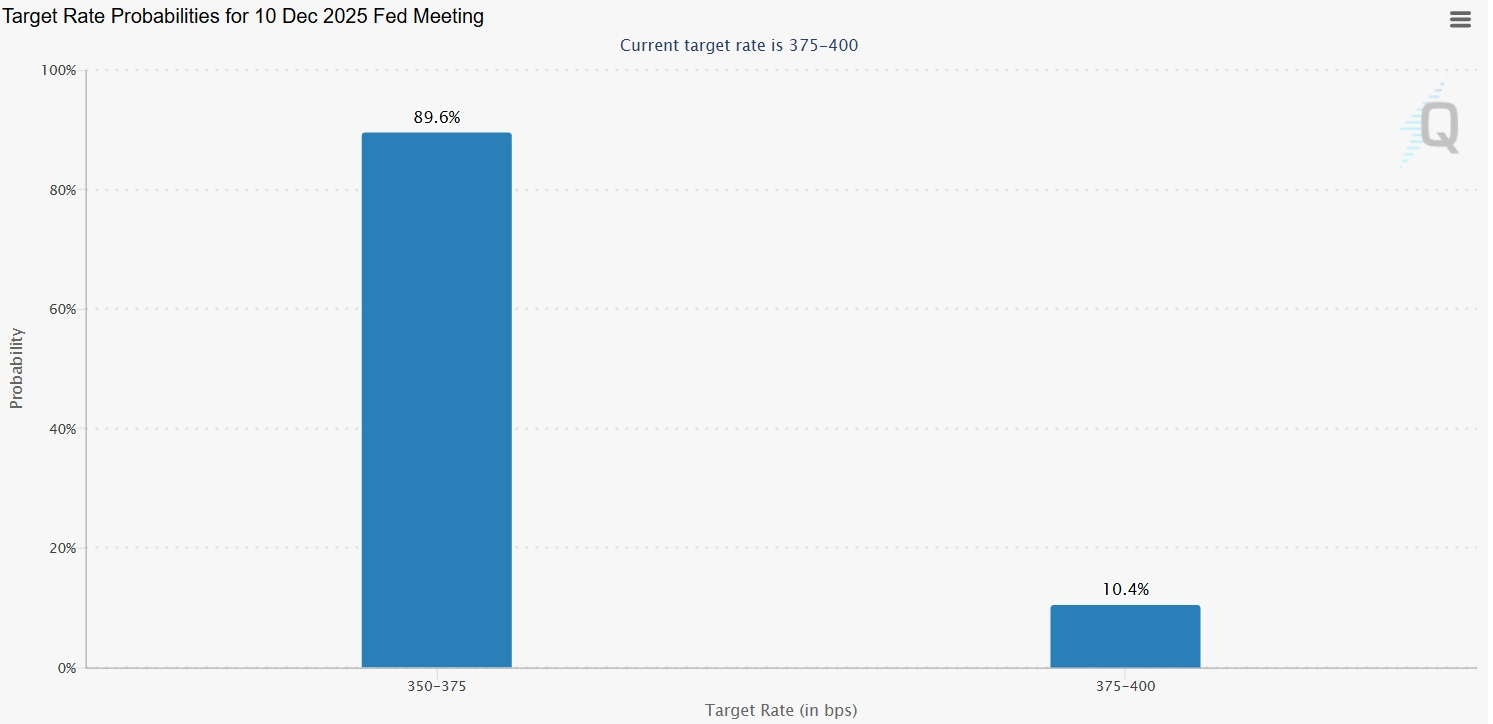

There are many factors behind this sell-off, which led to a loss of roughly $1 trillion in market capitalisation from the cryptocurrency market. However, one of the major reasons behind this downward trend was triggered by a change in expectations for U.S. monetary policy. Released Federal Reserve meeting minutes released on November 20 revealed low chances of cutting interest rates. This hesitation has broken investors’ confidence in highly volatile assets like cryptocurrencies. Adding to this, the data related to the U.S. jobs report has also reduced the chances of near-term rate cuts.

Apart from this, the turmoil in the crypto market also shook the institutional investors’ confidence as they started pulling out their investments from crypto-based ETPs. Bitcoin exchange-traded funds (ETFs), including BlackRock’s iShares Bitcoin Trust ETF and Fidelity’s fund, saw massive outflows totaling $3.7 billion in November, with daily peaks hitting $75 million.

Crypto whales and major funds also participated in this selling, which intensified the downward pressure on the price.

The declining price of Bitcoin also sparked a series of automatic sell-offs in the market. As Bitcoin fell below key technical support levels at $100,000 and then $90,000, it forced the liquidation of billions of dollars in leveraged positions placed by traders who were expecting the price to rise.

On the worst day, like November 21, over 140,000 traders had their positions liquidated, with between $500 million and $700 million in long positions being wiped out.

Apart from this, the European Systemic Risk Board (ESRB) has recently raised a warning on stablecoin. This has also impacted the crypto market.

Altcoins like Ethereum and Solana also followed Bitcoin’s downward trend with major losses, proving their correlation. Also, this bearish run damaged the stock price of Strategy, the biggest Bitcoin holding public company.

Will Bitcoin Follow a Downward Trajectory in December?

At the time of writing this, Bitcoin is showing a sign of recovery as it is currently trading at around $91,558 with a tiny surge of 1.3%. However, its total market capitalization still sits below $2 trillion.

According to Tom Lee, co-founder and Head of Research at Fundstrat Global Advisors, the supercycle in the cryptocurrency market is still active despite the market’s volatility in November. He affirmed that the recent decline and recovery period show more upside potential ahead.

In his forecast, he mentioned that the real golden age of cryptocurrencies has only just begun. He set 2026 price targets of $300,000 for Bitcoin and $20,000 for Ethereum. If this is true, $BTC could see some upswing in this month, such as breaking the psychological mark of $100,000.

British multinational bank Standard Chartered has reduced its 2025 year-end price forecast for Bitcoin by half, from $200,000 to $100,000. The bank’s analysts stated that the aggressive corporate buying trend, exemplified by firms like Strategy, has largely run its course.

(Source: CME Group)

Apart from this, the CME Group indicator shows an 89% chance of a 25bp Fed rate cut at the December 10-11 FOMC meeting, according to the CME FedWatch Tool. This would lower the federal funds rate to 3.50% to 3.75%.

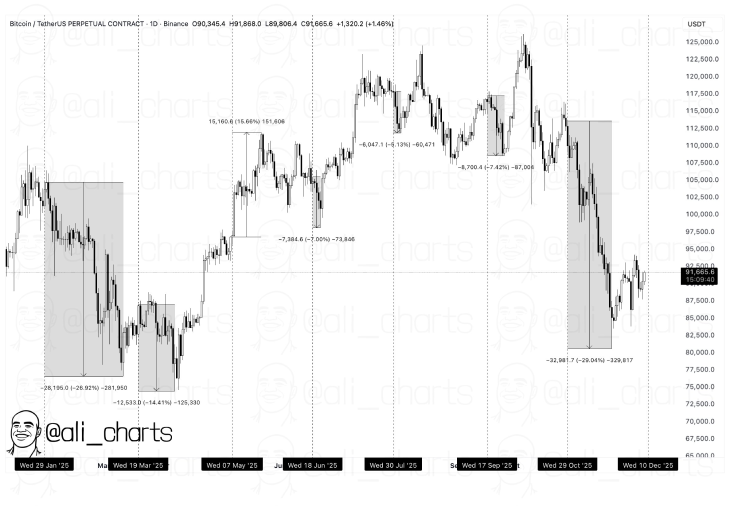

(Source: Ali on X)

However, throughout 2025, $BTC has shown a consistent tendency to drop after meetings of the Federal Reserve. According to market analyst Ali, out of seven Federal Open Market Committee (FOMC) meetings held so far this year, 6 have resulted in quick price corrections for Bitcoin. Only one meeting was followed by a short-term rally.

cryptonewsz.com

cryptonewsz.com