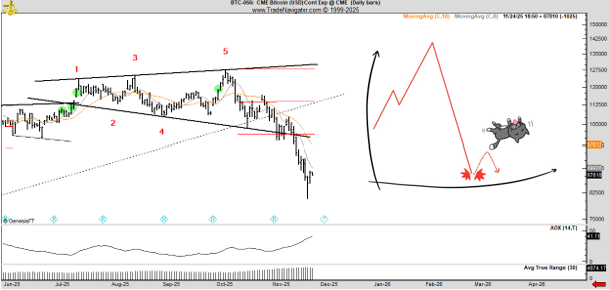

Veteran trader Peter Brandt remains cautious about Bitcoin’s outlook. In his latest post on X, he stated that the recent rally might be the only retest of the broadening top pattern that traders will get.

The formation, often called a megaphone pattern, is widely viewed in technical analysis as a warning sign that an uptrend could be approaching a bearish reversal.

“This week's rally may be all the retesting of the broadening top we will see. Of course, we will see,” the seasoned trader wrote.

This week's rally may be all the retesting of the broadening top we will see $BTC

— Peter Brandt (@PeterLBrandt) December 5, 2025

Of course, we will see pic.twitter.com/OmabcfgZVK

Bitcoin price to drop below $70,000?

According to Brandt, Bitcoin failed to reach the upper boundary of its long-term price channel during this year’s advance. In earlier market cycles, the same kind of behavior often preceded a decline toward the lower boundary of the channel.

That area begins below $70,000 and stretches into the mid $45,000, which is why Brandt treats that entire region as a realistic target rather than a dramatic scenario.

Brandt assigned a 30% probability that Bitcoin had already topped in the current cycle. If the top comes in the second half of September, it could even be remembered as the "Brandt Top," he said. The comment was made right at the time when Bitcoin (BTC) was trading at approximately $120,000.

In late November, Peter Brandt revisited the chart with a hand-drawn "dead cat bounce" figure, which usually describes a temporary recovery within a broader bearish trend. The setup sees Bitcoin's two-week drop from above $120,000 to the low $80,000s as a full five-wave correction, with nothing more than a basic rebound on the other side.

The chart shows the same zone that traders have been stuck in for days: around $88,000 to $92,000. According to Brandt, the $88,000–$92,000 range is the only one that matters right now.

Will Bitcoin recover in 2025?

Bitcoin started December near 85,000 dollars but staged a sharp rebound that pushed it up to the 94,000 dollar area. This move revived hopes among traders that a seasonal Christmas rally could still emerge.

Retail investors have been eyeing 97,000 dollars as an important resistance level and a potential point to take profit, yet the market has not been able to reach that target.

Despite the recent volatility, Bitcoin continues to dictate direction for the broader market. Most major altcoins tend to mirror its movements, and sentiment across the sector usually adjusts in response.

For now, market participants remain cautious but optimistic as they wait for a decisive breakout to set the tone going into 2025.

On the bright side, the “extreme fear” state of the past two months is starting to shift, as the Fear & Greed index moves from the red zone into orange.

u.today

u.today