The cryptocurrency market is showing signs of stability following days of heavy selling pressure. Bitcoin reclaimed the $93k level a few hours ago, adding 7% to its value in the last 24 hours.

The recent positive performance comes amid renewed bets that the Federal Reserve is nearing its first rate cut of the cycle.

Fed rate cut odds push BTC to $93k

Copy link to section

Bitcoin, the leading cryptocurrency by market cap, dropped below the $84k level on Monday following a poor start to the week.

However, the cryptocurrency turned things around on Tuesday and has added 7% to its value in the last 24 hours.

Thanks to the recent rally, Bitcoin is now trading at $93,000 per coin.

The bullish performance comes amid renewed optimism of an interest rate cut by the Federal Reserve in its upcoming FOMC meeting on December 10.

Softer US data, cooling inflation signals, and weakening labor market indicators have shifted market expectations, with over 50% of traders now expecting the Fed to reduce its benchmark rate next week.

The shift in sentiment has reduced fear across risk assets, allowing Bitcoin to find a footing around the region where institutional buyers previously stepped in.

In addition to that, lower yields expected from the beginning of Quantitative Easing (QE) by the Fed will reduce pressure on risk assets.

This could allow Bitcoin and other major cryptocurrencies to also rally higher in the near to medium term.

If US data continues to weaken, Bitcoin’s recovery window widens.

Furthermore, following heavy outflows, stabilizing inflows help reduce downward momentum.

Spot Bitcoin ETFs recorded a net inflow of $58 million on Tuesday, suggesting that institutional investors are regaining interest in the crypto market.

With derivatives wiped out in recent weeks and shorts built up, BTC is primed for short-covering rallies.

The rallies could potentially allow Bitcoin to retest the $100k psychological level in the near term.

These strong fundamentals support the switch in the weekly Order Block (OB) reaction, with a bullish movement expected to align with macro conditions easing.

Bitcoin could retest the $97k daily resistance

Copy link to section

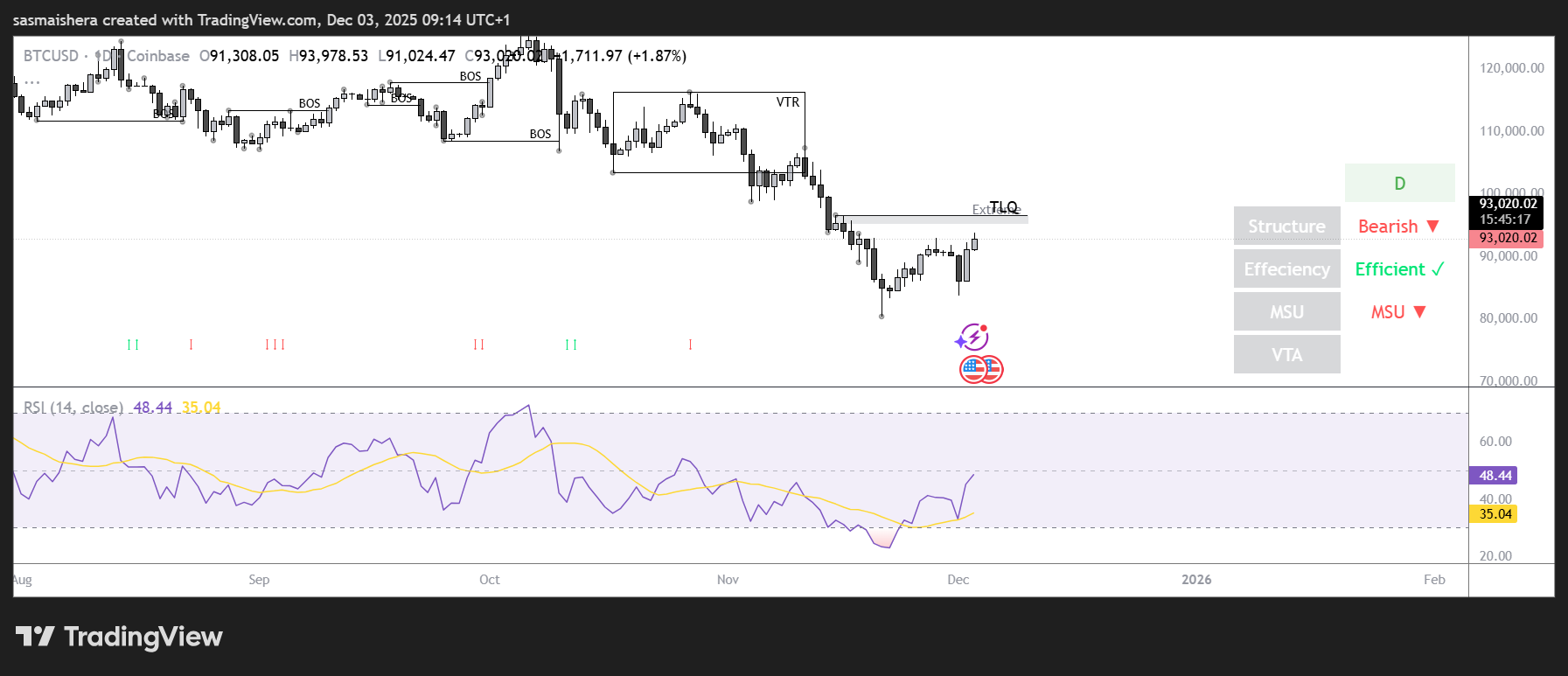

The BTC/USD daily chart is bearish and efficient as Bitcoin has added 7% to its value in the last 24 hours.

The leading cryptocurrency is trading at $93k and could rally to $97k if the resistance level is overcome.

The technical indicators have improved, suggesting that the bulls are regaining control of the market.

The RSI of 35 shows that the bears are still in control, but Bitcoin is no longer in the oversold region.

The MACD lines are also within the bearish zone.

If the recovery continues, BTC could rally towards the $97k level over the coming hours or days.

However, the resistance level above $93k remains strong.

On the flipside, if the bears regain dominance, Bitcoin could retest the $83k support level in the near term.

invezz.com

invezz.com