Bitcoin holds key Fibonacci support as signs of recovery appear and an analyst eyes a move to new all-time highs.

Renewed optimism around potential Federal Reserve rate cuts is lighting a hopeful spark for Bitcoin price recovery. Notably, Bitcoin’s price, currently at $87,729, reflects a period of consolidation in the past few hours, following a peak of $89,209 on Monday this week. The daily price range has fluctuated between $86,215 and $88,097, indicating a relatively tight trading range within the past 24 hours.

Looking at the performance over the longer term, Bitcoin’s price has dropped by 3.5% over the past week, and 15.1% over the last 14 days. The performance indicators point to a cautious outlook for the short-term. Will Bitcoin test and breach crucial resistance for another leg up?

Bitcoin Price Analysis

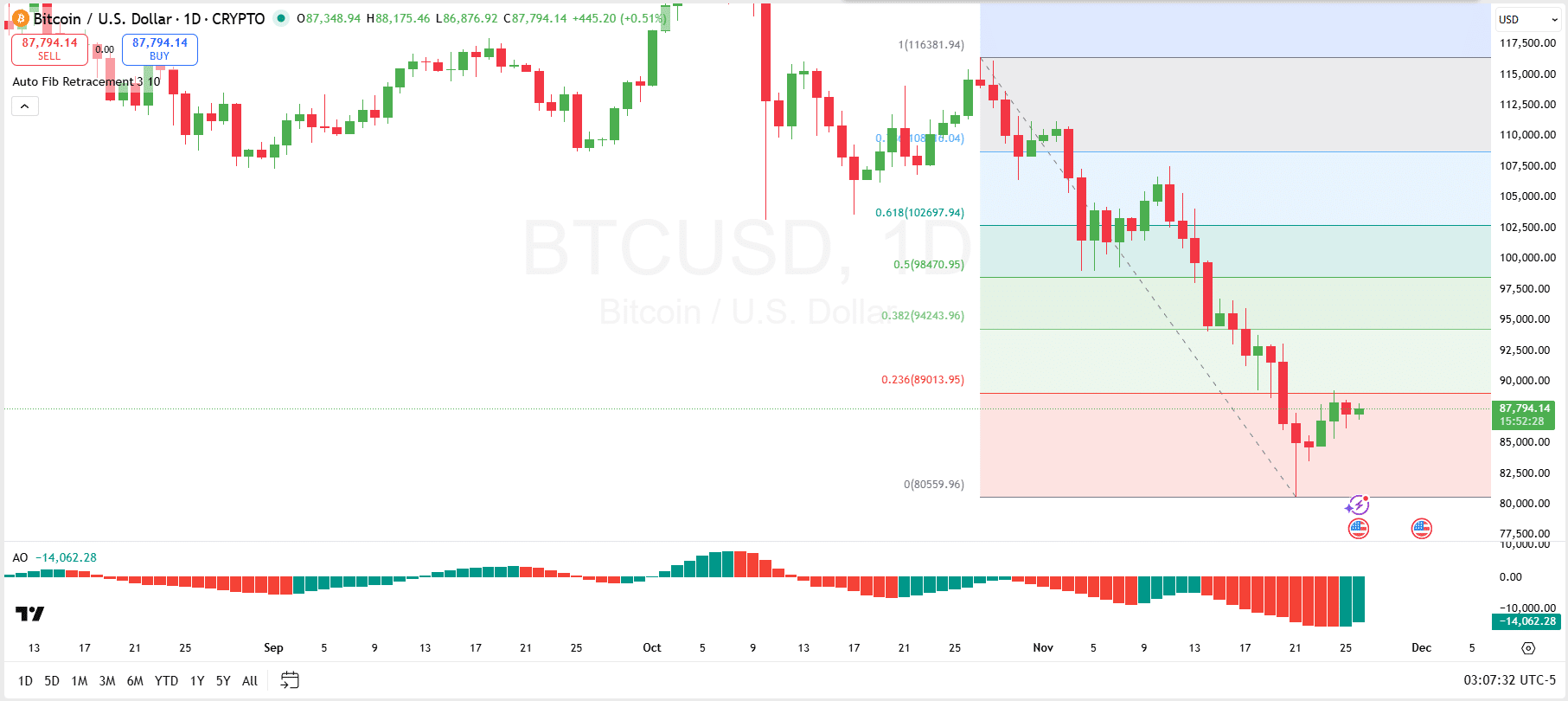

On the technical end, Bitcoin’s latest daily chart shows the asset attempting to stabilize with a modest rebound from the $80,559 local low from November 21. Price is now trading near $87,794, sitting in the mid-zone of its current range and testing early signs of recovery.

The Fibonacci retracement levels outline clear resistance zones ahead: BTC remains below the 0.236 level at $89,013, while the 0.382 ($94,243), 0.5 ($98,470), and 0.618 ($102,697) levels represent major barriers the bulls must reclaim to confirm a broader trend reversal. Until then, the market remains in a corrective structure, but the tightening range suggests momentum is shifting from aggressive selling to cautious accumulation.

Notably, a decisive break above the 0.236 Fib level could open the door for a recovery toward $94,000 and $98,000. Conversely, failure to hold above the mid-range could expose the $82,000–$80,500 support area again.

The Awesome Oscillator (AO) reinforces this shift by showing a gradual decline in bearish momentum. After printing deep red bars throughout most of November, the indicator is now turning lighter and beginning to produce green bars. This is typically an early bullish signal.

Bitcoin Repeats 2021 Bear Setup

Elsewhere, a latest analysis from Merlijn The Trader highlights a striking resemblance between Bitcoin’s current market structure and the 2021 bear market setup. In 2021, BTC failed to hold a key horizontal support level and broke below its descending trendline, triggering a prolonged downturn.

Today’s chart shows Bitcoin testing a similar structure, with price once again pressing against a major macro support zone, this time around $82,000. However, unlike in 2021 when the breakdown confirmed a deeper bear cycle, BTC has bounced off this level.

According to Merlijn, this successful defense of the $82K base is the key differentiator that could flip the entire market bullish if price manages to break above the prevailing downtrend line. The analyst places his target at $180,000 if the formation plays out. This would represent a 105% increase from the current price.

thecryptobasic.com

thecryptobasic.com