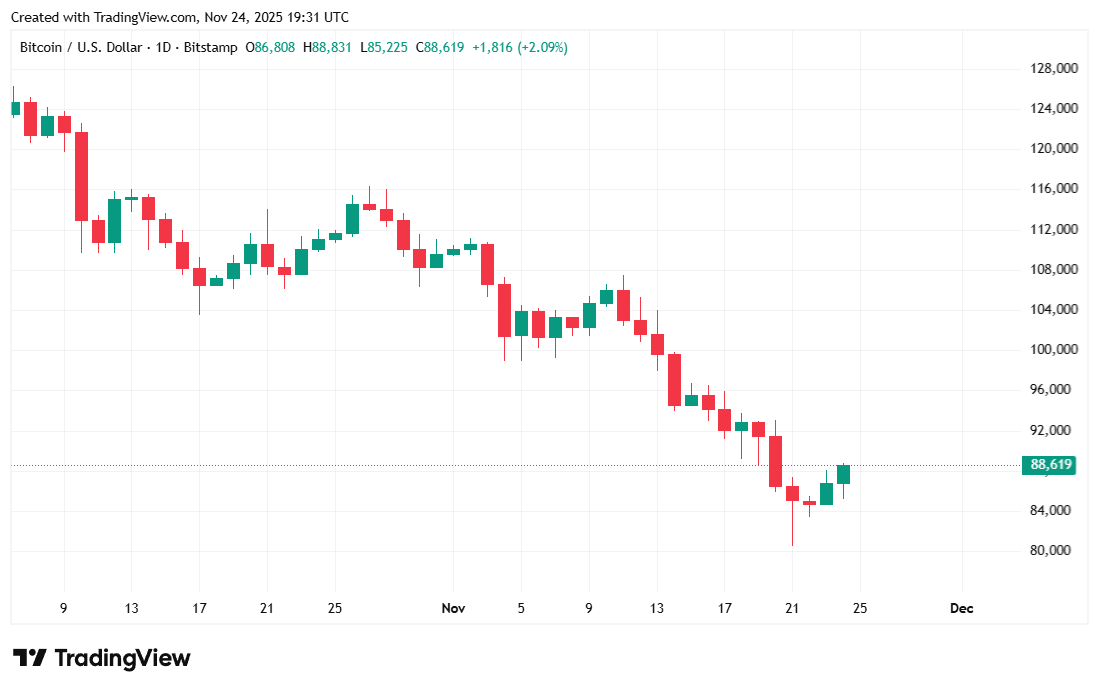

The cryptocurrency has managed to claw its way back to $88K after sinking all the way to $80K last week.

Bitcoin Gets a Boost from an Unlikely Ally: Google

The multi-trillion-dollar AI bubble appears to have made Google and bitcoin allies of convenience. At a time when AI startups such as Anthropic and OpenAI are throwing markets into chaos with what many consider to be overinflated valuations, Google may just be the much-needed counterbalance shrewd investors have been searching for.

The tech giant released its highly anticipated Gemini 3 model last week, touting it as Google’s “most intelligent model” capable of “PhD-level reasoning.” Google claims Gemini 3 handily outperforms competing products from both OpenAI and Anthropic across multiple benchmarks. And that’s probably true, because in a leaked memo obtained by The Information, Sam Altman, CEO of OpenAI, immediately sounded the alarm, warning his employees that Google’s new release will create “economic headwinds” for the tech mega-cap’s competitors.

Read more: Anthropic Hits $350 Billion Valuation, Adding to Fears of an AI Bubble

“We need to stay focused through short-term competitive pressure,” Altman reportedly said. “We have built enough strength as a company to weather great models shipping elsewhere.”

Google has not only been diligently working on AI models, but it has also invested heavily in chip technology. The 400-pound gorilla of AI chip manufacturing is Nvidia, which produces graphics processing units (GPUs). Google, however, has spent over a decade crafting its own tensor processing units (TPUs), which are innovative chips specifically designed for AI. The company released the seventh generation of its Ironwood TPUs earlier this month, a direct threat to Nvidia.

And now, with well-respected investors like Warren Buffett snapping up $4.3 billion in Google stock, many experts are hoping that the 27-year-old firm represents a level-headed bet on AI, unlike its overhyped startup competitors, who are hemorrhaging money and are projected to continue bleeding cash well into the foreseeable future. Google’s Gemini 3 announcement took place last Tuesday, but investor sentiment seemed to peak today. The company’s stock was up a whopping 6%, lifting both stock markets and, interestingly, bitcoin.

“Google has been doing excellent work recently in every aspect,” Altman said.

Overview of Market Metrics

Bitcoin was trading at $88,648.35 at the time of writing, up 1.27% since yesterday but still down 3.77% for the week, according to Coinmarketcap data. The digital asset’s price fluctuated between $85,272.20 and $88,809.01 over the past 24 hours.

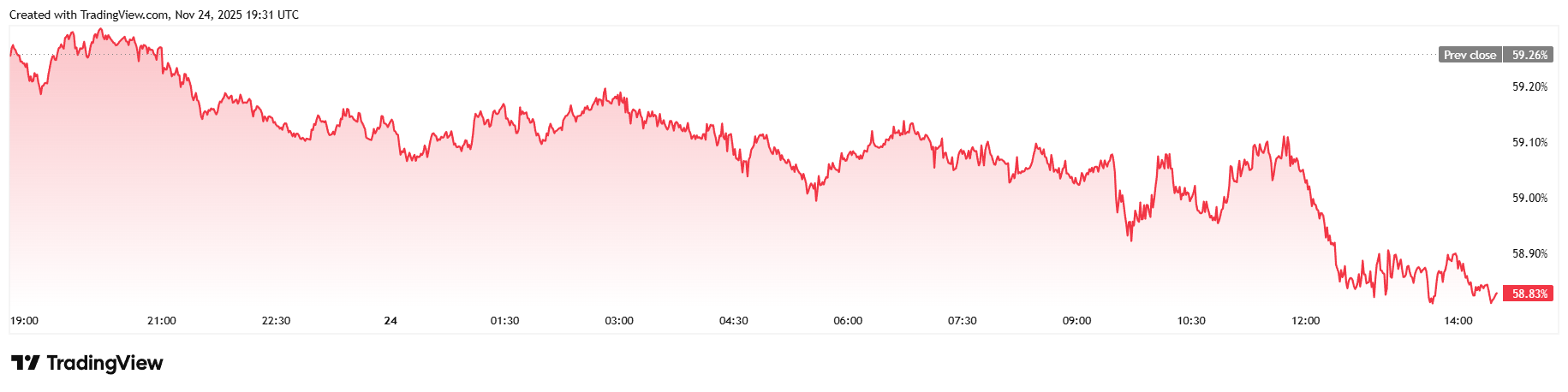

Daily trading volume was up 45.28% using Sunday as a benchmark, which translates to $74.48 billion or just under half of last Friday’s volume. Market capitalization inched up to $1.76 trillion but bitcoin dominance fell to 58.83%, a 0.72% decline.

Total bitcoin futures open interest increased 0.81% to $61.18 billion according to Coinglass data. Liquidations eased significantly compared to last week, reaching a total of $116.74 million at the time of reporting. This time, it was bearish short sellers who dominated losses, with $73.15 million wiped out. Long investors lost $43.59 in liquidated margin.

FAQ ⚡

-

Why did Google’s Gemini 3 announcement boost bitcoin?

Because Google’s strong AI showing calmed fears of an overheated AI bubble, improving overall risk sentiment and lifting bitcoin alongside tech stocks. -

How is Google influencing investor confidence right now?

Google’s advancements in Gemini 3 and its new TPU chips have positioned it as a stable, profitable AI leader compared to cash-burning startups. -

Why are experts calling Google an “ally of convenience” for bitcoin?

A stronger, more grounded tech narrative from Google counteracts market chaos caused by overhyped AI startups, indirectly benefiting bitcoin. -

What market reaction followed Google’s surge?

Google stock jumped 6%, boosting major indices and helping bitcoin climb above $88K as liquidations eased and futures markets stabilized.

news.bitcoin.com

news.bitcoin.com