Bitcoin has dropped 22% this month, causing anxiety among new investors.

Meanwhile, longtime crypto supporter Anthony Pompliano says it’s a normal part of Bitcoin’s cycle.

Speaking on CNBC, he noted that Bitcoin has seen 30% drops 21 times in the last 10 years, with seven of them over 50%.

Pompliano says this kind of volatility is normal for Bitcoin and mainly surprises people coming from traditional finance. He views the current 33% fall from its all-time high as a “healthy reset,” caused by changes in who holds Bitcoin and year-end trading pressures.

Why He Believes the Market May Be Near a Bottom

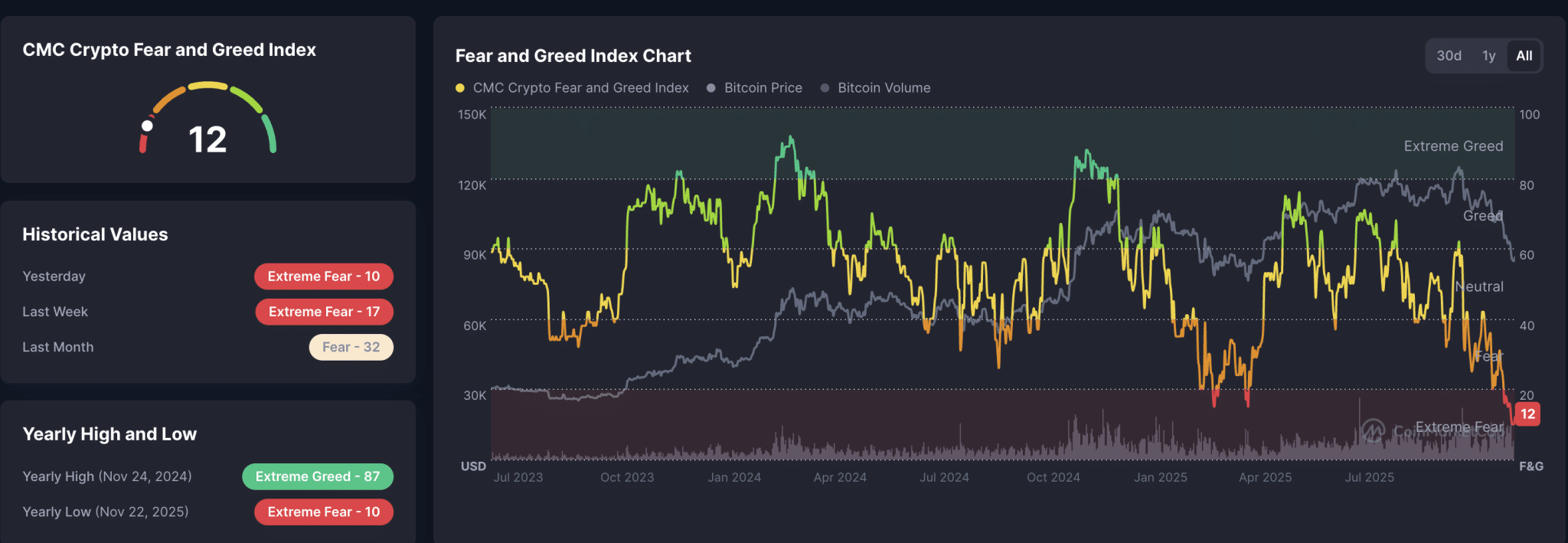

Pompliano pointed to several signs suggesting Bitcoin could be stabilizing. Among the strongest is extreme sentiment data.

Specifically, the Fear and Greed Index recently plunged to 8 for Bitcoin and 6 for equities, levels he described as “very, very rare”. “You can’t stay there that long,” he said.

Pompliano added that fear-driven conditions typically signal that leverage has already been flushed from the market. According to him, open interest and leverage levels were far more elevated in early October, right before widespread liquidations.

With high-risk positions wiped out and sentiment crushed, he believes the market may now be forming a base. He expects a period of sideways movement followed by a gradual grind higher over the next several weeks.

Role of Volatility as Bitcoin Matures

Pompliano also pointed out that Bitcoin’s volatility has dropped a lot over the past two years. Quoting VanEck’s Matt Seigel, he said that if volatility is “cut in half,” then big price drops might shrink too.

Instead of the historic 80% crashes, Bitcoin may now see pullbacks around 40%, which matches the current 30–37% drop. Lower volatility might mean less dramatic bull runs, but it could also make future crashes less severe.

“Volatility is actually a strong signal,” he said. “You need volatility for the asset to go up.”

“I’m Buy More Bitcoin”

Interestingly, Pompliano said that despite Bitcoin’s ups and downs, he has increased his holdings every year, including this one. He expects Bitcoin to keep outperforming stocks, even with slower growth, noting that a 20–35% annual return would still make it a top long-term investment.

He called Bitcoin the “category winner” in crypto, pointing out that Wall Street adopted it first and still invests heavily. While other cryptocurrencies like Ethereum and Solana have fallen more, he believes Bitcoin remains the main store-of-value and “will continue to be the king of the crypto market.”

thecryptobasic.com

thecryptobasic.com