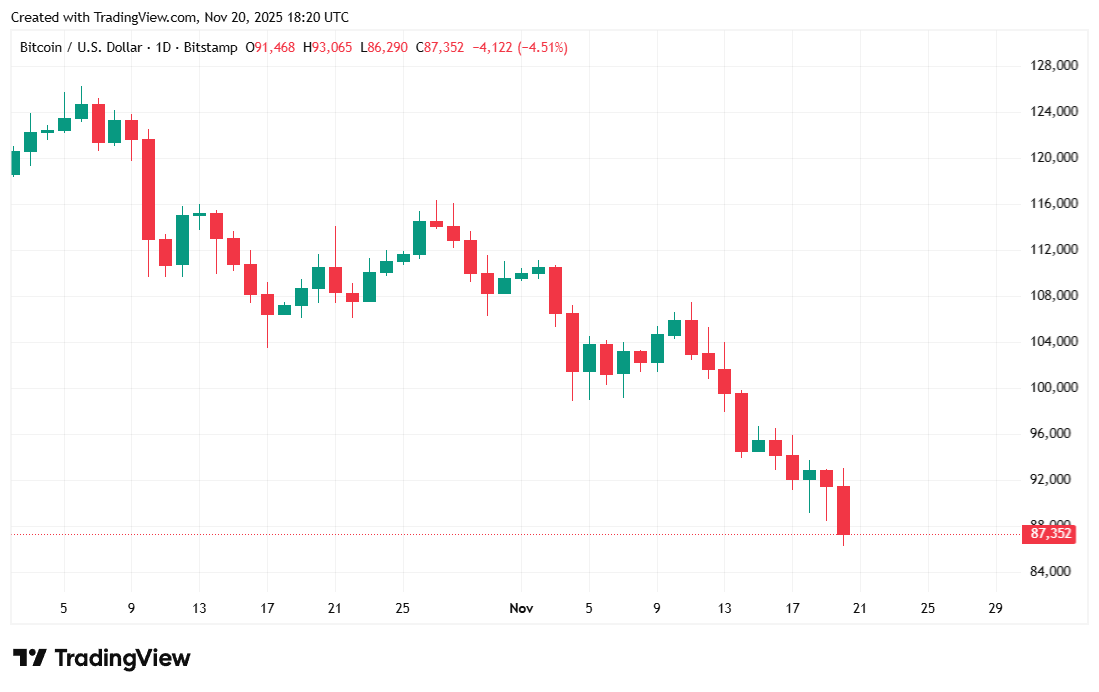

The cryptocurrency reclaimed $93K early Thursday morning, then suddenly retreated and fell to $86K.

Unemployment Fears May Have Just Sent Bitcoin Tumbling Once More

The U.S. Federal government machinery whirred to life after a record 43-day shutdown, and now key macroeconomic data, though somewhat stale, is beginning to trickle in. Thursday saw the U.S. Bureau of Labor Statistics (BLS) finally deliver its highly anticipated jobs report for September, showing the U.S. economy added 119,000 jobs, but also that unemployment crept up to 4.4% from 4.3%. Bitcoin dipped on the news, entering $86K territory for the first time since April 2025.

Reactions were mixed after the report was released. On one hand, economists were expecting a mere 50,000 additional jobs, so today’s numbers outperformed significantly. Average hourly earnings increased, and a separate weekly report from the Department of Labor shows a reduction in unemployment claims for the week ending November 15.

Read more: Bitcoin Dips After Powell Says a December Cut ‘Is Not a Foregone Conclusion’

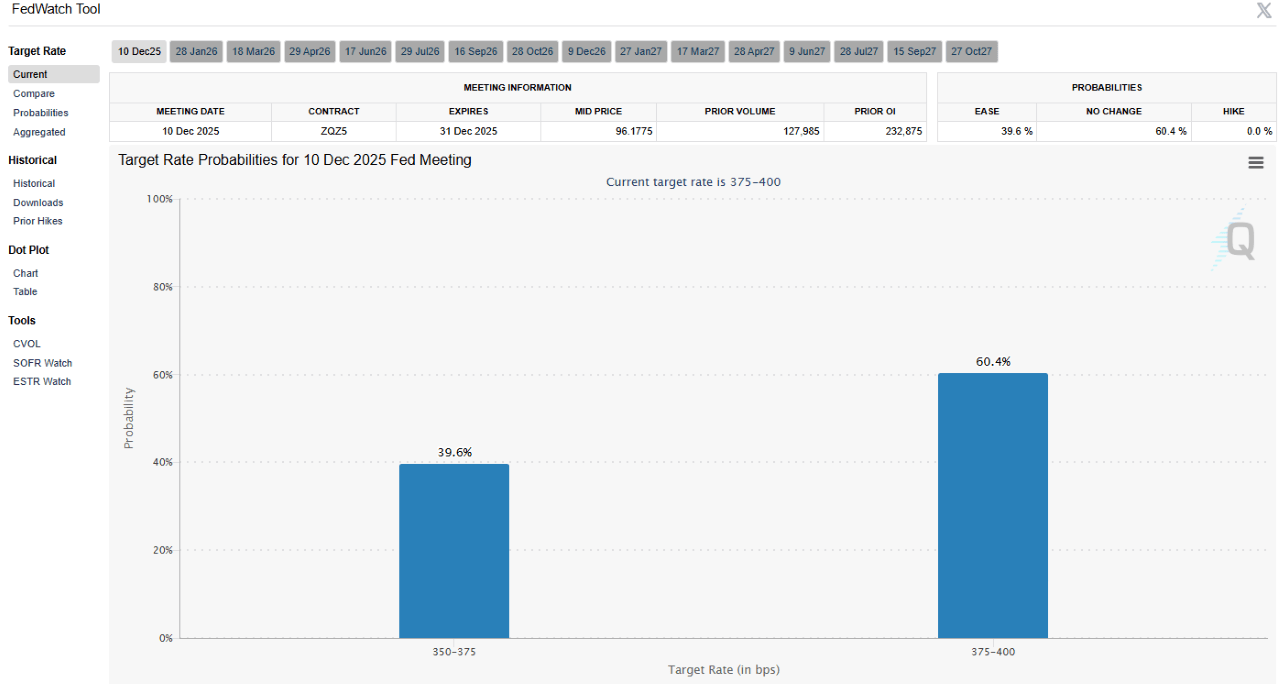

But on the other hand, the slight bump in the unemployment rate may have been unsettling to some. Especially given that today’s report is not current. The last BLS jobs report was published on September 5, more than two-and-a-half months ago. The uncertainty has led many to conclude that the Fed won’t cut rates in December. Both Polymarket and the CME Fedwatch Tool predict with a 60% likelihood that rates will be held steady. The overall hawkish sentiment appears to have sent both bitcoin and stocks lower.

“Investors expected a 25-basis point lowering in the target range for the federal funds rate at the October meeting and another 25-basis point lowering at the December meeting,” Joshua Gallin, secretary of the Federal Open Market Committee (FOMC) wrote in the minutes from the Fed’s October meeting released on Wednesday. “Some uncertainty around the December meeting was evident in responses to the Open Market Desk’s Survey of Market Expectations,” Gallin added.

Overview of Market Metrics

Bitcoin was trading at $87,281.06 at the time of writing, down 2.08% over 24 hours and 11.94% since last week, according to Coinmarketcap data. The digital asset has fluctuated between $86,345.15 and $93,025.07 since Wednesday.

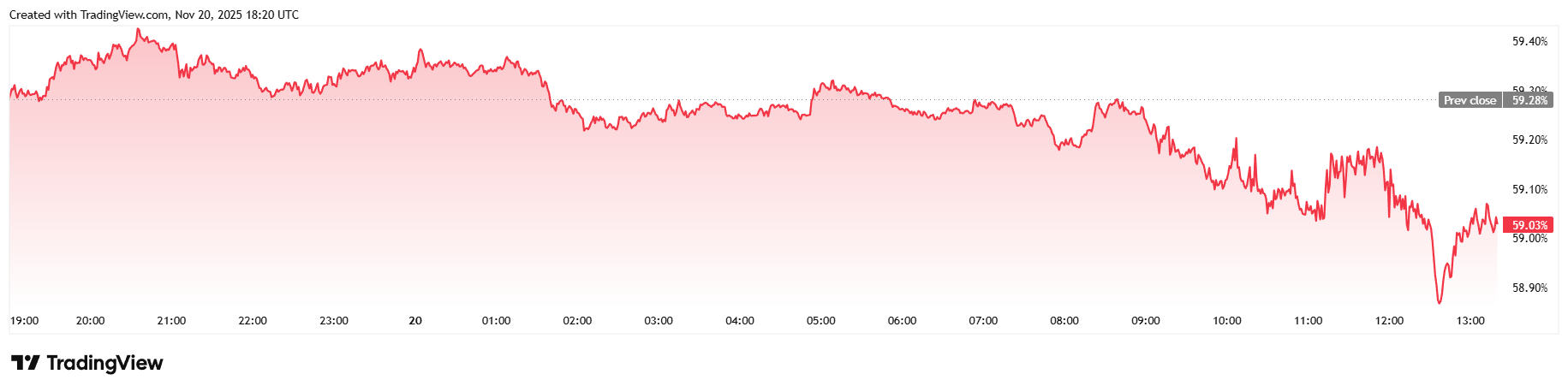

Daily trading volume climbed 37.71% to $95.25 billion and market capitalization fell to $1.73 trillion. Bitcoin dominance eased 0.44% to reach 59.04%, as several altcoins outperformed the flagship cryptocurrency.

Total bitcoin futures open interest was largely muted, dipping slightly by 0.63% to $64.88 billion, according to Coinglass data. Liquidations jumped once again, reaching $368.69 million in total, following bitcoin’s drop to $86K. As expected, most of that came from long investors who lost $325.18 million in liquidated margin. Short sellers completed the liquidation picture with $43.52 million in losses.

FAQ ⚡

-

Did unemployment data really push bitcoin down to $86K?

Markets reacted to a slight uptick in the jobless rate to 4.4%, fueling fears the Fed won’t cut rates soon. -

Why was the report so impactful?

It was the first U.S. jobs data released after a 43-day shutdown, making the numbers both stale and uncertain. -

How did traders interpret the mixed signals?

Strong job gains but higher unemployment led markets to price in a more hawkish Fed for December. -

How is bitcoin performing now?

BTC is hovering near $87K after a sharp drop, with liquidations surging to more than $368 million in 24 hours.

news.bitcoin.com

news.bitcoin.com