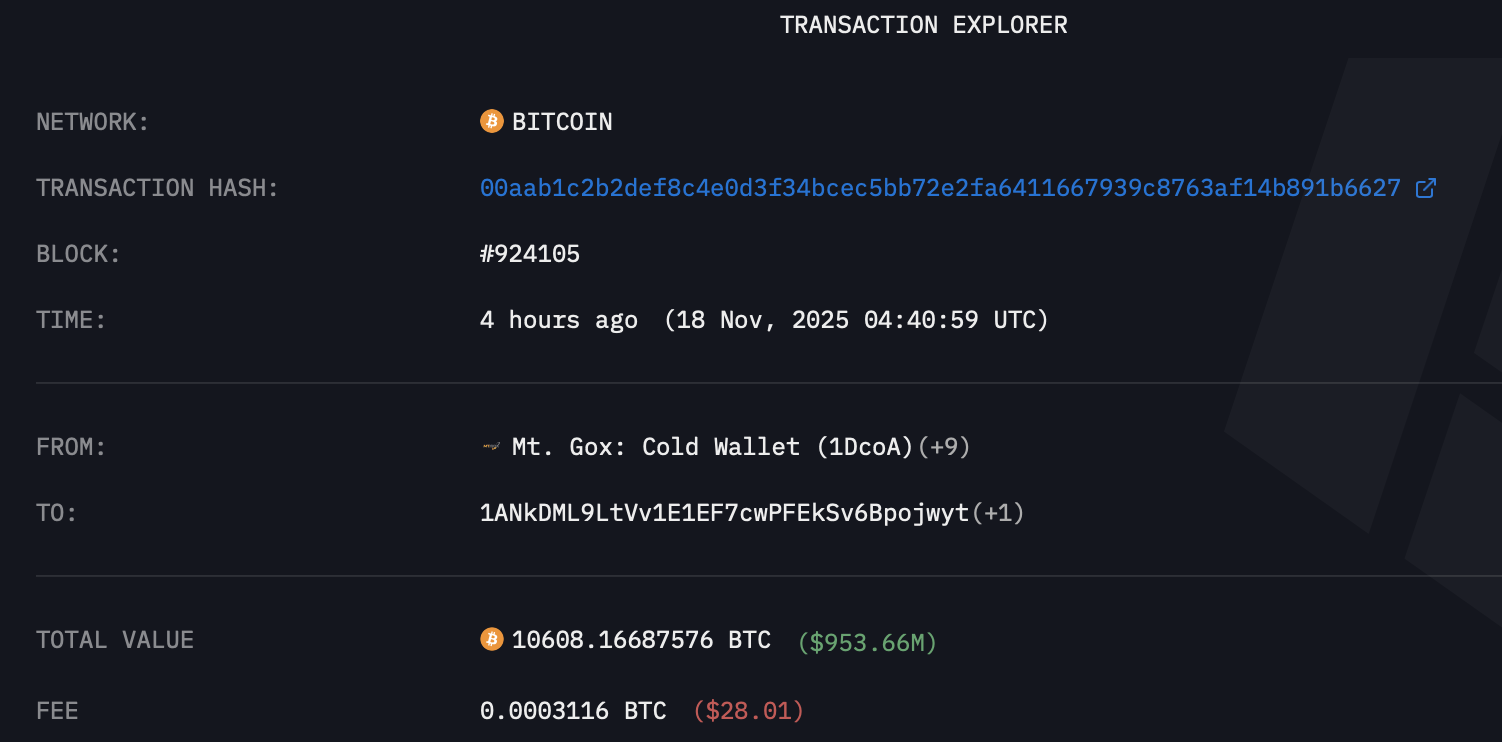

The long-dormant Mt. Gox saga returned to the spotlight late Monday after the collapsed exchange shifted a massive batch of Bitcoin - more than 10,600 BTC, nearly $1 billion worth - to a new, unidentified wallet.

The unexpected activity was flagged by Arkham Intelligence and quickly ignited speculation across the market.

The transfers took place just a few hours ago, when the exchange sent the bulk of the coins (roughly 10,422 BTC) to an unknown address, while a smaller amount was routed back to a Mt. Gox-controlled hot wallet. Whenever the defunct exchange moves funds, traders instinctively brace for the same possibility: creditor payouts may be on the horizon.

However, this latest shuffle offers no clear confirmation that distribution is imminent. Mt. Gox has moved coins ahead of repayments in the past, but the process has been drawn out, inconsistent, and repeatedly delayed.

A Decade-Old Collapse Still Echoing Through the Market

For newcomers, Mt. Gox was once the dominant force in Bitcoin trading, handling about 70% of global BTC volume before suffering the catastrophic 2014 hack that wiped out around 850,000 BTC and forced the exchange into bankruptcy. After years of legal limbo, the estate began issuing partial repayments in mid-2024 using remaining holdings: 142,000 BTC, a similar amount of Bitcoin Cash, and billions in yen.

But those repayments have been anything but smooth. The rehabilitation trustee already pushed the deadline back three times, most recently extending creditor payouts until October 2026. A handful of creditors have received partial funds through exchanges like Kraken and Bitstamp, but the vast majority are still waiting.

Billions Remain Under Mt. Gox Control

Despite the new transfer, Mt. Gox still controls a substantial stash. Arkham’s latest data shows the exchange holding 34,689 BTC, valued at more than $3.1 billion – a number large enough to rattle the market whenever movement occurs.

Whether this latest transaction signals preparation for another wave of creditor distributions or merely internal wallet consolidation remains unclear. But one thing is consistent: every time Mt. Gox moves coins, the entire crypto market pays attention.