Germany’s main opposition party, Alternative for Germany (AfD), is calling on the government to rethink how it treats Bitcoin, arguing that the digital currency should be viewed as a strategic national asset rather than a financial instrument subject to the same rules as other crypto tokens.

The motion, recently filed in the Bundestag, urges lawmakers to distinguish Bitcoin from the broader category of digital assets governed by the European Union’s Markets in Crypto-Assets (MiCA) regulation. According to the AfD, including Bitcoin under the MiCA framework risks stifling innovation and limiting financial freedom in Germany.

The proposal warns that excessive regulation could damage the country’s competitiveness in blockchain innovation. It also emphasizes that Bitcoin’s decentralized nature and monetary properties make it unique and deserving of a dedicated regulatory approach – one that acknowledges its potential role in areas like energy integration and national monetary reserves.

While the AfD describes Germany’s existing tax framework for Bitcoin as “fundamentally positive,” it points to ongoing legal uncertainty that discourages private investors from holding the asset long-term. The party calls for maintaining the 12-month tax exemption on Bitcoin gains, preserving its VAT-free status, and ensuring that citizens retain the right to self-custody of their assets.

The motion also advocates that Germany should consider holding Bitcoin in national reserves, echoing a growing movement in several European countries to explore Bitcoin as a hedge against monetary instability. Similar discussions have recently taken place in France, where lawmakers proposed relaxing MiCA rules to encourage stablecoin innovation while opposing the introduction of central bank digital currencies.

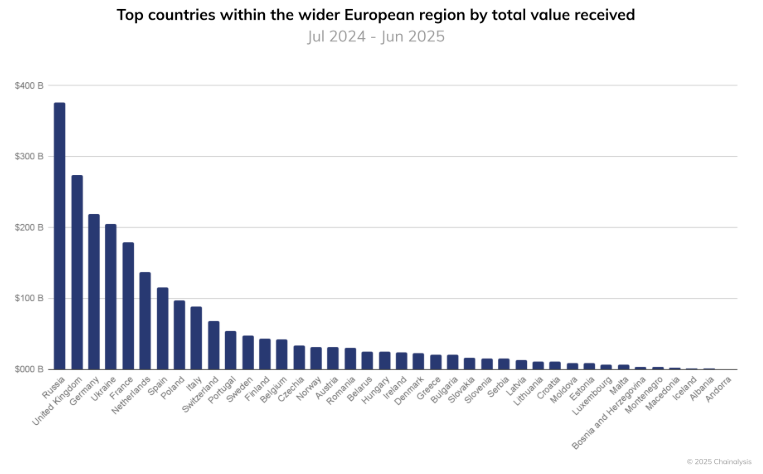

Despite such criticism, not all analysts agree that MiCA has held Europe back. Research by Chainalysis found that the framework has actually strengthened Europe’s position as a crypto-friendly region, with Germany ranking third on the continent by total crypto transaction volume.

Still, AfD’s proposal highlights a key tension in Europe’s crypto debate – between regulation designed to ensure stability and a growing belief among policymakers that Bitcoin deserves its own category as both a technological and strategic innovation.