Gold is up nearly 60% year-to-date, substantially outperforming bitcoin, which, in comparison, is up a paltry 13% – despite all the talk of a bull market.

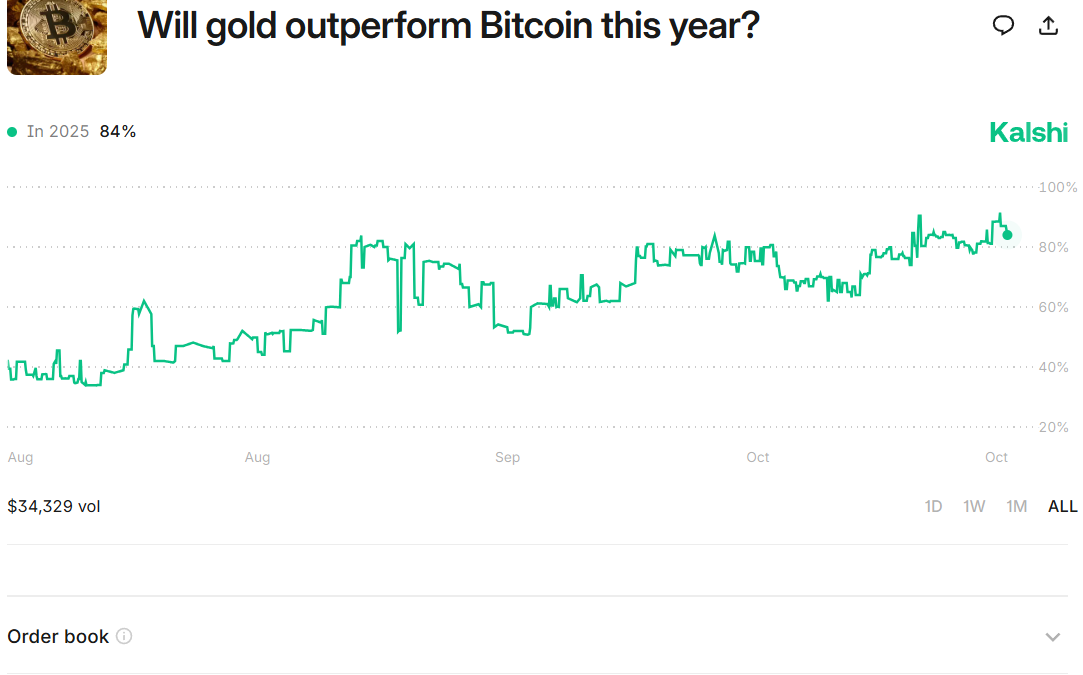

Analysts say that gold isn't overpriced, despite the epic rally, and traders on Kalshi are confident that 2025 will be the year that the yellow metal outperforms $BTC.

Yet data from Hyperliquid suggests crypto traders remain offside. Only 34% of positions are long, with just 35% of traders profitable, and a majority caught in losing short positions as volatility whipsaws markets as hyper-leveraged accounts increase the G-forces on the roller coaster.

The average user’s daily PnL has sunk to just under $50K, indicating that most have been consistently on the wrong side of the market.

It’s a telling snapshot of a trading community caught flat-footed. The latest wipeout of celebrity trader Machi Big Brother, whose account plunged from $43 million in profits to over $13 million in losses, underscores how overleveraged bets on bitcoin’s rebound continue to backfire.

Machi Big Brother(@machibigbrother) just got liquidated again — his account balance is down to only $32.8K.

— Lookonchain (@lookonchain) October 16, 2025

He's gone from +$43.64M in profits to now over -$13M in losses! https://t.co/fk2wRZjrzZ pic.twitter.com/EJPKga65Th

The combination of misplaced conviction and excessive leverage has turned crypto markets into a graveyard of mistimed trades rather than a reflection of genuine macro demand.

Glassnode’s latest market report reinforces this picture of fragility.

The research firm describes the recent $19 billion deleveraging as one of the largest in bitcoin’s history, wiping out leverage and leaving the market in what it calls a “reset phase.”

Funding rates have plunged to 2022 FTX-collapse levels, ETF inflows have turned negative, and long-term holders are distributing into strength. Glassnode warns that unless new demand emerges, bitcoin risks deeper contraction below the $108,000 level.

In contrast, gold’s ascent has been driven by conviction rather than leverage. Geopolitical tension, cooling inflation, and rate-cut bets have all reinforced its appeal as a haven asset in a world of macro uncertainty. Crypto’s speculative structure, dependent on ETF flows and derivatives leverage, hasn’t been able to capture the same narrative tailwind.

For now, the data tells a clear story: traders may still want a bitcoin bull market, but the market they actually have looks a lot more like gold’s.

Market Movement:

$BTC: Bitcoin is trading around $108,287, sliding on renewed risk aversion, profit‑taking after recent rallies, and macro uncertainty.

ETH: Ether is changing hands at $3891, experiencing a sell-off in tandem with $BTC as speculative demand weakens amid broader crypto pressure.

Gold: Gold is rallying as investors seek a safe-haven given ongoing geopolitical tension and expectations of U.S. rate cuts.

Nikkei 225: The Nikkei 225 is down 0.3% as major markets across Asia slip on growing concerns of geopolitical tensions.

Elsewhere in Crypto

- Trump Family Has Already Made Over $1 Billion in Profit on Crypto, Says Eric Trump (Decrypt)

- SEC Commissioner Peirce makes case for financial privacy, says tokenization is a ‘huge focus now’ (The Block)

- BNY Mellon Stays ‘Agile’ on Stablecoin Plans, Focuses on Infrastructure (CoinDesk)

coindesk.com

coindesk.com