The U.S. Federal Reserve published official minutes from its September meeting showing that half of the committee members expect two more rate cuts by year-end.

Bitcoin Hits $124K After Fed Minutes Hint at Accelerated Easing

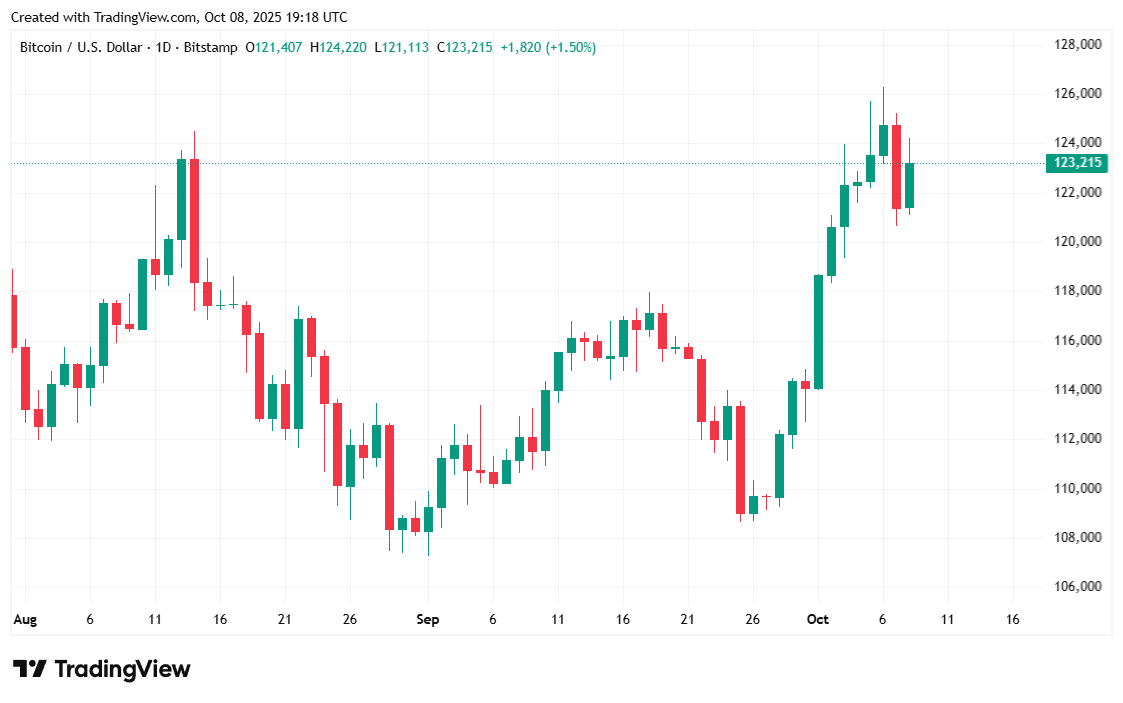

U.S. President Donald Trump is probably somewhere smiling after reading the official minutes from the Federal Reserve’s September meeting, published on Wednesday. The minutes reveal a dovish sentiment among Fed officials, with “around half” of Federal Open Market Committee (FOMC) members expecting two more rounds of interest rate cuts by the end of 2025. Bitcoin jumped on the news, breaking $124K again after a brief retreat from its recently minted record of $126,198.07.

After nearly a year of maintaining interest rates at the same level, the Federal Open Market Committee (FOMC) finally agreed to reduce its policy rate by 25 basis points last month, citing weak employment data. Trump had publicly criticized Fed Chair Jerome Powell for resisting rate cuts and pejoratively referred to the chairman as “Too Late.”

Powell, to his defense, was merely following the central bank’s dual mandate of facilitating stable prices and high employment. And even though September’s annualized inflation rate came in at 2.9%, way above the Fed’s 2% target, Powell and the rest of the FOMC were compelled to cut rates after a surprise jump in unemployment caught them off guard.

And it’s that weakness in the job market that triggered the hawkish to dovish shift among FOMC members, reflected in the minutes released earlier today. Pair that with the ongoing government shutdown, which will only exacerbate the employment situation, and the chances of two more rate cuts jump higher, which bodes well for the dominant cryptocurrency.

“The vast majority of survey respondents expected at least two 25 basis point cuts by year-end, with around half expecting three cuts over that time,” the minutes read, referring to the FOMC’s Open Market Desk’s Survey of Market Expectations.

Overview of Market Metrics

Bitcoin was trading at $123,506.78 at the time of reporting, up 1.7% over 24 hours or 5.19% on a weekly basis, according to Coinmarketcap data. The digital asset fluctuated between $121,119.18 and $124,167.09.

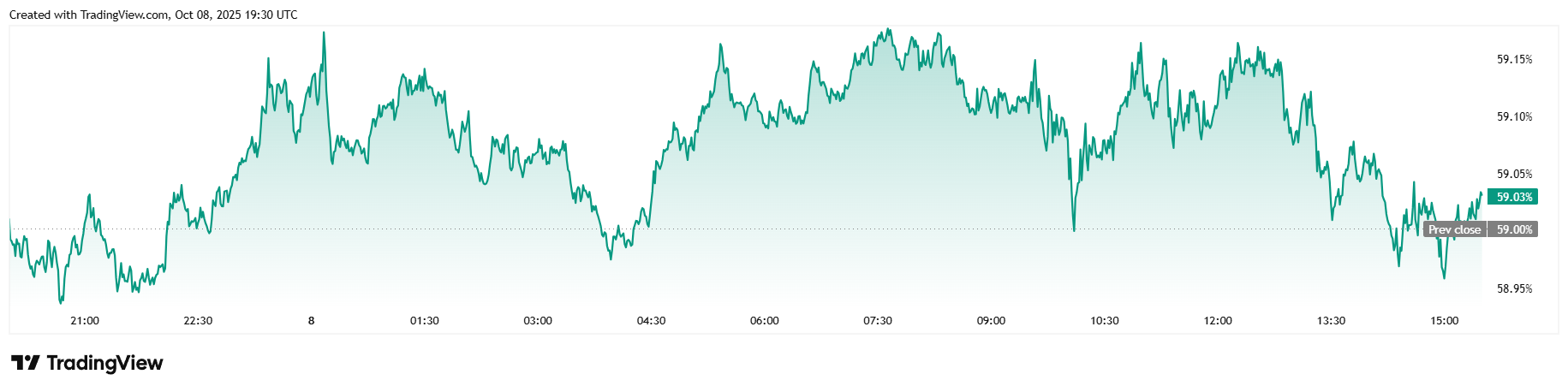

Twenty-four-hour trading volume was down 12.06% at $68.48 billion, but market capitalization climbed 1.86% to $2.46 trillion. Bitcoin dominance rose 0.02%, breaking the 59% threshold to sit at 59.04% at the time of writing.

Total bitcoin futures open interest was mostly flat, dipping slightly by 0.24% to $90.94 billion according to data from Coinglass. Bitcoin liquidations were also lower today at $77.77 million. Short sellers were responsible for the bulk of that liquidation total, getting wiped out to the tune of $52.22 million, with the remaining $25.55 million representing long liquidations.

news.bitcoin.com

news.bitcoin.com