Bitcoin $BTC$122,147.11 has ripped about 13% this week, surging Friday to just shy of a new record of $124,500.

With that ceiling nearly cleared, a quick move to $135,000 could be in the cards, according to Standard Chartered head of digital asset research Geoffrey Kendrick.

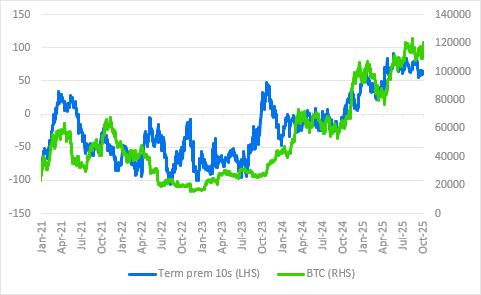

In a note published on Friday, Kendrick argued that the U.S. government shutdown is playing a bigger role in markets than in past episodes supporting bitcoin's rally. During the 2018-2019 shutdown, $BTC traded in a different context. Now, the largest crypto has been closely correlated with U.S. government risk, measured by the U.S. Treasury term premiums, a relationship that suggests the uncertainty around the shutdown acts as a bullish driver this time.

Traders on prediction marketplace Polymarket currently give more than a 60% chance that the shutdown lasts 10–29 days. Kendrick forecasted $BTC will continue to rise throughout that period.

Kendrick also highlighted a coming shift in ETF investor behavior. While gold ETFs have recently outperformed their $BTC counterparts with gold pushing to record prices, spot bitcoin ETF flows are poised to catch up providing tailwind for the asset, the report said.

Of the $58 billion in net $BTC ETF inflows so far, $23 billion has come in 2025, he said. This week alone, they attracted over $2.25 billion without the Friday session.

Kendrick projected that the vehicles could pull in another $20 billion investor capital by year-end – enough to keep his $200,000 year-end $BTC price target in play.

coindesk.com

coindesk.com