Many firms now hold Bitcoin as a reserve asset, but markets care how they hold it, a Nansen report shows.

Bitcoin ($BTC) is rapidly becoming a core part of the traditional financial system. According to a recent report by Nansen, new regulatory standards and macroeconomic factors have changed how corporations view Bitcoin exposure. This has led to the largest firms holding over 700K $BTC.

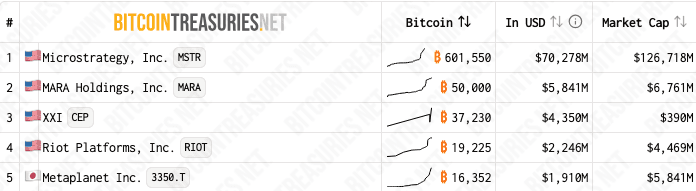

Collectively, Strategy, Marathon Digital, Twenty One Capital, Riot Platforms, and Metaplanet own Bitcoin worth about $81.9 billion. Strategy, formerly MicroStrategy, controls the lion’s share of these holdings, with 601,550 $BTC.

Still, not all of these companies are seeing the same effect on their stock prices. Specifically, Strategy trades at nearly double the valuation of its $BTC holdings. In contrast, Marathon Digital, where $BTC accounts for 85% of its market cap, trades at par with its Bitcoin reserves.

$BTC holdings and market cap of the five largest corporate Bitcoin holders">

$BTC holdings and market cap of the five largest corporate Bitcoin holders"> Strategy leverages debt to outperform $BTC

This suggests that markets care about how a company structures its $BTC holdings. Strategy uses debt, allowing it to consistently accumulate Bitcoin and effectively act as a leveraged bet on its price.

This gives Strategy’s stock both more upside and greater volatility than Bitcoin. For instance, in December 2024, Strategy’s stock fell by 21%, while Bitcoin declined just 2%. However, Strategy’s stock has outperformed Bitcoin over the long term.

“Investors treat MicroStrategy akin to a leveraged Bitcoin ETF, amplifying exposure to Bitcoin price movements. Consequently, its stock typically exhibits 2–3× Bitcoin’s volatility,” Nansen report.

Japanese firm Metaplanet also trades above the value of its $BTC holdings, at a 3.5x multiple. Nansen notes that traders favor its first-mover advantage in Asia. Like Strategy, Metaplanet is also issuing debt to buy Bitcoin.