Standard Chartered has also raised an optimistic outlook for $BTC. As noted in our earlier post, the global bank targeted $BTC at $135,000 in Q3. This projection aligns with an earlier forecast from Berstein Research, as detailed in our last news piece.

- Bitcoin futures funding rates flipped negative, suggesting a potential price rebound ahead.

- Momentum for Bitcoin is improving with $BTC eyeing the $ATH.

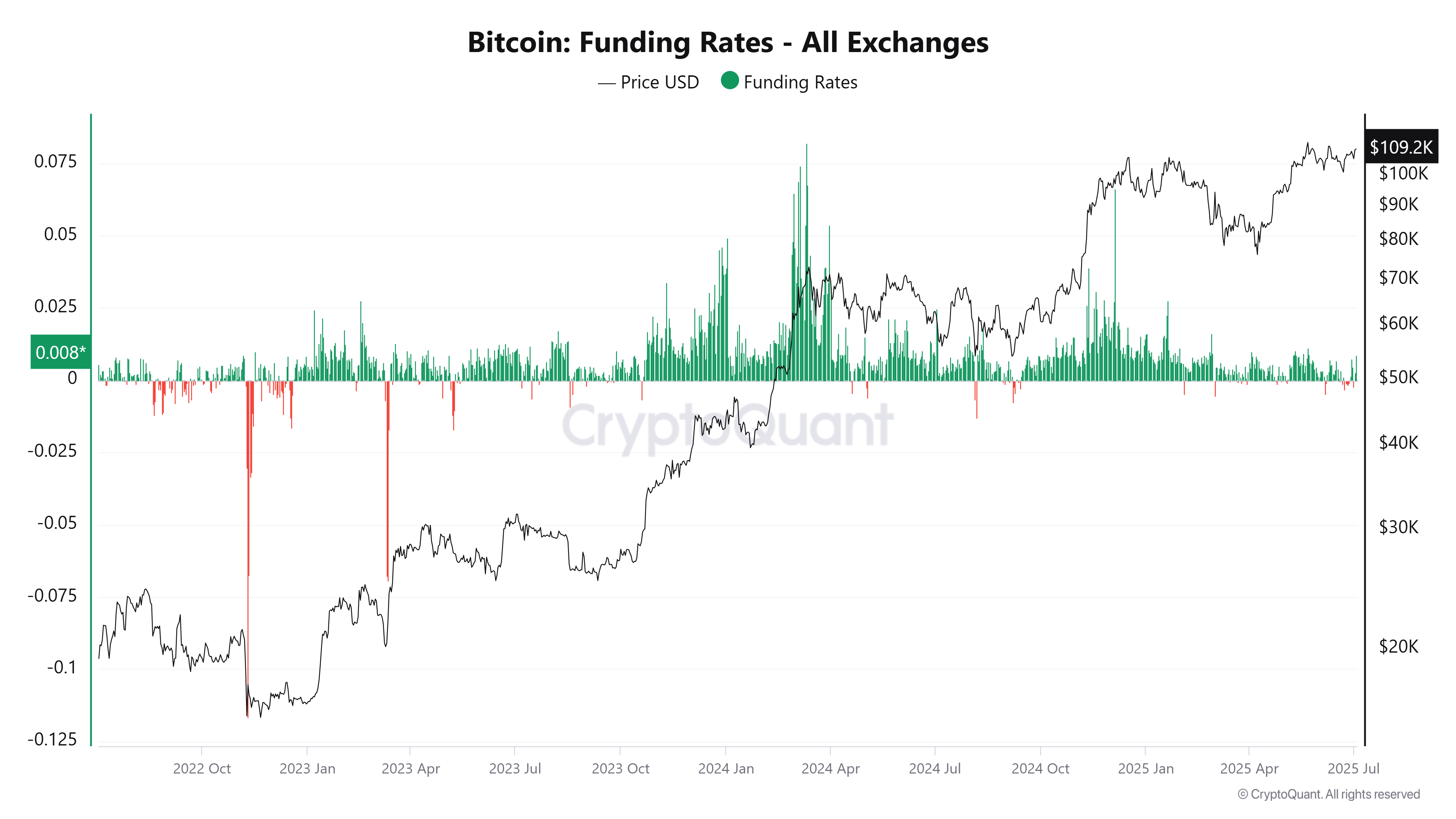

The Bitcoin ($BTC) futures funding rates have brought optimism for bulls. Notably, this metric flipped negative in late June. During this period, the $BTC spot price climbed from below $100,000 to $108,000.

In the past, such a divergence indicated a major price boom ahead for Bitcoin. In one cycle, the price of $BTC surged 80%.

Will Bitcoin Price Follow Historical Trends

Onchain data analytics platform CryptoQuant revealed that the Bitcoin futures perpetual funding rates have turned negative. A negative funding rate means short-position holders are paying long traders to maintain their contracts. This is typically a sign of bearish market sentiment.

However, a persistent negative rate may suggest the market is oversaturated with bearish bets. This could precede a price rebound if shorts are forced to buy back their positions.

When futures funding rates slipped in September 2024 and July 2023, $BTC soon experienced 80% and 150% gains, respectively. Considering this performance, the leading coin may be gearing up for fresh rallies ahead. Analysts claimed the bearish reset may have already played out.

According to CoinGlass liquidation data, $111,320 on the $BTC/USDT pair shows the highest concentration of predicted liquidations in the past three months. Within this price level, the data revealed an estimated $520.31 million in leveraged positions at risk.

This liquidity, if tapped, could trigger a short squeeze. In this case, forced buybacks from short traders could drive prices higher.

Two major factors that influenced the latest $BTC rally are ETF inflows and fading confidence in fiat strength. In a recent update, we covered that the US dollar declined nearly 11% in 2025, reaching lows not seen in decades.

Amid the weakened dollar, the US spot Bitcoin ETFs recorded over $4.63 billion of net inflows in just three weeks. Long-term holders continue to buy Bitcoin. In H1 2025, Bitcoin minted over 26,000 millionaires, indicating its soaring adoption.

$BTC Moves Closer to $ATH

Bitcoin, the leading cryptocurrency, is currently trading at $110,306. In the last 24 hours, the $BTC price has increased by 2.3%.

The daily trading volume also surged over 24% to $58.4 billion. The rally indicates that momentum has resumed as investors show renewed interest in the coin.

Based on the latest price performance, $BTC is moving closer towards its All-Time High ($ATH) of $111,924. Technical analysis also points to a potential rally on the horizon.

Analyzing the daily chart revealed a breakout above the upper trendline of a bull flag pattern. The movement of this pattern points to a potential target near $117,500, based on the prior flagpole. This price closely aligns with $116,000 forecasted by 10x Research’s Markus Thielen for the end of July.