Based on current data, the 12 U.S. spot bitcoin exchange-traded funds (ETFs) collectively manage over 1.2 million $BTC. Yet, two in particular—Blackrock’s IBIT and Fidelity’s FBTC—command a striking majority, accounting for more than 71% of that aggregate.

Wall Street’s Bitcoin Giants: IBIT, FBTC, MSTR Tighten Grip on Bitcoin’s Scarce Supply

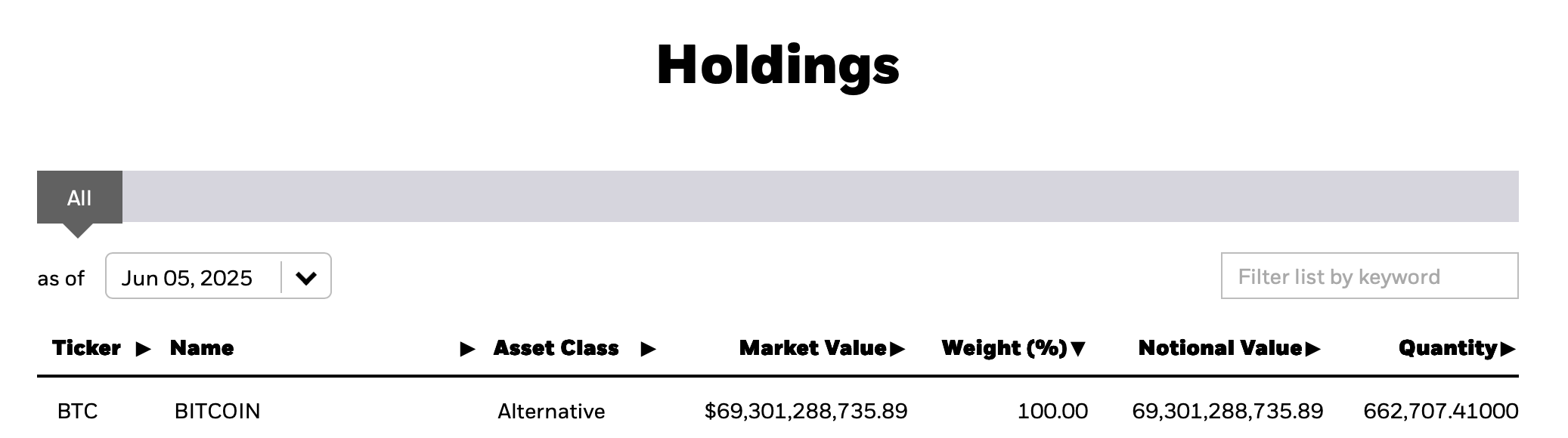

Blackrock’s IBIT debuted on Wall Street on Jan. 11, 2024—exactly 1 year, 4 months, and 26 days ago. As of data collected on June 5, 2025, the firm’s Ishares Bitcoin Trust ETF controls roughly 662,707.41 $BTC, translating to $69.2 billion in value. This single ETF alone accounts for 55.23% of the 1.2 million $BTC managed by the 12 publicly traded bitcoin funds.

IBIT’s holdings comprise 3.16% of bitcoin’s 21 million fixed supply and 3.34% of the 19,875,085.22 $BTC in circulation at the time of publication. No other crypto exchange-traded product (ETP) has achieved this scale of accumulation this fast. Although IBIT and its peers trade five days a week, observing holidays and pauses, if IBIT had been acquiring $BTC every calendar day since Jan. 11, 2024, its daily haul would be approximately 1,296.88 $BTC over that stretch.

If this cadence continues, Blackrock’s ETF is projected to reach 1 million $BTC by Feb. 21, 2026—just 260 days from now—representing 4.76% of bitcoin’s hard cap. Fidelity’s FBTC, by contrast, has taken a more tempered route. Over the same 1 year, 4 months, and 26 days, it has gathered 196,264.34 $BTC, currently worth just over $20 billion at prevailing rates. Applying identical calculations, FBTC has averaged 389.34 $BTC per day since Jan. 11, 2024.

While FBTC holds the distinction of being the second-largest U.S. bitcoin ETF, its trajectory has been far more measured than IBIT’s accumulation. Should it maintain this current rhythm, FBTC would hit the 500,000 $BTC milestone by around July 18, 2027. Consider Strategy (formerly Microstrategy), which initiated its bitcoin ($BTC) acquisitions on Aug. 11, 2020. Averaged out, this translates to a daily accumulation rate of 330.09 $BTC. If that same trajectory holds steady, Strategy will not cross the 1 million $BTC threshold until Oct. 27, 2028.

The accelerating competition among major financial institutions for bitcoin dominance hints at a deeper strategic shift unfolding beneath the surface. With accumulation timelines now plotted years into the future, these ETFs are not merely chasing assets—they’re staking claims in a digital monetary order. What began as a race for returns may well evolve into a contest over monetary influence itself.

news.bitcoin.com

news.bitcoin.com