-

Whale accumulation and exchange outflows continue backing Bitcoin’s climb toward the $100K zone.

-

Elevated NVT ratio and liquidation clusters hint at caution despite bullish momentum.

Bitcoin’s profit levels surge as whale activity drives prices, but caution grows amid emerging risks—an analysis of the current market dynamics.

Whale transactions explode: Are institutions fueling the rally?

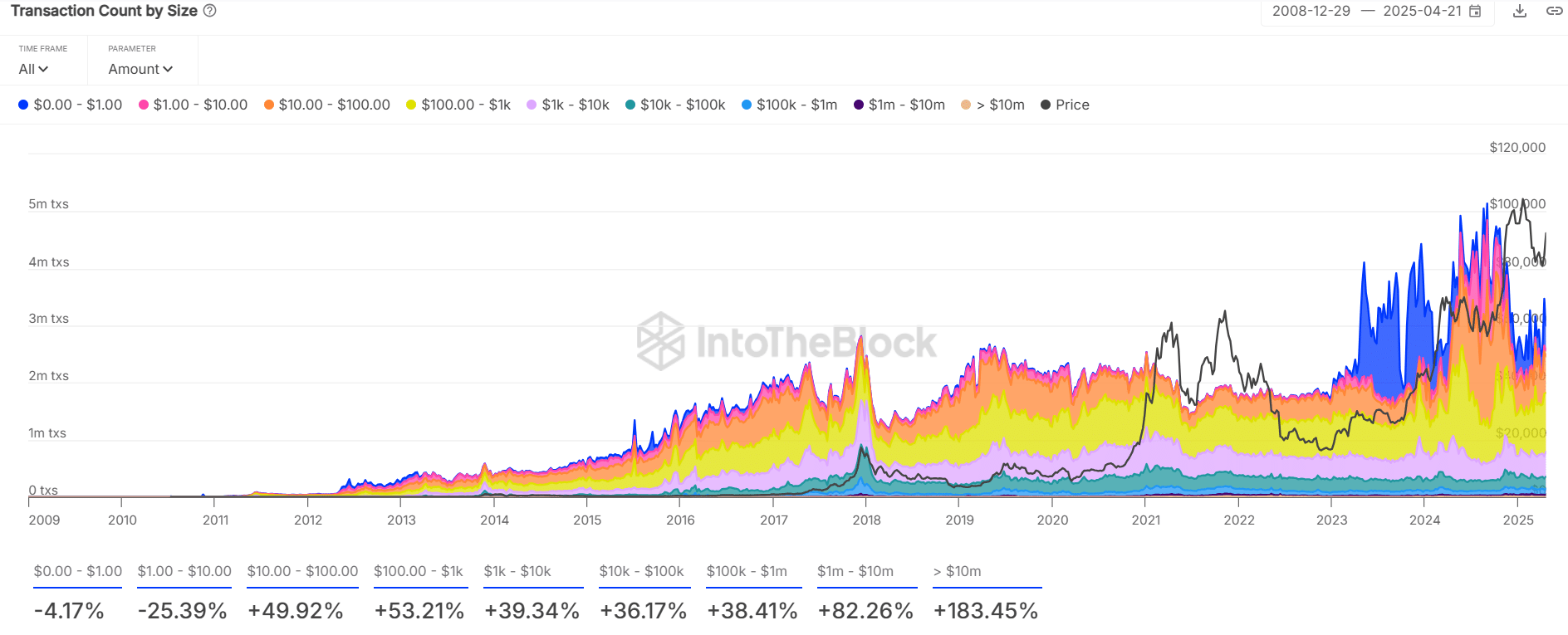

Large-value Bitcoin transactions have expanded significantly across the board. Transfers above $10 million have spiked by 183.45%, while those between $1 million and $10 million climbed 82.26%.

Moreover, transaction activity in the $100K–$1M and $10K–$100K ranges also grew by 38.41% and 36.17%, respectively.

This explosive surge points to a resurgence of whale and institutional activity, typically associated with major market moves. Therefore, strong participation from deep-pocketed players adds substantial weight behind Bitcoin’s ongoing climb toward six figures.