The company’s CEO took a page out of Michael Saylor’s playbook after Saylor’s wild success with using bitcoin treasury management as a corporate strategy.

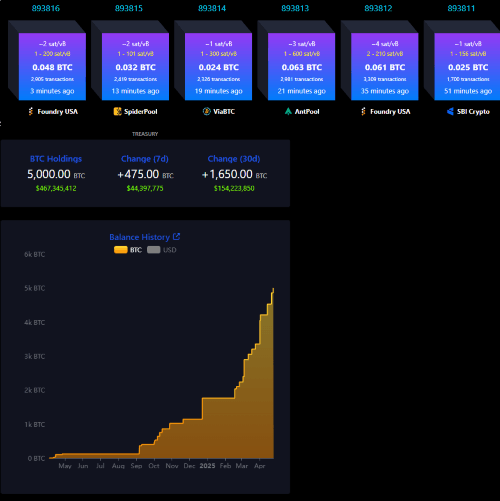

Japan’s Metaplanet Amasses 5,000 BTC With Bold Bitcoin Treasury Strategy

Japanese bitcoin treasury firm Metaplanet, once a struggling hotel developer, has come one step closer to its corporate goal of purchasing 21,000 bitcoin ( BTC) by 2026, after the firm reached 5,000 BTC in its treasury on Thursday, according to a post by its CEO, Simon Gerovich.

The firm has been working with Evolution Financial Group, a financial services company that runs the “Evo fund,” to implement a debt financing strategy where Metaplanet issues zero-coupon bonds to Evo and receives capital to purchase bitcoin in return. Metaplanet simultaneously issues stock acquisition rights or warrants, that allow Evo to purchase Metaplanet shares based on the prior day’s closing price. Metaplanet then turns around and uses the proceeds from those stock purchases to pay off the bond debt.

Evo benefits from the arbitrage opportunity it has from owning stock acquisition rights, which, according to Unchained analyst Johan Bergman, can generate a compounded annual return of up to 20% with minimal risk. And of course, Metaplanet get access to capital for its bitcoin purchases, which now stand at 5,000 BTC after just one year of implementing the strategy.

“Let it be said of April 24, 2025: Metaplanet claimed its 5,000th bitcoin, not with noise, but with purpose,” said Gerovich in a post on X. “We are not done, we have only just begun.”

news.bitcoin.com

news.bitcoin.com