President Trump’s ‘Liberation Day’ tariffs yesterday wiped roughly $140 billion from the cryptocurrency market within a matter of hours. Notably, the announcement of the new duties being imposed caused an immediate sell-off from short-term Bitcoin ($BTC) holders.

To be more precise, short-term traders sold a total of 18,930 Bitcoins in the immediate aftermath of the trade war’s latest chapter, per a chart shared on April 3 by noted crypto chart researcher Ali Martinez on X.

The multicolored Spent Output Age Bands (SOAB) chart delineates liquidations based on position age. Traders who had been holding Bitcoin for one to three months sold 3,113 $BTC, while those who had been holding for three to six months sold slightly less of the cryptocurrency — 2,737 Bitcoins, to be exact.

However, the majority of the sell-off came from investors whose positions were six months to a year old (3,983 $BTC) and between a year and a year and a half old (9,097 $BTC).

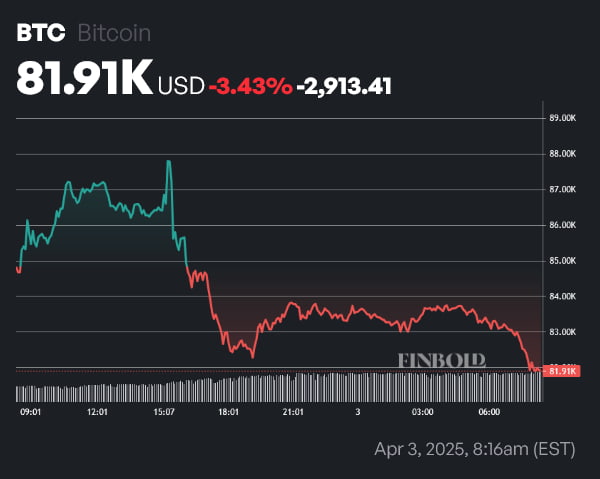

At the time of writing, the cryptocurrency was trading at $81,910, having marked a 3.43% decline on the daily chart, and a 1.06% decline from the prices seen at the time of the Bitcoin sell-off seen on Martinez’s chart.

With everything taken into account, the present atmosphere has taken a bearish turn — even notable $BTC bulls like Robert Kiyosaki are shifting their focus to commodities like silver as a defensive measure. Lastly, caution and patience are advised — current conditions are not favorable for either investing or trading — and without a clear catalyst to stop the bleeding, it’s unclear when the downturn could begin to reverse.

Featured image via Shutterstock

finbold.com

finbold.com