Strategy’s executive chairman, Michael Saylor, sparked debate with a poll suggesting Gamestop must buy over $3 billion in bitcoin to earn $BTC legitimacy.

Michael Saylor Turns up the Heat With Poll—Can Gamestop Meet $BTC Expectations?

Michael Saylor, co-founder and executive chairman of software intelligence firm Microstrategy (Nasdaq: MSTR), which recently rebranded as Strategy, launched a poll on March 26 on social media platform X asking how much bitcoin Gamestop Corp. (NYSE: GME) would need to acquire in order to gain legitimacy among bitcoin enthusiasts.

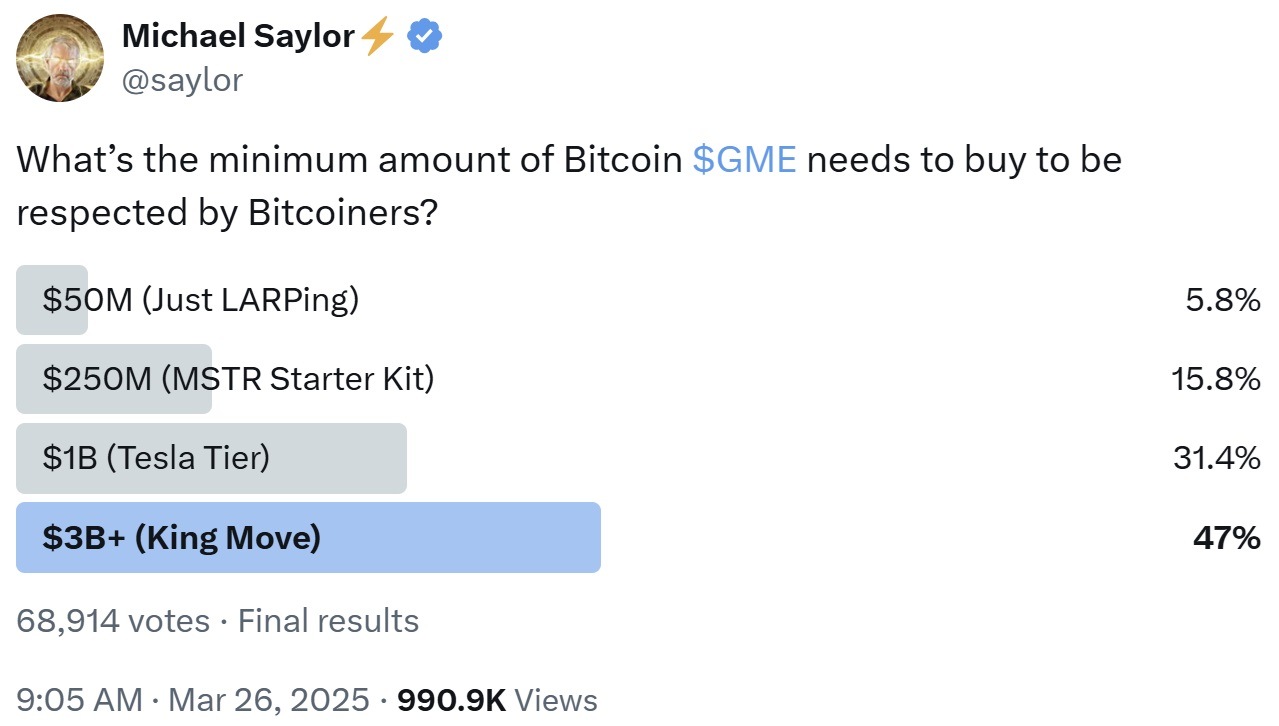

Saylor asked his 4.2 million followers how much bitcoin Gamestop would need to buy to gain credibility among bitcoin supporters. The 24-hour poll, which drew 68,914 votes, offered four escalating purchase tiers. The $3 billion-plus option, which Saylor called the “King Move,” led with 47% of the vote. The $1 billion “Tesla Tier” received 31.4%, indicating many see a billion-dollar investment as the threshold for corporate seriousness. The $250 million “MSTR Starter Kit,” referencing Microstrategy’s 2020 entry, garnered 15.8%, while just 5.8% backed the $50 million “Just LARPing” option. Saylor’s post attracted nearly 1 million views.

Gamestop announced its bitcoin strategy on March 25, revealing that its board of directors had “unanimously approved an update to its investment policy to add bitcoin as a treasury reserve asset.” The company stated that a portion of its current cash balance, along with proceeds from future capital raises, could be used to acquire $BTC. “The company’s investment policy permits investments in certain cryptocurrency assets, including bitcoin and U.S. dollar-denominated stable coins.”

The following day, Gamestop said it would raise $1.3 billion via a private offering of convertible senior notes, with the option to issue an additional $200 million. “Gamestop expects to use the net proceeds from the offering for general corporate purposes, including the acquisition of bitcoin in a manner consistent with Gamestop’s Investment Policy,” the company detailed. On March 27, Gamestop’s stock experienced a significant decline of over 20% following the company’s announcement of a $1.3 billion convertible bond offering aimed at financing bitcoin acquisitions.

Meanwhile, Strategy has continued its aggressive bitcoin accumulation. On March 24, it disclosed the purchase of 6,911 $BTC for $584.1 million at an average price of $84,529 per coin. Saylor stated that the company has achieved a year-to-date bitcoin yield of 7.7% in 2025. As of March 23, Strategy holds 506,137 $BTC acquired for approximately $33.7 billion at an average price of $66,608 per coin.

news.bitcoin.com

news.bitcoin.com