Bitcoin ETFs continued their winning streak, securing a 9th straight day of inflows with a $90 million addition, while ether ETFs continued the outflow trend with a $6 million exit.

Bitcoin ETFs Mark 9 Consecutive Days of Inflows with $90 Million Fund Influx

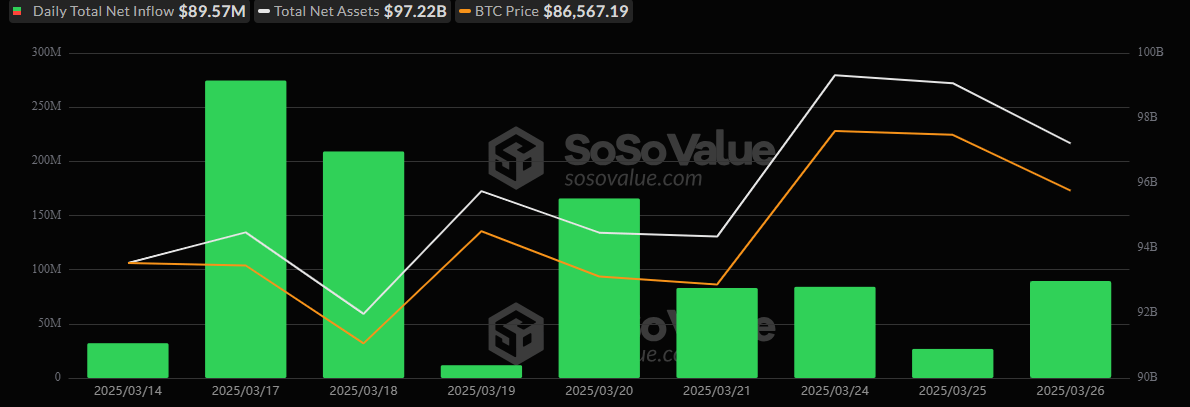

Bitcoin ETFs continued their winning streak, securing a 9th straight day of inflows with an $89.57 million addition. Blackrock’s Ishares Bitcoin Trust (IBIT) was the sole recipient of new funds, attracting a substantial $107.89 million.

However, Bitwise’s BITB saw an $18.32 million exit, slightly dampening the day’s net inflow. The remaining ten bitcoin ETFs held steady with no activity. The total trading volume for bitcoin ETFs surged to $1.87 billion, reinforcing strong investor engagement. However, total net assets for bitcoin ETFs declined to $97.22 billion, a $1.78 billion dip from the previous day’s close.

Meanwhile, ether ETFs struggled once again, extending their outflow trend with a $5.89 million net loss. Grayscale’s ETH led the downturn with a $4.90 million outflow, while Fidelity’s FETH saw a smaller withdrawal of $996,090. As a result, total net assets for ether ETFs dipped below the $7 billion threshold, closing at $6.84 billion.

With bitcoin ETFs maintaining consistent inflows and ether ETFs facing persistent outflows, the divergence in investor sentiment remains evident, with investors fully inclined toward bitcoin at the moment.

news.bitcoin.com

news.bitcoin.com