The Federal Reserve’s concerns over persistent inflation and its subsequent move to slow the pace of quantitative tightening pushed bitcoin above $86K this morning.

Bitcoin Hits $86K Following Federal Reserve’s Policy Change

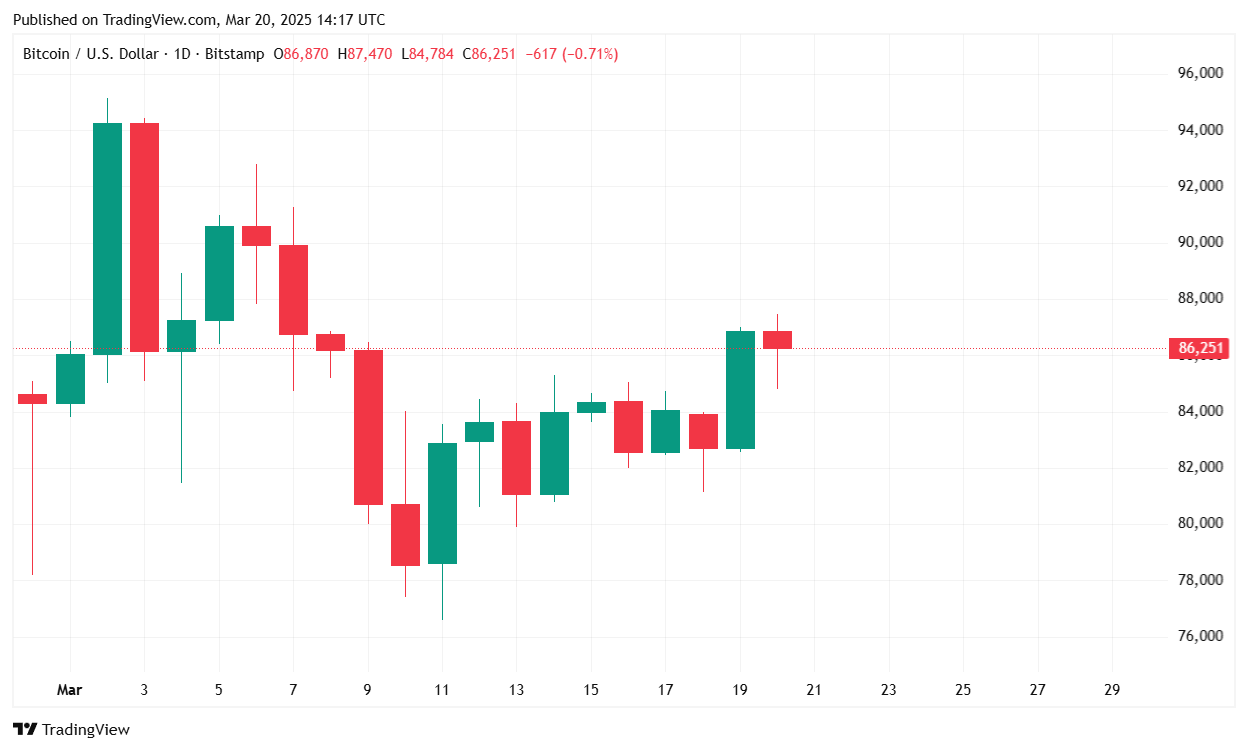

Bitcoin has extended its bullish momentum, reaching a high of $87,443 in the past 24 hours before settling at $86,053.70 at the time of reporting. The leading cryptocurrency is up 1.92% over the past day and has gained 4.92% over the last week as the Fed expressed concerns over inflation and announced plans for less aggressive quantitative tightening.

Trading volume has surged by 44.02% to $35.68 billion in the past 24 hours, reflecting heightened investor activity following the conclusion of the U.S. Federal Reserve’s latest policy meeting. Bitcoin’s market capitalization has risen by 1.81% to $1.7 trillion, reinforcing its dominance in the crypto market.

Market Dynamics & Liquidations

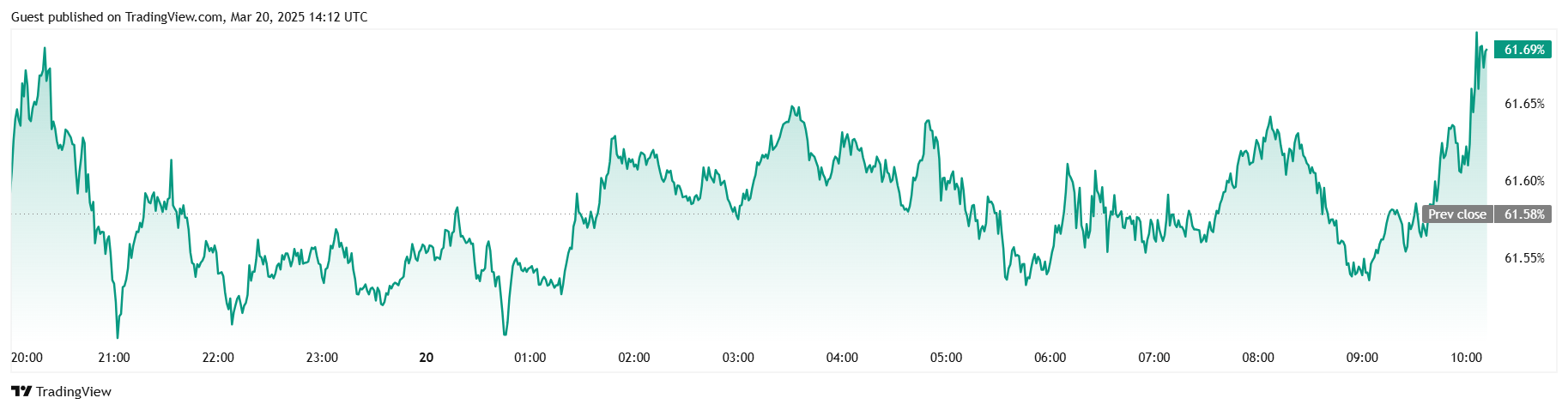

Bitcoin dominance stands at 61.68%, marking a slight increase of 0.16% over the last 24 hours. Futures market data from Coinglass reveals that total open interest in bitcoin futures has increased by 2.27% to $51.03 billion.

Significant liquidations have taken place over the past 24 hours, totaling $136.25 million. Notably, short positions bore the brunt of the losses, with $97.72 million in short liquidations compared to $38.53 million in long liquidations. This indicates that bearish traders misjudged the market direction.

Federal Reserve Meeting & Market Impact

The Federal Open Market Committee (FOMC) meeting concluded with the Fed maintaining its key interest rate within the 4.25%-4.5% range. The central bank cited stable unemployment and solid economic growth but acknowledged persistent inflationary pressures.

Revised projections from the Fed suggest a slowdown in economic growth to 1.7% for 2025, down from the previous estimate of 2.1%, while inflation expectations have been raised to 2.7% from 2.5%.

A notable shift in policy includes the Fed’s decision to slow the pace of balance sheet reduction beginning in April. The monthly redemption cap on Treasury securities will be lowered from $25 billion to $5 billion, signaling a shift toward a less aggressive form of quantitative tightening (QT). While this does not constitute a return to quantitative easing (QE), it suggests a more accommodative stance that could provide liquidity support to financial markets, including bitcoin.

Bitcoin Price Outlook

Bitcoin’s recent uptrend has been fueled by increasing investor confidence and a less restrictive monetary policy stance from the Fed. The surge in trading volume indicates strong market participation, while short-sellers facing liquidations suggest continued upward pressure on prices.

With the Fed slowing its balance sheet reduction and inflation expectations rising, bitcoin may continue to act as a hedge against economic uncertainty. If buying momentum sustains, BTC could challenge new resistance levels above $88,000. However, investors should remain cautious of potential macroeconomic headwinds that could introduce volatility in the coming weeks.

news.bitcoin.com

news.bitcoin.com