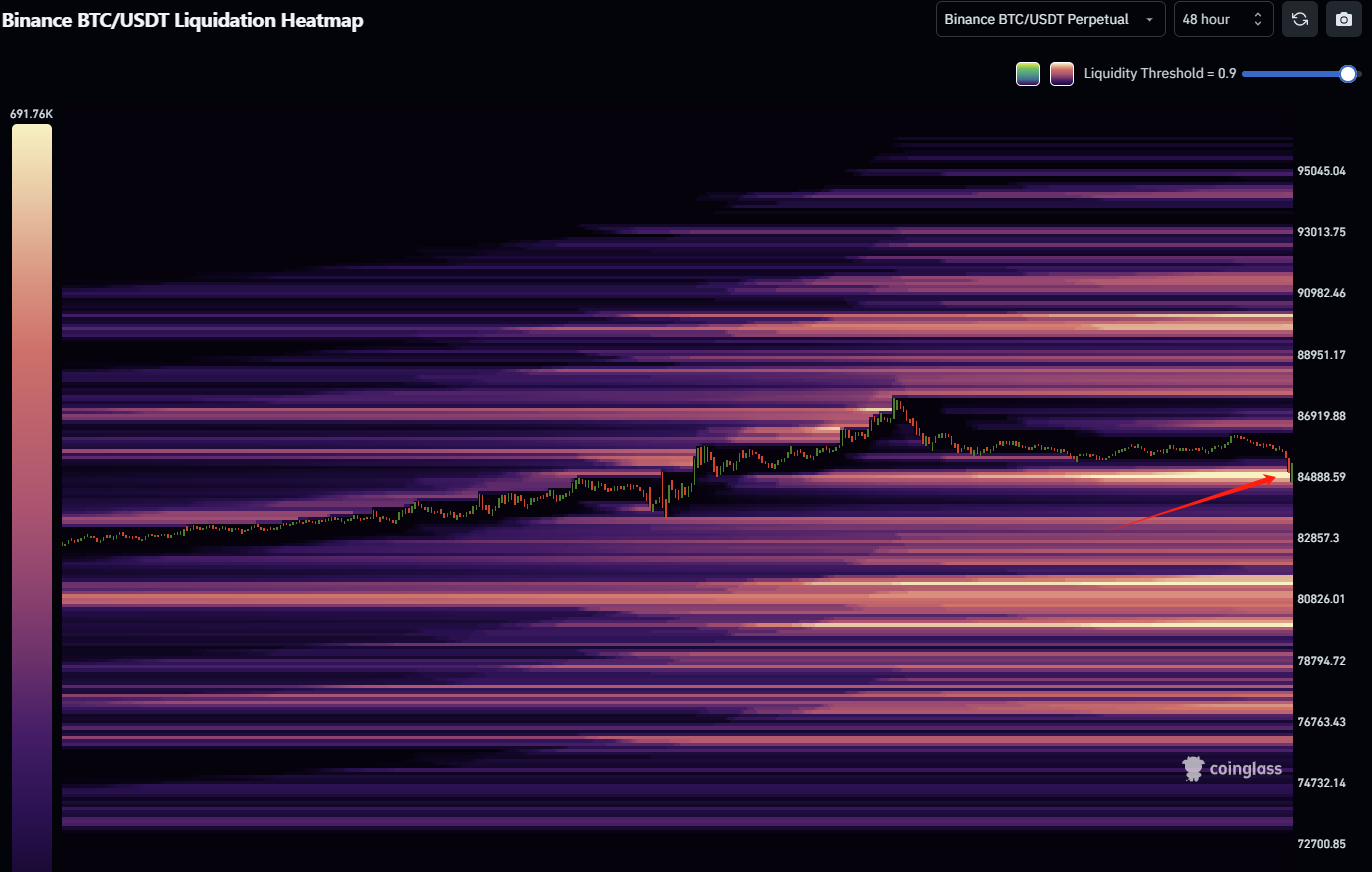

The price of Bitcoin has been volatile lately, and the most recent liquidation events have made matters worse. A series of extremely leveraged 100x long positions were wiped out when Bitcoin was unable to maintain upward momentum, which led to a series of liquidations, according to the most recent BTC liquidation heatmap. The erratic performance of the market prevails, but the most recent moves of the digital gold bring some hope.

Bitcoin was just rejected at the 200-day EMA, a crucial resistance level, as the BTC/USDT chart illustrates. Due to the steep price decline that followed this rejection, traders who were overly leveraged were forced to exit the market. At the moment, Bitcoin is trading in the highly liquid range of $85,000 to $86,000.

The heatmap suggests that additional downward movement may be anticipated if Bitcoin is unable to maintain its position above $84,888. Both profits and losses are magnified by leverage trading, but even minor price changes can lead to forced liquidations when many traders take highly leveraged long positions (like 100x longs). A significant liquidation event is evident from the heatmap, as Bitcoin fell below $85,000.

It appears that many traders set stop losses in the densely populated liquidity pockets at lower levels, which were ultimately triggered by market movements. Technical indicators and the mood of the market today suggest that Bitcoin could face one of two outcomes.

Recovery above resistance: A bullish rally back toward the $95,000-$100,000 range may be initiated if Bitcoin is able to regain its 200-day EMA and surpass $90,000.

Additional downside: Should selling pressure persist and Bitcoin lose $84,888, the next significant liquidity zone is located around $80,000, where the possibility of another round of liquidations exists. All things considered, the Bitcoin market is still very erratic, so traders should proceed with caution, particularly when using large amounts of leverage.

u.today

u.today