Santiment data shows whales and sharks sold over 57,000 $BTC in a week, signaling profit-taking and increased selling pressure on Bitcoin.

Bitcoin has experienced a consistent decline, with recent data showing a notable downtrend in price and a reduction in holdings by key stakeholders.

Notably, Bitcoin’s 30-day performance stands at negative 14.7%. The 7-day and 24-hour performances also show dips of 7.3% and 1.6%, respectively, suggesting continued bearish momentum.

This decline aligns with a decrease in shareholder activity, particularly among whales and sharks, as recent Santiment data shows.

Large Holders Reduce Bitcoin Holdings

The analysis highlights significant Bitcoin sell-offs among two major wallet categories: whales and sharks. Whales, holding between 100 and 1,000 $BTC, collectively sold 50,625 $BTC in the past week.

This amount equates to roughly $4.07 billion at current market prices. As of March 13, these holders accounted for approximately 22.95% of Bitcoin’s total supply.

Shark wallets, which hold between 10 and 100 $BTC, also showed a decrease in Bitcoin holdings. Over the same period, this group sold 7,062 $BTC, translating to about $567.1 million. Presently, sharks hold around 21.77% of the Bitcoin supply.

Notably, this massive sale of over $4.56 billion in Bitcoin by whales and sharks coincided with the asset’s consistent dip this month. This week, Bitcoin touched $76K amid these sell-offs.

According to Santiment, over the longer term, markets typically fluctuate with a mid-sized positive alignment with these wallet tiers. Essentially, the behavior of these large Bitcoin holders tends to have a moderate, positive impact on Bitcoin’s market movements.

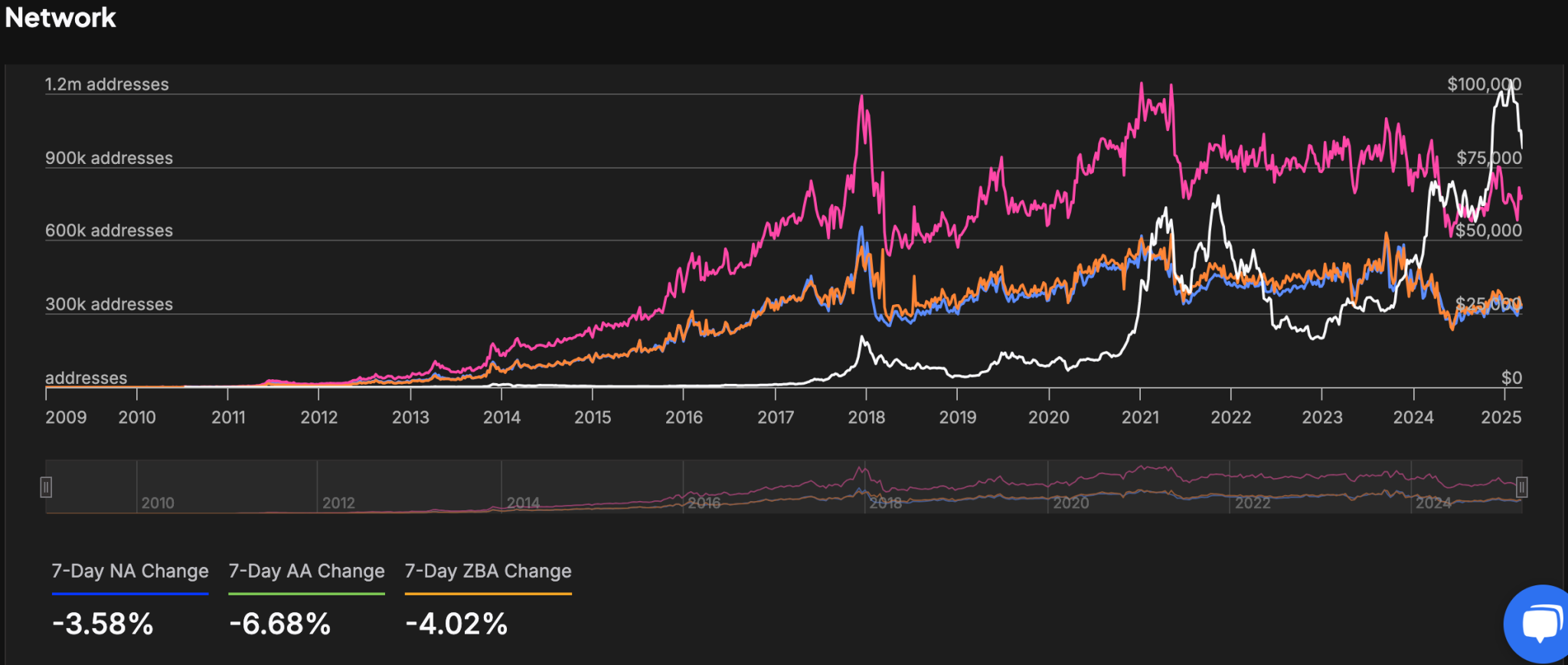

Bitcoin Network Activity Declines

Adding to the bearish narrative, data from IntoTheBlock provides further insights into Bitcoin’s network activity. It highlighted a decline in transaction volumes and user engagement. The 7-day Network Activity Change dropped by 3.58%, indicating lower transaction levels.

Additionally, the 7-day Active Addresses Change decreased by 6.68%, signaling reduced user participation. Meanwhile, the 7-day Zero-Balance Addresses Change fell by 4.02%, suggesting an increase in emptied wallets.

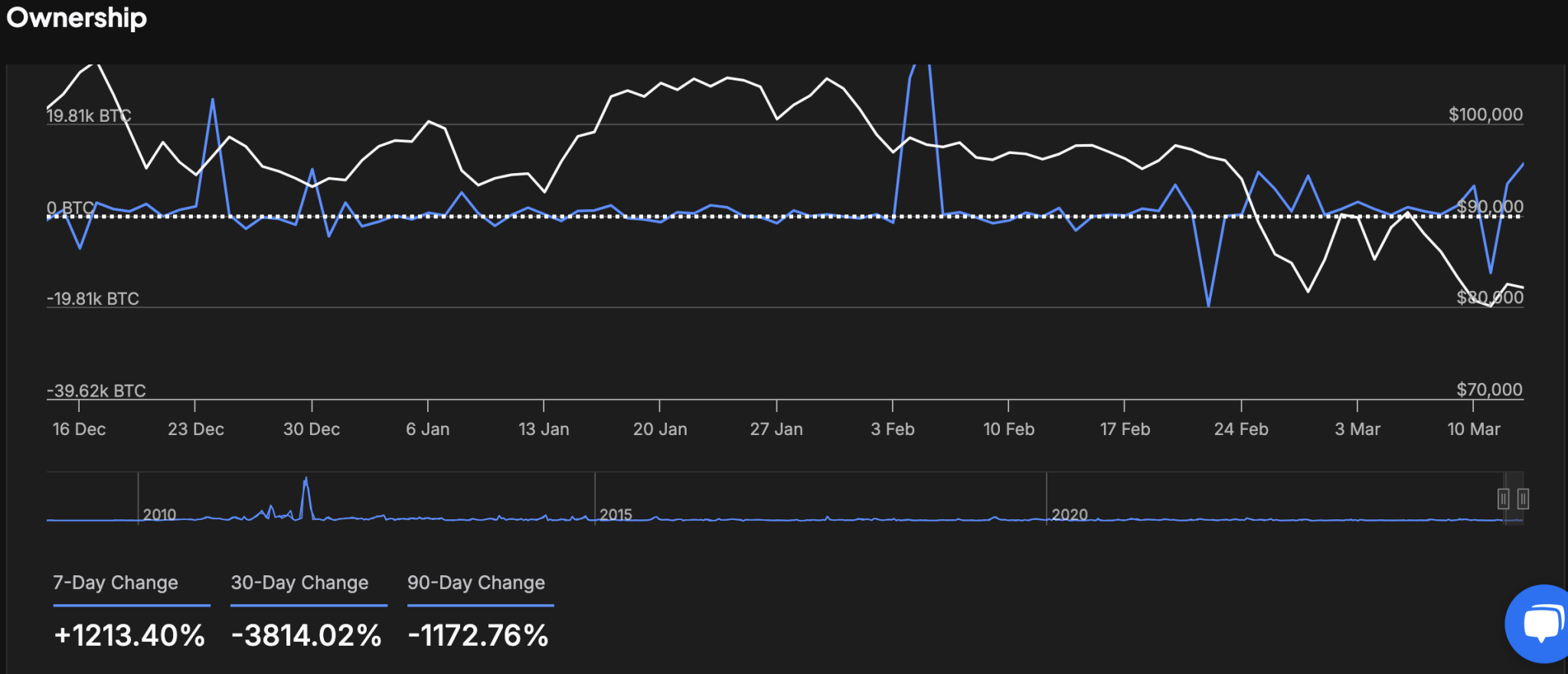

Furthermore, IntoTheBlock’s Ownership Chart shows shifts in large holder netflows, a key indicator of whale and institutional activity. Over the past seven days, large holder netflows spiked by 1,213.40%, suggesting temporary whale accumulation or redistribution.

However, the 30-day netflow dropped by 3,814.02%, indicating a continued exit by large holders. The 90-day netflow recorded a 1,172.76% decline, confirming an extended period of Bitcoin outflows from whale wallets.

thecryptobasic.com

thecryptobasic.com