Andrew Hohns, founder of Newmarket Investment Management, unveiled a proposal for U.S. “Bit Bonds” designed to leverage bitcoin’s growth to reduce national debt, lower interest rates, and empower household savings during the Bitcoin Policy Institute’s March 11 summit in Washington, D.C.

Bitcoin Bonds Could Slash U.S. Interest Rates, Boost Savings, Andrew Hohns Argues

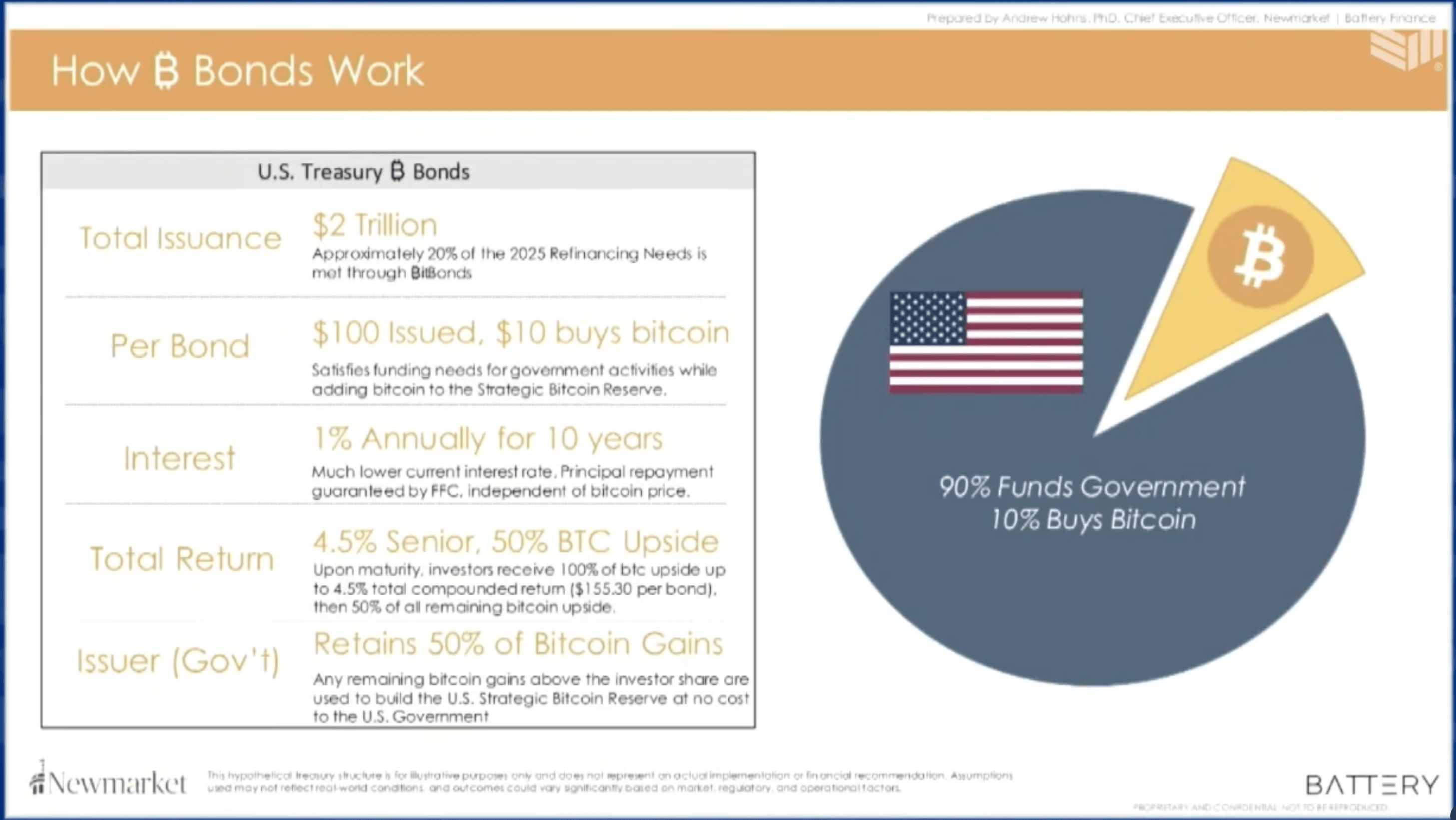

Speaking at the Bitcoin For America event, which coincided with President Trump’s executive order establishing a Strategic Bitcoin Reserve (SBR), Hohns outlined a plan to issue $2 trillion in bonds. Under the proposal, 10% of proceeds ($200 billion) would purchase bitcoin (BTC), while 90% would fund government operations. The bonds would carry a 1% annual interest rate—far below current 10-year Treasury yields of 4.5%—saving an estimated $554 billion in present-value interest costs over a decade.

“The United States federal government could acquire $200 billion of Bitcoin and save $354 billion at the same time,” Hohns remarked, emphasizing the dual benefit of reduced borrowing expenses and bitcoin exposure. Investors would receive a 4.5% annual return plus 50% of bitcoin’s appreciation, with the government retaining the other half.

For American families, Hohns advocated tax-free access to Bit Bonds, shielding gains from income and capital gains taxes. Projections based on bitcoin’s historical performance suggest even modest growth could deliver households a 7% to 17% annualized return. This puts in the hands of everyday American families “a tremendous tool” to defend against inflation, he added.

In the long term, Hohns argued that bitcoin’s potential appreciation could offset trillions in federal debt. At the 25th percentile of bitcoin’s historical growth (37% annually), the government’s retained bitcoin gains could reach $1.776 trillion by 2035. By 2045, those gains might surpass $50.8 trillion, matching projected federal debt levels.

He further noted that the proposal aligns with Treasury Secretary Bessent’s goal to spread debt maturities and curb refinancing risks. While speculative, Hohns framed Bit Bonds as a “win-win-win” for taxpayers, savers, and policymakers.

The summit concluded with calls for more legislative action, though questions remain about bitcoin’s volatility and regulatory hurdles. The event marked a pivotal moment in ongoing debates over cryptocurrency’s role in fiscal policy.

news.bitcoin.com

news.bitcoin.com