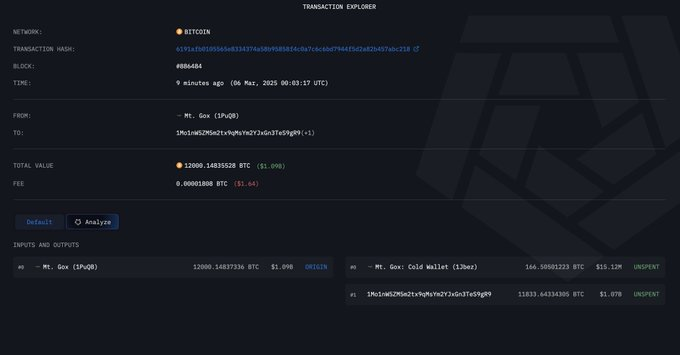

The Bitcoin price, steady at $90,397 after a 3.44% rise over the last 24 hours, now confronts another challenge. Early Thursday, March 6, 2025, blockchain analysts at Arkham tracked a $1 billion Bitcoin transfer from the defunct Mt. Gox exchange—12,000 $BTC shifted in one go.

This move, spotlighted by Arkham’s Transaction Explorer, has sparked concerns among market participants about potential volatility as creditors of the long-shuttered exchange weigh their options.

With Bitcoin stabilizing at $90,000, the question looms: will this jolt steady the market or trigger a wave of profit-taking?

Mt. Gox’s $1 Billion Bitcoin Price Trigger

Arkham’s alert on March 6, 2025, detailed the transfer of 12,000 $BTC, valued at over $1 billion at current prices, from a Mt. Gox-linked wallet to an unidentified address.

This isn’t an isolated event—December 2024 saw a $2.8 billion Bitcoin shift. The exchange, which collapsed in 2014 after losing 850,000 $BTC, still holds a substantial reserve enough to influence price dynamics if unleashed.

Bitcoin’s price has rallied 3.4% on select exchanges, per market data, with trading volume dropping massively over the last 24 hours.

The cryptocurrency had been edging toward $100,000 hinged on the hopes of a U.S. Bitcoin Strategic reserve at White House crypto summit on Friday.

However, this $1 billion move has introduced uncertainty. The market’s response hinges on whether these coins flow to exchanges or stay dormant.

A Legacy of Loss and Repayment

Mt. Gox’s 2014 hack wiped out 850,000 $BTC—billions in today’s terms—once making it the world’s top Bitcoin exchange.

Its ongoing creditor repayments, extended to October 31, 2025 keeps it relevant. This $1 billion transfer could signal progress toward that deadline, though the recipient wallet’s purpose remains unclear, per Arkham’s screenshot. Creditors holding pre-2013 coins might see $90,000 as a sell signal—or a reason to wait.

Arkham’s live tracking keeps the focus sharp. The $1 billion $BTC landed in an unknown wallet—exchange-bound or cold storage? No confirmation yet. Bitcoin’s price resilience, bolstered by institutional adoption, might absorb some shock, per past trends.

thecoinrepublic.com

thecoinrepublic.com